CHAPTER 1

Rajasthan’s economy has undergone significant transformation over the past decades, with steady growth driven by a shift from an agriculture-based economy to one increasingly reliant on industry and services. As one of India’s largest states, Rajasthan’s economic structure and performance are critical not only to its own development but also to the national economy. The state’s Gross State Domestic Product (GSDP) serves as a primary indicator of its economic health, capturing the value of goods and services produced across key sectors, including agriculture, industry, and services.

This chapter explores Rajasthan’s macroeconomic trends, with a focus on GSDP growth, sectoral contributions, and per capita income, providing insights into the state’s economic trajectory. Special emphasis is placed on the evolving sectoral composition of the economy, with the service sector emerging as a dominant growth driver, while the industrial sector continues to expand, supported by infrastructure development and policy reforms. The agricultural sector, though experiencing a relative decline in its share of GSDP, remains an important part of the economy due to its role in employment and rural livelihoods.

The chapter also delves into the investment landscape, analyzing trends in Gross Fixed Capital Formation (GFCF), and provides an overview of inflationary pressures through Consumer Price Index (CPI) and Wholesale Price Index (WPI) data. By examining these key economic indicators, Chapter 1 offers a comprehensive view of Rajasthan’s economic environment, highlighting both its strengths and challenges as the state continues its journey toward modernization and balanced growth.

- GSDP: Rajasthan’s Economic Growth Analysis

- Rajasthan’s Gross State Domestic Product (GSDP) at current prices for 2023-24 is projected at ₹15.28 lakh crore, reflecting a 12.56% growth rate.

- The state has shown consistent nominal GSDP growth, though slightly lower than the 13.63% growth rate seen in 2022-23. This marginal reduction can be attributed to inflationary effects and sectoral slowdowns, especially in agriculture.

- When compared to India’s nominal GDP growth of 9.6%, Rajasthan has outperformed the national average in recent years.

- Objective Insight: The state contributes approximately 5.17% to India’s overall GDP in 2023-24, up from 4.84% in previous years. This showcases Rajasthan’s growing influence on the national economy.

- Real vs. Nominal GSDP

- At constant prices (2011-12 base year), the real GSDP for 2023-24 is expected to reach ₹8.45 lakh crore, marking an 8.03% growth rate.

- The real GSDP accounts for inflation, thus providing a more accurate picture of actual economic growth in terms of production volume.

- This contrasts with the nominal GSDP, which reflects both the price level and volume changes. The nominal GSDP growth is higher due to inflation, whereas the real growth rate is a better measure of Rajasthan’s economic performance in constant terms.

- Objective Insight: With a Compound Annual Growth Rate (CAGR) of 11.19% over the past five years at current prices, Rajasthan has maintained a steady economic expansion, driven by increased industrial output and service sector growth.

- Sectoral Contributions to GSDP

- The state’s Gross State Value Added (GSVA) highlights the key role played by various sectors:

- Agriculture accounts for 26.72% of GSVA in 2023-24, down slightly from 27.11% in 2011-12. While this sector still commands a large share, its growth rate has slowed to 2.13%.

- This deceleration reflects challenges like unpredictable weather, rural distress, and low productivity growth. However, Rajasthan remains a significant player in livestock and crop production.

- Industry contributes 28.21% to GSVA, growing by 12.43% in 2023-24, representing the fastest-growing sector.

- This growth is primarily due to increased manufacturing, construction, and mining activities. The government’s focus on infrastructure and industrial investments has stimulated growth.

- Services account for 45.07% of GSVA in 2023-24, marking a significant jump from 38.75% in 2011-12.

- The service sector includes trade, hotels, transport, and financial services, and has seen robust growth due to increasing urbanization, tourism, and service exports.

- Objective Insight: The growing dominance of the service sector reflects structural changes in Rajasthan’s economy, with a shift away from agriculture toward more value-added services and industries.

- Agriculture accounts for 26.72% of GSVA in 2023-24, down slightly from 27.11% in 2011-12. While this sector still commands a large share, its growth rate has slowed to 2.13%.

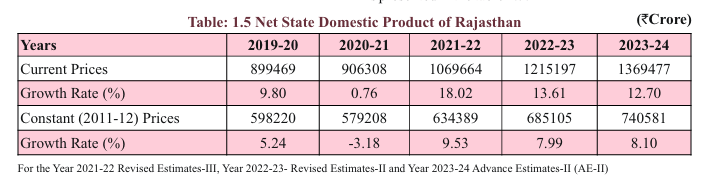

- Net State Domestic Product (NSDP) Analysis

- The Net State Domestic Product (NSDP), which adjusts GSDP for the depreciation of fixed capital assets, reached ₹13.69 lakh crore at current prices in 2023-24. This marks a 12.70% growth rate.

- Depreciation (also referred to as Consumption of Fixed Capital or CFC) is critical to understanding the net income generated by the state’s economy, which more directly impacts living standards.

- At constant prices, the NSDP grew by 8.10%. This consistency with GSDP growth indicates stable investment and asset utilization in the economy.

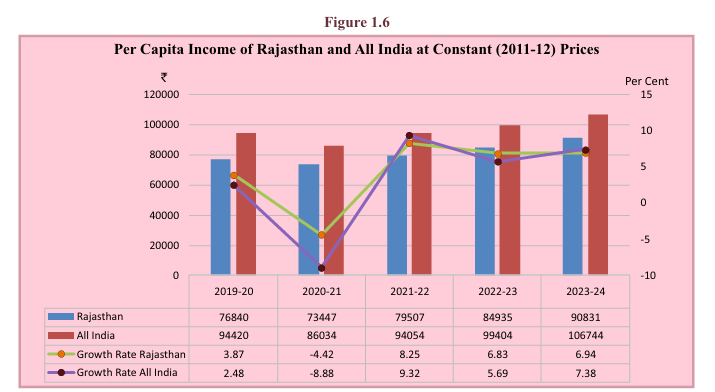

- Per Capita Income (PCI) and Standard of Living

- Per Capita Income (PCI) for 2023-24 at current prices is projected to be ₹167,964, showing an 11.49% increase over the previous year.

- When adjusted for inflation, the PCI at constant prices stands at ₹90,831, reflecting a 6.94% growth rate.

- This suggests that, despite inflationary pressures, the average income per person has risen significantly, improving the overall standard of living in Rajasthan.

- Objective Insight: Compared to the national per capita income of ₹184,205 (current prices), Rajasthan’s PCI is below the national average but catching up rapidly, narrowing the income gap with the rest of India.

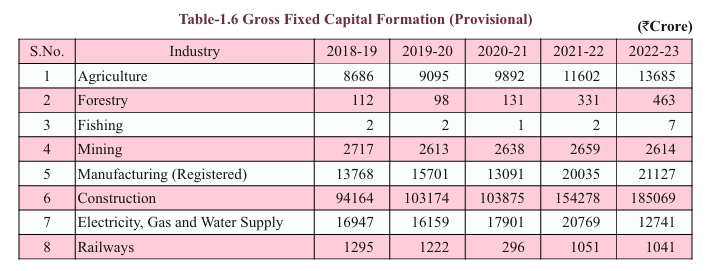

- Gross Fixed Capital Formation (GFCF) and Investment Trends

- GFCF measures the total value of investments in fixed assets like machinery, infrastructure, and buildings. For 2023-24, the GFCF is expected to be ₹399,594 crore, representing 29.43% of GSDP.

- The private sector dominates capital formation, contributing 78.54%, while the public sector’s contribution is 21.46%.

- Objective Insight: Rajasthan has seen a 12.78% growth in GFCF from the previous year, reflecting increasing investment confidence. The construction sector, in particular, has witnessed a surge, driven by infrastructure projects and urban development.

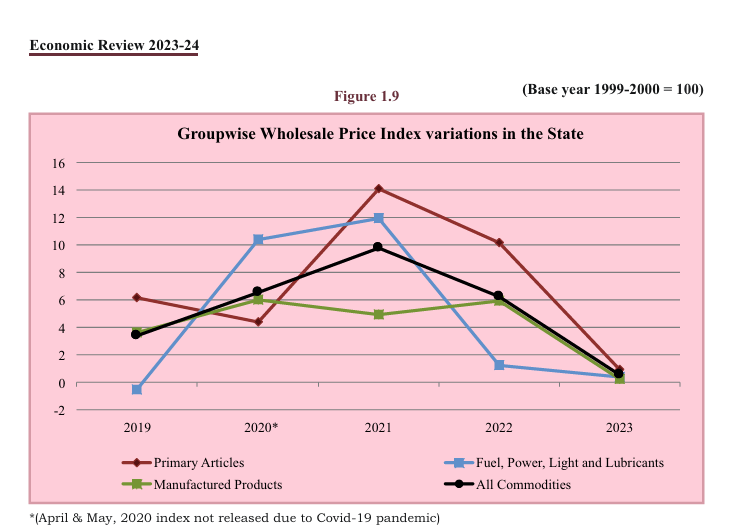

- Price Statistics and Inflation

- Wholesale Price Index (WPI) in Rajasthan saw a modest increase of 0.54% from 2022 to 2023, with slight growth across all categories:

- Primary Articles: Increased by 0.96%.

- Fuel and Power: Increased by 0.39%.

- Manufactured Products: Increased by 0.23%.

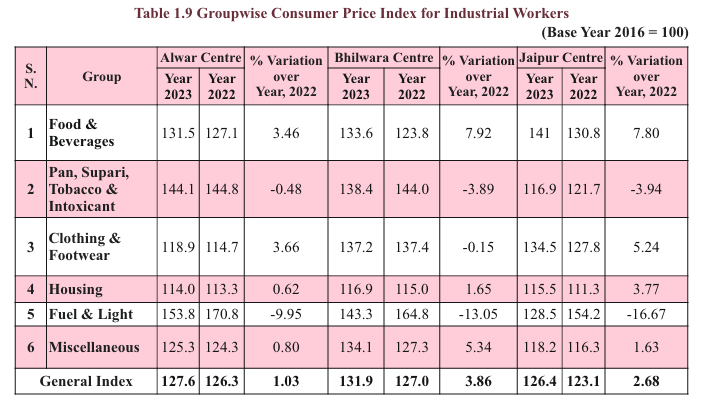

- Rajasthan’s Consumer Price Index (CPI) for industrial workers registered notable inflation rates in different cities:

- Alwar: 1.03% increase.

- Bhilwara: 3.86% increase.

- Jaipur: 2.68% increase.

- Nationally, CPI for industrial workers grew by 5.57%, indicating moderate inflationary pressures across key consumption sectors like food, housing, and clothing.

- CPI Variations

- The Consumer Price Index (CPI) reflects inflation faced by consumers:

- Food & Beverages in Bhilwara saw an inflation rate of 7.92%, while in Jaipur it was 7.80%.

- Fuel & Light witnessed a deflation across all centers, indicating a drop in energy costs.

- Objective Insight: Rajasthan’s inflation remains under control, with CPI reflecting typical inflationary pressures from housing, food, and services. A slight deflation in energy prices provides relief to consumers.

Conclusion

Rajasthan’s macroeconomic landscape has experienced sustained growth over the years, with notable sectoral shifts and an increasing contribution from services and industry. Below is an in-depth conclusion based on the data provided in this chapter.

- Steady GSDP Growth amid Challenges

- Rajasthan’s Gross State Domestic Product (GSDP) at current prices is projected to reach ₹15.28 lakh crore in 2023-24, marking a 12.56% growth rate over the previous year. At constant prices (2011-12 base), the real GSDP growth stands at 8.03%.

- Objective Insight: Despite challenges like inflation and global economic uncertainties, Rajasthan has maintained steady growth, driven primarily by investments in infrastructure, industrial output, and a booming service sector.

- Sectoral Composition: The Rise of Services

- The economy is increasingly service-oriented, with the service sector contributing 45.07% to the Gross State Value Added (GSVA) in 2023-24, up from 38.75% in 2011-12.

- Industry contributed 28.21%, and agriculture accounted for 26.72% of GSVA in 2023-24.

- Objective Insight: The shift from agriculture to services and industry reflects a broader structural transformation in the state’s economy. While agriculture continues to employ a large portion of the population, services are becoming the primary growth driver, aligning with national trends.

- Agriculture’s Declining Share

- Agriculture’s share of the state’s economy has decreased from 28.56% in 2011-12 to 26.72% in 2023-24. While agriculture remains important, its reduced contribution signals a gradual transition toward a more diversified economy.

- Objective Insight: The relative decline in agriculture highlights the increasing reliance on industry and services for economic growth, though the sector still plays a pivotal role in providing employment and livelihoods to a large segment of the population.

- Service Sector as a Growth Engine

- The service sector has seen the fastest growth, with an average annual growth rate of 11.26% in 2023-24 at current prices. It includes key areas such as trade, hospitality, transport, and financial services, reflecting growing urbanization, rising consumer demand, and an expanding tourism industry.

- Objective Insight: The service sector’s rapid growth indicates Rajasthan’s increasing integration into the broader national economy, particularly in hospitality and tourism, areas where the state has significant competitive advantages.

- Industrial Growth and Infrastructure Development

- The industrial sector contributed 28.21% of the GSVA in 2023-24, growing at a rate of 12.43%. The sector’s robust growth is fueled by investments in manufacturing, construction, and mining, as well as improvements in infrastructure and industrial policies.

- Objective Insight: Rajasthan’s industrial growth is aligned with the state’s push for industrialization, backed by initiatives such as Make in India and Startup India. The state is positioning itself as a hub for manufacturing and infrastructure development, particularly in sectors like mining, textiles, and cement production.

- Per Capita Income Growth

- Rajasthan’s Per Capita Income (PCI) at current prices is expected to reach ₹167,964 in 2023-24, reflecting a 11.49% increase over the previous year. At constant prices, PCI stands at ₹90,831, with a 6.94% growth.

- Objective Insight: Although Rajasthan’s PCI is still below the national average, the steady growth in income levels signals improving living standards. This growth, driven by rising wages in both the industrial and service sectors, reflects a gradual closing of the income gap with more prosperous states.

- Investment Confidence and Gross Fixed Capital Formation (GFCF)

- Gross Fixed Capital Formation (GFCF), an indicator of investment in fixed assets like infrastructure and machinery, was ₹3.99 lakh crore in 2022-23, accounting for 29.43% of GSDP. Private sector investments made up 78.54% of GFCF, while the public sector contributed 21.46%.

- Objective Insight: The high level of private sector participation in GFCF reflects strong investment confidence in the state’s economic environment. Investments in infrastructure, urban development, and industrial capacity expansion will be crucial for sustained long-term growth.

- Inflation Control and Price Stability

- The Wholesale Price Index (WPI) increased by 0.54% between 2022 and 2023, while the Consumer Price Index (CPI) for industrial workers increased by 5.57% nationally. In Rajasthan, the CPI increase was 6.64% for rural areas and 6.73% for urban areas.

- Objective Insight: Rajasthan has managed to keep inflation in check despite global inflationary pressures. However, rural inflation remains slightly higher, which could be linked to supply chain disruptions and the cost of food in rural areas.

- Net State Domestic Product (NSDP) and Wealth Generation

- The Net State Domestic Product (NSDP) at current prices is projected to be ₹13.69 lakh crore in 2023-24, reflecting 12.70% growth. At constant prices, NSDP is projected at ₹7.41 lakh crore, with 8.10% growth.

- Objective Insight: NSDP growth reflects the wealth generation within the state, adjusted for depreciation of assets. The steady growth of the NSDP indicates sustainable economic development, with a significant portion of economic output being reinvested into the state’s assets.

- Challenges Ahead: Climate Change and Resource Management

- Rajasthan’s economy, particularly the agriculture sector, remains vulnerable to climate change and water scarcity. With a rapidly declining groundwater level, efforts to manage water resources efficiently and mitigate the impact of drought and climate variability are critical.

- Objective Insight: Addressing these challenges will require comprehensive strategies, including rainwater harvesting, sustainable agricultural practices, and water-efficient technologies to ensure that economic growth is not derailed by environmental factors.

Final Thoughts

- Service-Led Growth: The rapid expansion of the service sector positions Rajasthan as a key player in India’s overall economic transformation. Tourism, hospitality, financial services, and transport are driving this shift.

- Industrial Expansion: The state’s growing industrial base, backed by policy support and infrastructure investment, will continue to play a vital role in enhancing economic output and providing employment opportunities.

- Agriculture’s Transition: Though agriculture’s contribution to GSDP is declining, it still remains an important sector for livelihoods. Diversification into livestock and allied activities, combined with better water management, can help sustain its relevance.

- Income Growth: Steady increases in per capita income indicate improving living standards. However, continued efforts are needed to address income disparities between urban and rural areas.

- Investment Confidence: Strong private sector participation in capital formation shows growing confidence in Rajasthan’s economic future, particularly in industrial and infrastructure sectors.

- Inflation Management: Effective inflation control measures have helped maintain price stability, though rural inflation remains a concern. Focus on improving rural supply chains and productivity could ease inflationary pressures.

- Sustainability and Climate Risks: As Rajasthan faces severe climate risks, addressing environmental sustainability through water conservation, climate adaptation, and better resource management is crucial for future economic resilience.

By addressing these structural challenges while leveraging its growing industrial base and service sector, Rajasthan is poised for sustained long-term economic growth. The state’s future depends on balanced development, with continued focus on infrastructure, resource management, and inclusive growth across all sectors.

Chapter 1

Table 1.1

Analytical Summary

Here is an analytical summary based on the table showing the GSDP/GDP of Rajasthan and All India at current prices from 2019-2020 to 2023-2024 (₹Crore):

- Rajasthan GSDP Analysis:

- 2019-20: The GSDP of Rajasthan stood at ₹10,00,032 crore.

- 2020-21: Rajasthan’s GSDP experienced a marginal growth of 1.79%, increasing to ₹10,17,917 crore. This reflects a slowdown compared to the previous year.

- 2021-22: A significant recovery can be seen in 2021-22, with Rajasthan’s GSDP growing by 17.39% to ₹11,94,961 crore. This could indicate recovery post-pandemic or strong growth due to economic revival initiatives.

- 2022-23: The GSDP continues to grow at 13.63%, reaching ₹13,57,851 crore.

- 2023-24: Estimated GSDP for Rajasthan is ₹15,28,385 crore, with a growth rate of 12.56%. Though growth remains robust, it shows a slight deceleration compared to the previous two years.

- All India GDP Analysis:

- 2019-20: The national GDP stood at ₹2,01,03,593 crore.

- 2020-21: India’s GDP contracted by -1.2% to ₹1,98,54,096 crore. This reflects the economic impact of the COVID-19 pandemic.

- 2021-22: A strong recovery occurred in 2021-22 with GDP growing by 18.9%, reaching ₹2,35,97,399 crore.

- 2022-23: India’s GDP continued to grow at 14.2%, reaching ₹2,69,49,646 crore, reflecting a sustained economic expansion.

- 2023-24: The projected GDP for the year is ₹2,95,35,667 crore, with a more moderate growth rate of 9.6%. This reduction in growth may indicate stabilization after the post-pandemic recovery surge.

Key Observations

- Rajasthan’s economic growth has been relatively stable with higher growth rates in 2021-22 and 2022-23, reflecting recovery from the pandemic and stronger regional economic performance.

- India’s GDP saw significant recovery after a contraction in 2020-21, but the growth rate has gradually slowed to 9.6% by 2023-24, indicating a normalization of the economy after the initial rebound.

Key Terms

- GSDP (Gross State Domestic Product): It is the measure of the economic output of a state or region within a country, calculated as the market value of all goods and services produced within the boundaries of that state over a period of time.

- GDP (Gross Domestic Product): It refers to the total market value of all goods and services produced within the country’s borders in a specific period. It reflects the overall economic health of the nation.

- Current Prices: These are prices that reflect the value of goods and services at the prices that prevail in the year in question, without adjusting for inflation.

- Growth Rate (%): The percentage increase (or decrease) in the economic output from one year to the next, reflecting the health and expansion of the economy.

This data presents a positive trend for both Rajasthan and India, with sustained growth rates after the economic disruptions of the pandemic, though the rates are now normalizing.

Figure 1.1

Analytical Summary

The image provided shows a bar graph representing the Gross State Domestic Product (GSDP) of Rajasthan at current prices from 2019-2020 to 2023-2024. The graph illustrates the steady growth of Rajasthan’s economy over this period, with the Compound Annual Growth Rate (CAGR) calculated at 11.19%.

Key Data Points

- 2019-20: GSDP was ₹10,00,032 crore.

- 2020-21: GSDP increased slightly to ₹10,17,917 crore, reflecting a modest growth amid challenging economic conditions.

- 2021-22: GSDP rose significantly to ₹11,94,961 crore, indicating a strong economic recovery and a year of substantial growth.

- 2022-23: Continued growth to ₹13,57,851 crore, showcasing sustained economic expansion.

- 2023-24: The GSDP is projected to reach ₹15,28,385 crore, representing consistent upward momentum in Rajasthan’s economic performance.

Key Observations

- Growth Trend: The GSDP shows a clear upward trend, with a CAGR of 11.19%, which suggests robust economic development over the five-year period. The graph visualizes this sustained growth.

- Pandemic Impact and Recovery: The relatively low growth between 2019-2020 and 2020-2021 (₹10,00,032 crore to ₹10,17,917 crore) could be attributed to the global and national disruptions caused by the COVID-19 pandemic. However, post-2020, the sharp increase in GSDP reflects recovery efforts and economic policies driving growth.

- Projection for 2023-24: The GSDP is projected to reach ₹15,28,385 crore, which shows continued optimism for Rajasthan’s economic growth. The increase from ₹13,57,851 crore in 2022-23 to this figure also suggests that key sectors may be performing well.

Key Term

- CAGR (Compound Annual Growth Rate): This is a useful metric that shows the mean annual growth rate of an investment or the economy over a specified period of time longer than one year. It accounts for the compounding effect of growth over time. Here, a CAGR of 11.19% means that Rajasthan’s economy has grown at an average rate of 11.19% annually from 2019-2020 to 2023-2024.

This visualization reinforces Rajasthan’s consistent economic progress and highlights the stability of its growth trajectory despite challenges faced in earlier years. The CAGR of 11.19% showcases healthy economic growth over the observed period.

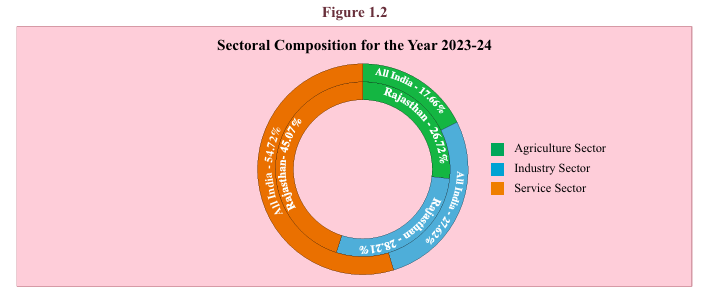

Figure 1.2

Analytical Summary

The provided image illustrates a sectoral composition chart for Rajasthan and All India in the fiscal year 2023-24. It divides the economy into three major sectors: Agriculture, Industry, and Service.

Key Sectoral Contributions for Rajasthan

- Agriculture Sector:

- Rajasthan: 27.67%

- All India: 17.46%

- Agriculture contributes a significant share of Rajasthan’s GSDP, much higher than the national average. This highlights the agricultural dominance in Rajasthan’s economy, especially relative to the national landscape.

- Industry Sector:

- Rajasthan: 28.21%

- All India: 27.69%

- The Industry sector’s contribution in Rajasthan is marginally higher than the national average, showing a balanced role of manufacturing, construction, and industrial activities in the state’s economy. Rajasthan’s reliance on industries, particularly textiles, mining, and energy, reflects this sectoral strength.

- Service Sector:

- Rajasthan: 44.12%

- All India: 54.85%

- The Service sector in Rajasthan accounts for a smaller proportion of GSDP compared to the national level. Nationally, the service sector is the largest contributor to GDP, but in Rajasthan, it plays a smaller role, indicating a relatively lower presence of service industries compared to other states or the national level.

Key Observations

- Agriculture’s Prominence in Rajasthan:

- Rajasthan’s agriculture sector plays a more prominent role compared to the national economy. With a contribution of 27.67%, Rajasthan’s economy is more reliant on agriculture and allied activities than the national average of 17.46%.

- Balanced Industrial Contribution:

- The industry sector has a similar share in both Rajasthan (28.21%) and All India (27.69%), showing that Rajasthan has a balanced industrial base, with activities ranging from traditional industries like handicrafts and textiles to modern sectors like mining and energy.

- Service Sector’s Lower Share:

- At 44.12%, Rajasthan’s service sector contribution is significantly lower than the national figure of 54.85%. The national economy has seen rapid growth in services like IT, banking, and education, but Rajasthan’s economy is more heavily weighted towards agriculture and industry, reflecting the state’s structural composition.

Sector Definitions

- Agriculture Sector: Includes activities such as farming, livestock, forestry, and fisheries. In Rajasthan, this sector plays a major role due to the state’s large rural population and vast arable land.

- Industry Sector: Comprises manufacturing, mining, construction, and utilities (electricity, water supply). This sector is important for Rajasthan, given its mineral resources and traditional industries.

- Service Sector: Encompasses a broad range of activities such as trade, transport, communication, financial services, real estate, and government services. It tends to dominate in economies that have moved beyond industrial development into more modern services.

Conclusion

The sectoral composition for Rajasthan reveals a traditional economy with a strong reliance on agriculture and a balanced industrial sector. The service sector, while significant, plays a relatively smaller role compared to the national economy. This composition points to opportunities for Rajasthan to potentially expand its service sector while maintaining its strengths in agriculture and industry.

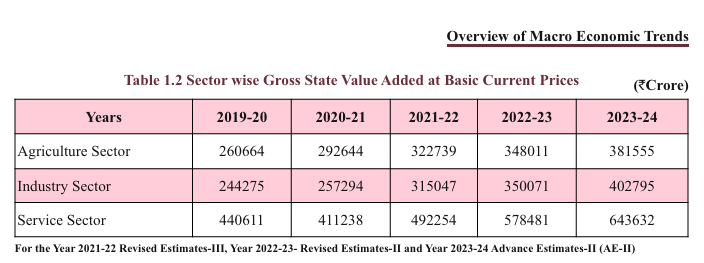

Table 1.2

Analytical Summary

The table shows the sector-wise Gross State Value Added (GSVA) for Rajasthan from 2019-20 to 2023-24, covering the Agriculture, Industry, and Service sectors at basic current prices. The values are expressed in ₹ Crore.

Key Data Points by Sector

- Agriculture Sector:

- 2019-20: ₹2,60,664 crore

- 2020-21: ₹2,92,644 crore

- 2021-22: ₹3,22,739 crore

- 2022-23: ₹3,48,011 crore

- 2023-24: ₹3,81,555 crore (estimated)

- The agriculture sector has shown consistent growth year-on-year, with an increase from ₹2,60,664 crore in 2019-20 to an estimated ₹3,81,555 crore in 2023-24, reflecting a robust performance in this sector.

- Industry Sector:

- 2019-20: ₹2,44,275 crore

- 2020-21: ₹2,57,294 crore

- 2021-22: ₹3,15,047 crore

- 2022-23: ₹3,50,071 crore

- 2023-24: ₹4,02,795 crore (estimated)

- The industry sector also shows strong growth, with a notable increase in value from ₹2,44,275 crore in 2019-20 to an estimated ₹4,02,795 crore in 2023-24. The growth from 2021-22 to 2022-23 is particularly significant, indicating a strong post-pandemic recovery in industrial activity.

- Service Sector:

- 2019-20: ₹4,40,611 crore

- 2020-21: ₹4,11,238 crore

- 2021-22: ₹4,92,254 crore

- 2022-23: ₹5,78,481 crore

- 2023-24: ₹6,43,632 crore (estimated)

- The service sector, the largest contributor to Rajasthan’s GSVA, also experienced steady growth. While there was a minor decline in 2020-21 (likely due to the pandemic), the sector quickly recovered and is projected to reach ₹6,43,632 crore in 2023-24.

Key Observations

- Steady Growth Across Sectors:

- All three sectors (Agriculture, Industry, and Services) have shown steady year-on-year growth, with the service sector consistently being the largest contributor to the GSVA, followed by industry and agriculture.

- Post-Pandemic Recovery:

- There was a notable slowdown in growth in the 2020-21 fiscal year, likely due to the economic impact of the COVID-19 pandemic. However, all sectors showed strong recovery starting from 2021-22, with both the industry and service sectors seeing significant growth rates.

- Agriculture’s Solid Performance:

- Agriculture has maintained a steady upward trajectory, showing strong resilience and consistent contributions to Rajasthan’s economy, particularly during the post-pandemic recovery.

- Services Sector Dominance:

- The services sector remains the dominant force in the state’s economy, showing robust growth from ₹4,40,611 crore in 2019-20 to an estimated ₹6,43,632 crore in 2023-24. This indicates a growing importance of sectors such as finance, IT, and trade in Rajasthan’s economic structure.

Key Definitions

- Gross State Value Added (GSVA): GSVA measures the value of goods and services produced in a state by its different sectors. It is a crucial indicator of the economic performance of different sectors (agriculture, industry, and services) at the state level.

- Basic Current Prices: Refers to the prices of goods and services at the time of the transaction, without adjusting for inflation. These prices reflect the market value of production in the present context.

Conclusion

This data suggests that Rajasthan’s economy is well-diversified, with strong contributions from all three sectors. While services dominate, agriculture and industry are also showing substantial growth, indicating a balanced economic structure. The post-pandemic recovery in the industry and service sectors is particularly noteworthy, driving overall growth in the state’s economy.

Table 1.3

Analytical Summary

The table provides an analysis of the Gross State Domestic Product (GSDP) of Rajasthan and the Gross Domestic Product (GDP) of All India at constant 2011-12 prices from 2019-20 to 2023-24, along with the corresponding growth rates for each year.

Key Data Points

- Rajasthan’s GSDP:

- 2019-20: ₹6,78,316 crore

- 2020-21: ₹6,65,963 crore (growth rate: -1.82%)

- 2021-22: ₹7,25,586 crore (growth rate: 8.95%)

- 2022-23: ₹7,82,287 crore (growth rate: 7.81%)

- 2023-24: ₹8,45,115 crore (growth rate: 8.03% – estimated)

- Rajasthan’s GSDP shows a contraction of -1.82% in 2020-21 due to the impact of the COVID-19 pandemic. However, there has been a strong recovery since 2021-22, with a consistent growth trajectory, reaching an estimated 8.03% in 2023-24. The GSDP has increased steadily over the years, with the growth rates reflecting economic resilience and expansion post-pandemic.

- All India GDP:

- 2019-20: ₹1,45,34,641 crore

- 2020-21: ₹1,36,94,869 crore (growth rate: -5.8%)

- 2021-22: ₹1,50,21,846 crore (growth rate: 9.7%)

- 2022-23: ₹1,60,71,429 crore (growth rate: 7.0%)

- 2023-24: ₹1,73,81,722 crore (growth rate: 8.2% – estimated)

- The national GDP also reflects a contraction of -5.8% in 2020-21, a sharper decline compared to Rajasthan. However, a robust recovery followed with growth rates of 9.7% in 2021-22 and an estimated 8.2% in 2023-24. The All India GDP mirrors the global recovery post-pandemic, indicating a return to strong growth trends.

Key Observations

- Pandemic Impact and Recovery:

- Both Rajasthan and India experienced a contraction in 2020-21 due to the economic effects of the COVID-19 pandemic. The negative growth rates for that year reflect the significant disruptions in economic activities. However, Rajasthan’s contraction was less severe than the national contraction (-1.82% vs. -5.8%), indicating relatively better resilience.

- Strong Recovery in Following Years:

- Both Rajasthan and the national economy saw a sharp recovery in 2021-22, with growth rates of 8.95% (Rajasthan) and 9.7% (All India). This suggests that economic recovery efforts, stimulus measures, and the reopening of sectors post-pandemic had a strong positive impact.

- Continued Growth:

- In 2022-23 and 2023-24, the growth rates for both Rajasthan and India remain robust, showing steady economic expansion. Rajasthan’s projected growth of 8.03% in 2023-24 aligns with India’s projected 8.2% growth, suggesting that Rajasthan is on par with national trends in terms of economic performance.

Key Terms

- GSDP (Gross State Domestic Product): Refers to the total economic output of a state, calculated at constant prices (adjusted for inflation to a base year, in this case, 2011-12). It measures the value of goods and services produced within the state’s borders.

- GDP (Gross Domestic Product): Measures the overall economic output of the entire country at constant prices. Like GSDP, it reflects the value of goods and services produced but at a national level.

- Constant Prices (2011-12): Refers to the method of measuring GDP or GSDP by using prices from a base year (2011-12) to remove the effects of inflation and provide a clearer picture of real growth over time.

- Growth Rate (%): The year-on-year percentage change in GSDP/GDP, indicating how much the economy has expanded or contracted compared to the previous year.

Conclusion

The table presents a picture of economic resilience and recovery for both Rajasthan and India, following the contraction caused by the pandemic in 2020-21. The steady growth observed from 2021-22 onwards indicates a return to stable and sustained economic expansion, with Rajasthan showing growth trends largely in line with national performance.

Figure 1.3

Analytical Summary

The graph illustrates the Gross State Domestic Product (GSDP) of Rajasthan at constant 2011-12 prices over the five-year period from 2019-20 to 2023-24, along with the Compound Annual Growth Rate (CAGR) of 5.65%.

Key Data Points (₹ Crore):

- 2019-20: ₹6,78,316 crore

- 2020-21: ₹6,65,963 crore

- 2021-22: ₹7,25,586 crore

- 2022-23: ₹7,82,287 crore

- 2023-24: ₹8,45,115 crore (estimated)

Key Observations

- Steady Growth Over Time:

- The graph shows that the GSDP of Rajasthan has steadily increased over the five-year period, except for a slight dip in 2020-21, which reflects the economic disruption caused by the COVID-19 pandemic. However, a strong recovery is evident from 2021-22 onwards, with consistent growth.

- Pandemic Impact and Recovery:

- The GSDP declined from ₹6,78,316 crore in 2019-20 to ₹6,65,963 crore in 2020-21, indicating a 1.82% contraction. This likely reflects the effects of the pandemic on Rajasthan’s economy. The recovery in 2021-22 (₹7,25,586 crore) and subsequent years shows the resilience of the state’s economy.

- Compound Annual Growth Rate (CAGR):

- The GSDP growth over the five-year period has resulted in a CAGR of 5.65%, indicating moderate but steady economic growth in Rajasthan. This CAGR reflects the average annual growth over the period, accounting for both the contraction in 2020-21 and the subsequent recovery.

- Strong Growth in 2022-23 and 2023-24:

- The GSDP is projected to reach ₹8,45,115 crore in 2023-24, marking a significant rise from ₹7,82,287 crore in 2022-23. This suggests strong economic expansion, driven by recovery across sectors such as industry, agriculture, and services.

Key Term

- CAGR (Compound Annual Growth Rate): A useful measure of the average annual growth rate of an investment or economy over a certain period, accounting for compounding. A CAGR of 5.65% indicates that, on average, Rajasthan’s economy has grown by this rate each year over the five-year period, despite the pandemic-related contraction.

Conclusion

The graph demonstrates steady economic growth for Rajasthan over the period, with a slight dip in 2020-21 due to the pandemic but a robust recovery afterward. The CAGR of 5.65% reflects consistent economic expansion, positioning Rajasthan on a stable growth trajectory moving forward.

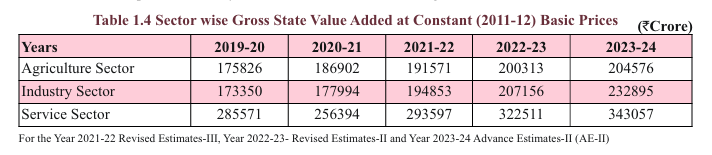

Table 1.4

Analytical Summary

The table shows the Sector-wise Gross State Value Added (GSVA) for Rajasthan at constant 2011-12 prices, from 2019-20 to 2023-24, broken down into the Agriculture, Industry, and Service sectors.

Key Data Points (₹ Crore)

- Agriculture Sector:

- 2019-20: ₹1,75,826 crore

- 2020-21: ₹1,86,902 crore

- 2021-22: ₹1,91,571 crore

- 2022-23: ₹2,00,313 crore

- 2023-24: ₹2,04,576 crore (estimated)

- The Agriculture sector has seen steady growth over the years, showing resilience, especially during the pandemic years, with a notable increase from ₹1,75,826 crore in 2019-20 to an estimated ₹2,04,576 crore in 2023-24.

- Industry Sector:

- 2019-20: ₹1,73,350 crore

- 2020-21: ₹1,77,994 crore

- 2021-22: ₹1,94,853 crore

- 2022-23: ₹2,07,156 crore

- 2023-24: ₹2,32,895 crore (estimated)

- The Industry sector also shows steady growth, especially after a slower growth period during 2020-21, likely due to the pandemic. The sector’s growth picked up pace from ₹1,77,994 crore in 2020-21 to an estimated ₹2,32,895 crore in 2023-24.

- Service Sector:

- 2019-20: ₹2,85,571 crore

- 2020-21: ₹2,56,394 crore

- 2021-22: ₹2,93,597 crore

- 2022-23: ₹3,22,511 crore

- 2023-24: ₹3,43,057 crore (estimated)

- The Service sector, the largest contributor to the GSVA, experienced a decline in 2020-21 (₹2,56,394 crore), likely due to pandemic-related restrictions affecting the services economy. However, the sector has bounced back strongly, with a significant rise to ₹3,43,057 crore estimated for 2023-24.

Key Observations

- Agriculture Sector Stability:

- The agriculture sector has shown consistent growth over the years, with its GSVA increasing from ₹1,75,826 crore in 2019-20 to ₹2,04,576 crore in 2023-24. Despite the challenges posed by the pandemic, the sector has shown resilience, with steady year-on-year growth.

- Industry Sector’s Strong Growth Post-Pandemic:

- The industry sector exhibited moderate growth in 2020-21 but rebounded strongly in subsequent years. The projected GSVA for 2023-24 (₹2,32,895 crore) reflects the sector’s recovery and expansion, especially in manufacturing, mining, and construction activities.

- Service Sector’s Fluctuation and Recovery:

- The service sector saw a sharp decline in 2020-21 (down to ₹2,56,394 crore) during the pandemic, which heavily impacted industries like trade, tourism, and financial services. However, the recovery is strong, with GSVA expected to reach ₹3,43,057 crore in 2023-24, showing the sector’s return to its dominant role in the economy.

Key Terms

- Gross State Value Added (GSVA): Measures the value of goods and services produced within a state by various sectors of the economy. It reflects the contribution of each sector (agriculture, industry, and services) to the state’s economy, excluding taxes and subsidies.

- Constant (2011-12) Basic Prices: Refers to the method of calculating GSVA by using the prices from a base year (2011-12) to account for inflation. This gives a more accurate picture of real growth over time by removing the effects of price changes.

Conclusion

The data shows that Rajasthan’s economy has grown across all sectors, with the service sector remaining the largest contributor. The agriculture sector has been stable, while the industry and service sectors, after facing some pandemic-related disruptions, are showing strong recovery. The growth in the industry sector post-pandemic is particularly noteworthy, and the recovery in the service sector is essential for Rajasthan’s long-term economic stability.

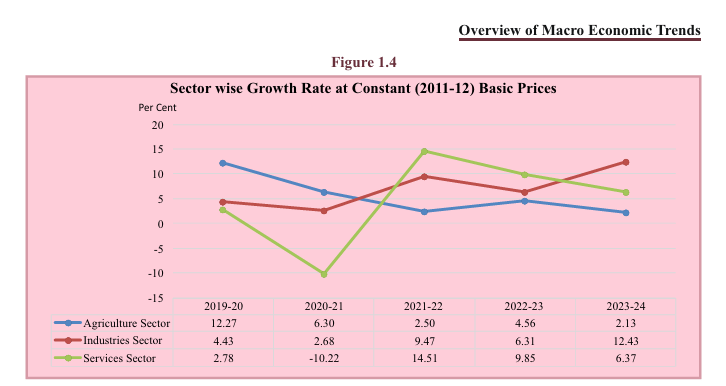

Figure 1.4

Analytical Summary

This chart presents the sector-wise growth rates at constant (2011-12) prices for the Agriculture, Industry, and Service sectors in Rajasthan from 2019-20 to 2023-24. The growth rates highlight the performance of each sector over time, reflecting the economic fluctuations and recovery patterns.

Key Data Points (Growth Rates in %)

- Agriculture Sector:

- 2019-20: 12.27%

- 2020-21: 6.30%

- 2021-22: 2.50%

- 2022-23: 4.56%

- 2023-24: 2.13% (estimated)

- The agriculture sector had a robust growth rate of 12.27% in 2019-20, but it gradually slowed down to 2.13% in 2023-24. The sector has faced challenges, possibly due to external factors such as changing weather patterns, resource constraints, or pandemic impacts.

- Industry Sector:

- 2019-20: 4.43%

- 2020-21: 2.68%

- 2021-22: 9.47%

- 2022-23: 6.31%

- 2023-24: 12.43% (estimated)

- The industry sector shows a clear recovery trajectory. After a modest growth of 2.68% in 2020-21 (during the pandemic), the sector rebounded strongly with 9.47% growth in 2021-22 and is projected to continue this positive trend with an estimated growth of 12.43% in 2023-24. This indicates increased industrial activity and production post-pandemic.

- Service Sector:

- 2019-20: 2.78%

- 2020-21: -10.22%

- 2021-22: 14.51%

- 2022-23: 9.85%

- 2023-24: 6.37% (estimated)

- The service sector was severely impacted by the pandemic, reflected in the sharp -10.22% contraction in 2020-21. However, it saw a strong recovery in 2021-22 with a growth rate of 14.51%. While growth slowed slightly in 2022-23 and is projected to moderate further to 6.37% in 2023-24, the sector has bounced back significantly from the pandemic lows.

Key Observations

- Pandemic Impact:

- The Service sector was hit hardest during the pandemic, with a -10.22% contraction in 2020-21. This is likely due to the lockdowns and restrictions that heavily impacted sectors like trade, tourism, hospitality, and financial services. However, the sharp recovery in subsequent years shows the resilience of the service industry in Rajasthan.

- Agriculture Sector’s Slowing Growth:

- The Agriculture sector, while initially strong in 2019-20 with 12.27% growth, has seen a slowdown over the years, projected to grow by only 2.13% in 2023-24. This reflects the sector’s vulnerability to structural and external challenges such as weather conditions, labor issues, and fluctuating market demands.

- Industry Sector’s Steady Growth:

- The Industry sector exhibited the most consistent growth trend, especially from 2021-22 onwards. The sector’s projected growth of 12.43% in 2023-24 indicates strong recovery, likely due to increased manufacturing, mining, and construction activities, which are key components of Rajasthan’s industrial base.

- Service Sector’s Fluctuations:

- Despite being the hardest hit during the pandemic, the service sector has bounced back with impressive growth in 2021-22 (14.51%), but this growth appears to be stabilizing, with a projected rate of 6.37% for 2023-24.

Key Insights

- Recovery and Resilience: All sectors experienced some degree of contraction or slowed growth due to the pandemic in 2020-21. However, each sector rebounded at different rates, with the industry and service sectors showing the strongest post-pandemic recoveries, while agriculture remained stable but slower in growth.

- Sectoral Growth Balance: While the service sector remains crucial to Rajasthan’s economy, both the agriculture and industry sectors are showing steady growth, indicating that Rajasthan’s economy is becoming more balanced across all sectors.

Conclusion

This data reflects the varying impacts of the pandemic on Rajasthan’s economy, with the service sector experiencing the greatest volatility. The industry’s strong recovery and the service sector’s rebound indicate a positive economic outlook for Rajasthan, while the agriculture sector shows more gradual growth, emphasizing the need for attention to agricultural productivity and sustainability.

Table 1.5

Analytical Summary

This table provides the Net State Domestic Product (NSDP) of Rajasthan for the years 2019-20 to 2023-24, both at current prices and constant (2011-12) prices. It also includes the annual growth rates for each year, which help in understanding Rajasthan’s economic performance over time.

Key Data Points

- NSDP at Current Prices (₹ Crore):

- 2019-20: ₹8,99,469 crore

- 2020-21: ₹9,06,308 crore (growth: 0.76%)

- 2021-22: ₹10,69,664 crore (growth: 18.02%)

- 2022-23: ₹12,15,197 crore (growth: 13.61%)

- 2023-24: ₹13,64,977 crore (growth: 12.70% – estimated)

- After a 0.76% growth in 2020-21, reflecting the pandemic’s impact, Rajasthan’s economy recovered strongly, with significant growth rates of 18.02% in 2021-22 and 13.61% in 2022-23. The projected growth for 2023-24 is slightly lower at 12.70%, reflecting a stabilization of growth as the economy normalizes post-recovery.

- NSDP at Constant (2011-12) Prices (₹ Crore):

- 2019-20: ₹5,98,220 crore

- 2020-21: ₹5,79,208 crore (growth: -3.18%)

- 2021-22: ₹6,34,389 crore (growth: 9.53%)

- 2022-23: ₹6,85,105 crore (growth: 7.99%)

- 2023-24: ₹7,40,581 crore (growth: 8.10% – estimated)

- The constant price data (adjusted for inflation) shows a clearer picture of real economic growth. The 3.18% contraction in 2020-21 highlights the significant economic impact of the pandemic, but the economy has since recovered, with growth stabilizing at around 8% from 2021-22 to 2023-24.

Key Observations

- Pandemic Impact and Recovery:

- The table clearly shows the economic contraction in 2020-21 due to the pandemic, with very low growth at current prices (0.76%) and negative growth at constant prices (-3.18%). This highlights the economic shock caused by the pandemic across sectors in Rajasthan.

- However, the sharp recovery in 2021-22, with growth rates of 18.02% at current prices and 9.53% at constant prices, shows the resilience of Rajasthan’s economy as it rebounded from the pandemic disruptions.

- Growth Stabilization:

- Post-recovery, the growth rates have gradually normalized. While the growth was extraordinarily high in 2021-22 as part of the recovery phase, it slowed slightly to 12.70% (current prices) and 8.10% (constant prices) in 2023-24, reflecting a return to more sustainable levels of economic expansion.

- Inflation-Adjusted Growth:

- The difference between growth at current prices and constant prices reflects inflationary pressures. For instance, the growth rate at current prices for 2023-24 is 12.70%, whereas at constant prices it is 8.10%, indicating inflation-adjusted real growth.

Key Terms

- NSDP (Net State Domestic Product): Represents the total value of goods and services produced within a state, after accounting for depreciation (wear and tear of capital goods). It is an important indicator of the state’s economic health.

- Current Prices: These reflect the actual market prices at the time, without any adjustments for inflation. This shows the nominal growth of the economy.

- Constant Prices (2011-12): These prices are adjusted for inflation using a base year (2011-12), giving a clearer picture of real growth by removing the effect of price changes.

- Growth Rate (%): The percentage change in NSDP from one year to the next, which helps gauge economic expansion or contraction.

Conclusion

This table illustrates the impact of the pandemic on Rajasthan’s economy and its subsequent recovery. After a brief contraction in 2020-21, Rajasthan experienced strong growth in 2021-22, and although growth rates have stabilized since then, the state is still seeing healthy economic expansion in 2022-23 and 2023-24.

Figure 1.5

Analytical Summary

The graph displays the Per Capita Income of Rajasthan and All India at current prices from 2019-20 to 2023-24, along with their respective growth rates. Per capita income is a vital measure to understand the average income of individuals within the state or country, providing insights into the economic well-being of the population.

Key Data Points

- Per Capita Income (₹):

- Rajasthan:

- 2019-20: ₹1,15,534

- 2020-21: ₹1,14,925

- 2021-22: ₹1,34,060

- 2022-23: ₹1,50,653

- 2023-24: ₹1,67,964 (estimated)

- All India:

- 2019-20: ₹1,32,341

- 2020-21: ₹1,27,244

- 2021-22: ₹1,50,996

- 2022-23: ₹1,69,946

- 2023-24: ₹1,84,205 (estimated)

- Rajasthan:

- Growth Rates (%):

- Rajasthan:

- 2019-20: 8.38%

- 2020-21: -0.53%

- 2021-22: 16.65%

- 2022-23: 12.38%

- 2023-24: 11.49% (estimated)

- All India:

- 2019-20: 5.08%

- 2020-21: -3.85%

- 2021-22: 18.60%

- 2022-23: 12.32%

- 2023-24: 8.68% (estimated)

- Rajasthan:

Key Observations

- Pandemic Impact and Recovery:

- Both Rajasthan and All India experienced a contraction in per capita income during 2020-21 due to the economic effects of the COVID-19 pandemic. Rajasthan saw a minor decline of -0.53%, while India faced a larger decline of -3.85%.

- The sharp recovery in 2021-22 with growth rates of 16.65% (Rajasthan) and 18.60% (All India) highlights the economic rebound after the pandemic, driven by recovery measures and the reopening of the economy.

- Rajasthan vs. All India:

- Rajasthan’s per capita income consistently lags behind the national average. In 2019-20, Rajasthan’s per capita income was ₹1,15,534, while All India’s was ₹1,32,341. This gap continues through the years, with the 2023-24 estimates showing Rajasthan at ₹1,67,964 and India at ₹1,84,205.

- Rajasthan’s growth rate tends to closely follow national trends but slightly underperforms compared to India in terms of absolute values of per capita income.

- Strong Growth Post-Pandemic:

- Rajasthan saw a significant recovery after the pandemic, with growth rates of 16.65% in 2021-22 and 12.38% in 2022-23, indicating a sustained economic recovery. The growth rate is projected to stabilize at 11.49% in 2023-24, reflecting continued improvement in economic conditions.

- Growth Stabilization:

- Both Rajasthan and India show stabilization in growth rates by 2023-24. Rajasthan’s growth rate is projected at 11.49%, while India’s is estimated at 8.68%. This suggests that the extraordinary growth seen immediately after the pandemic has normalized, with both regions returning to more sustainable growth levels.

Key Insights

- Per Capita Income Trends:

- While both Rajasthan and India are on a positive growth trajectory, Rajasthan’s per capita income remains lower than the national average. This could indicate structural challenges in the state’s economy, such as lower industrialization or a higher reliance on agriculture, which tends to have lower productivity and wages than other sectors.

- Economic Recovery:

- The steep growth in 2021-22 for both Rajasthan and India signals a strong recovery from the economic disruptions caused by the pandemic. The continued positive growth through 2023-24 points to economic resilience and the effectiveness of recovery policies.

- Relative Underperformance of Rajasthan:

- Despite steady growth, Rajasthan’s lower per capita income compared to the national average may point to inequalities in economic development across states. Efforts to boost industrial and service sector growth could help bridge this gap over time.

Key Terms

- Per Capita Income: The average income earned by each person in a state or country over a specific period, typically calculated by dividing the total income of the region by its population.

- Growth Rate (%): The percentage change in per capita income from one year to the next, which helps gauge the rate at which the economy is growing in terms of income generated per individual.

- Current Prices: Values measured in terms of the current year’s prices, without adjustment for inflation, showing the nominal change in income.

Conclusion

The data shows that both Rajasthan and India experienced a significant economic impact during the pandemic, with negative growth in per capita income in 2020-21. However, the strong recovery in the following years reflects resilience and sustained economic growth, with Rajasthan’s growth following a similar trajectory to the national average but maintaining a lower absolute income level.

Figure 1.6

Analytical Summary

This graph illustrates the Per Capita Income of Rajasthan and All India at constant (2011-12) prices from 2019-20 to 2023-24, along with the respective growth rates. This data is adjusted for inflation, providing a clearer picture of real income growth.

Key Data Points (₹)

- Per Capita Income (₹):

- Rajasthan:

- 2019-20: ₹76,840

- 2020-21: ₹73,447

- 2021-22: ₹79,507

- 2022-23: ₹84,935

- 2023-24: ₹90,831 (estimated)

- All India:

- 2019-20: ₹94,420

- 2020-21: ₹86,034

- 2021-22: ₹94,054

- 2022-23: ₹99,404

- 2023-24: ₹1,06,744 (estimated)

- Rajasthan:

- Growth Rates (%):

- Rajasthan:

- 2019-20: 3.87%

- 2020-21: -4.42%

- 2021-22: 8.25%

- 2022-23: 6.83%

- 2023-24: 6.94% (estimated)

- All India:

- 2019-20: 2.48%

- 2020-21: -8.88%

- 2021-22: 9.32%

- 2022-23: 5.69%

- 2023-24: 7.38% (estimated)

- Rajasthan:

Key Observations

- Pandemic Impact and Recovery:

- Both Rajasthan and All India experienced negative growth in 2020-21 due to the economic effects of the COVID-19 pandemic, with Rajasthan seeing a contraction of -4.42% and All India experiencing a steeper decline of -8.88%. This highlights the pandemic’s significant disruption to income levels across the country.

- The recovery phase is evident in 2021-22, where Rajasthan’s per capita income grew by 8.25%, while India’s grew by 9.32%, indicating a strong rebound after the pandemic.

- Rajasthan vs. All India:

- Rajasthan’s per capita income is consistently lower than the national average. For example, in 2023-24, Rajasthan’s estimated per capita income is ₹90,831, while the national average is estimated at ₹1,06,744. This disparity highlights structural differences in the economies of Rajasthan and the nation, such as lower industrialization or higher dependence on agriculture in Rajasthan.

- The growth rates for Rajasthan tend to closely follow national trends but often underperform in comparison to India in terms of absolute per capita income levels.

- Growth Stabilization Post-Recovery:

- After the strong post-pandemic recovery, growth rates are stabilizing for both Rajasthan and India. For 2023-24, Rajasthan is estimated to grow at 6.94%, while India is projected to grow at 7.38%. This suggests that the extraordinary growth seen immediately after the pandemic has normalized, with both economies returning to more sustainable growth patterns.

- Real Income Trends:

- Adjusting for inflation (using constant prices), both Rajasthan and India show positive growth trends in per capita income after 2020-21, indicating real improvements in income levels. However, the persistent gap between Rajasthan and the national average suggests potential areas for improvement in Rajasthan’s economic development, particularly in high-productivity sectors.

Key Insights

- Rajasthan’s Real Income Growth:

- Rajasthan’s per capita income, although growing, remains lower than the national average. This highlights the need for further development efforts, particularly in industrial and service sectors, to boost income levels.

- Pandemic-Induced Fluctuations:

- The negative growth in 2020-21 for both Rajasthan and India highlights the significant economic impact of the pandemic, particularly on individual income levels. However, the recovery in subsequent years demonstrates resilience in both the state and national economies.

- Closing the Gap:

- While both Rajasthan and India have experienced consistent growth in per capita income, Rajasthan’s income levels remain below the national average. Addressing this gap may require strategic investments in infrastructure, education, and industry to enhance productivity and raise income levels.

Key Terms

- Per Capita Income: The average income earned per person in a state or country over a period, calculated by dividing the total income of the region by its population.

- Constant (2011-12) Prices: Values adjusted for inflation to reflect the real growth in income, using 2011-12 as the base year. This provides a clearer picture of purchasing power and economic performance over time.

- Growth Rate (%): The percentage change in per capita income from one year to the next, showing the rate of increase or decrease in average income.

Conclusion

The data shows that both Rajasthan and India have recovered well from the pandemic-induced decline in per capita income, with steady growth in subsequent years. However, Rajasthan’s per capita income continues to lag behind the national average, suggesting that targeted economic interventions are necessary to close this gap and enhance the state’s economic prosperity.

Figure 1.7

Analytical Summary

This chart represents the Gross Fixed Capital Formation (GFCF) for the years 2018-19 to 2022-23, broken down into Private and Public investments. GFCF measures the net increase in physical assets (like infrastructure, buildings, machinery) within an economy and is a key indicator of investment trends.

Key Data Points (₹ Crore)

- Private Investment:

- 2018-19: ₹1,98,583 crore

- 2019-20: ₹2,10,971 crore

- 2020-21: ₹2,05,609 crore

- 2021-22: ₹2,76,046 crore

- 2022-23: ₹3,13,860 crore

- Public Investment:

- 2018-19: ₹66,545 crore

- 2019-20: ₹64,783 crore

- 2020-21: ₹65,067 crore

- 2021-22: ₹78,279 crore

- 2022-23: ₹85,734 crore

Key Observations

- Private Investment Growth:

- Private sector investment has shown significant growth, particularly in 2021-22 and 2022-23. After a slight dip in 2020-21 (likely due to pandemic-related disruptions), private investment rebounded sharply in 2021-22, increasing to ₹2,76,046 crore, and continued its growth to ₹3,13,860 crore in 2022-23. This indicates renewed business confidence and economic recovery post-pandemic.

- Public Investment Stability:

- Public investment has remained relatively stable, though it saw a notable increase in 2021-22, rising from ₹65,067 crore in 2020-21 to ₹78,279 crore in 2021-22. Public investment further increased to ₹85,734 crore in 2022-23, suggesting a continued focus on infrastructure and government-led projects, potentially as part of stimulus efforts during the recovery phase.

- Post-Pandemic Recovery:

- Both private and public investment declined or stagnated during 2020-21, reflecting the global economic downturn caused by the COVID-19 pandemic. However, the sharp rise in investments in 2021-22 and 2022-23 suggests a strong recovery, with both sectors investing heavily in fixed capital to drive long-term growth.

- Private Sector Dominance:

- The private sector accounts for a significantly larger portion of total GFCF compared to the public sector, consistently contributing over 70% of the total investment each year. This dominance suggests that private companies are the primary drivers of capital formation in the economy, focusing on industrial and service sector expansions.

- Public Sector Investment’s Crucial Role:

- While smaller in absolute terms, the public sector’s investment plays a crucial role, particularly in infrastructure projects like roads, energy, and public utilities. The increasing trend in public investment, particularly in 2021-22 and 2022-23, indicates an active role by the government in boosting capital formation through infrastructure and development projects.

Key Insights

- Investment Trends Reflect Economic Health:

- The sharp rise in GFCF in 2021-22 and 2022-23 highlights the post-pandemic recovery and suggests that both the private and public sectors are heavily investing in long-term assets, which is crucial for sustained economic growth.

- Balanced Growth in Public and Private Investments:

- Both private and public investments are growing, though at different scales. The private sector’s larger role indicates strong business activity, while the government’s rising investments suggest an emphasis on infrastructure development and economic recovery programs.

- Pandemic-Related Impact:

- The slight decline or stagnation in investments during 2020-21 reflects the significant economic challenges posed by the pandemic. However, the strong recovery in subsequent years demonstrates resilience in the economy.

Key Term

- Gross Fixed Capital Formation (GFCF): Refers to the net increase in fixed capital stock in an economy, including investments in physical assets such as machinery, buildings, infrastructure, and equipment. It is a key measure of investment activity, influencing future productive capacity.

Conclusion

The data shows a strong upward trend in both private and public investments, with a noticeable boost in 2021-22 and 2022-23. This surge in GFCF indicates a post-pandemic recovery, with both sectors contributing significantly to long-term economic growth. Private investment remains the dominant force, but public investment plays a crucial role in supporting infrastructure and development projects.

Table 1.6

Analytical Summary

This table provides a detailed breakdown of Gross Fixed Capital Formation (GFCF) by industry for the years 2018-19 to 2022-23 (provisional), measured in ₹ Crore. It highlights investment trends across key sectors such as agriculture, manufacturing, construction, and others.

Key Data Points (₹ Crore)

- Agriculture:

- 2018-19: ₹8,686 crore

- 2019-20: ₹9,095 crore

- 2020-21: ₹9,892 crore

- 2021-22: ₹11,602 crore

- 2022-23: ₹13,685 crore

- Investment in the agriculture sector has steadily increased, rising from ₹8,686 crore in 2018-19 to ₹13,685 crore in 2022-23. This reflects a consistent focus on improving agricultural infrastructure.

- Forestry:

- 2018-19: ₹112 crore

- 2019-20: ₹98 crore

- 2020-21: ₹131 crore

- 2021-22: ₹331 crore

- 2022-23: ₹463 crore

- Investment in forestry has grown significantly, especially in 2021-22 and 2022-23, where it saw an increase to ₹463 crore. This reflects increased capital formation in sustainable forest management and related industries.

- Fishing:

- 2018-19 to 2020-21: Minimal investments (₹1-2 crore)

- 2021-22: ₹2 crore

- 2022-23: ₹7 crore

- Investment in the fishing industry remains minimal, although it has slightly increased in recent years.

- Mining:

- 2018-19: ₹2,717 crore

- 2019-20: ₹2,613 crore

- 2020-21: ₹2,638 crore

- 2021-22: ₹2,659 crore

- 2022-23: ₹2,614 crore

- Investment in mining has remained relatively flat over the five-year period, hovering around ₹2,600 crore annually. This suggests stable but limited growth in the mining sector.

- Manufacturing (Registered):

- 2018-19: ₹13,768 crore

- 2019-20: ₹15,701 crore

- 2020-21: ₹13,091 crore

- 2021-22: ₹20,035 crore

- 2022-23: ₹21,127 crore

- Registered manufacturing experienced a dip during the pandemic (2020-21), but rebounded strongly in 2021-22 and 2022-23, with significant growth to ₹21,127 crore in 2022-23, indicating a recovery and renewed investments in the sector.

- Construction:

- 2018-19: ₹94,164 crore

- 2019-20: ₹1,03,174 crore

- 2020-21: ₹1,03,875 crore

- 2021-22: ₹1,54,278 crore

- 2022-23: ₹1,85,069 crore

- The construction sector has seen a significant increase in investments, with GFCF growing from ₹94,164 crore in 2018-19 to ₹1,85,069 crore in 2022-23. This rapid growth highlights the importance of infrastructure development in the state’s economy.

- Electricity, Gas, and Water Supply:

- 2018-19: ₹16,947 crore

- 2019-20: ₹16,159 crore

- 2020-21: ₹17,901 crore

- 2021-22: ₹20,769 crore

- 2022-23: ₹12,741 crore

- Investment in the electricity, gas, and water supply sector peaked at ₹20,769 crore in 2021-22 before dropping to ₹12,741 crore in 2022-23, indicating a potential shift in focus or completion of large infrastructure projects.

- Railways:

- 2018-19: ₹1,295 crore

- 2019-20: ₹1,222 crore

- 2020-21: ₹296 crore

- 2021-22: ₹1,051 crore

- 2022-23: ₹1,041 crore

- Investment in the railways sector fluctuated, with a sharp decline in 2020-21, followed by a recovery in 2021-22 and stability in 2022-23. Despite this, railways remain a smaller component of overall capital formation.

Key Observations

- Growth in Construction Sector:

- The construction industry has seen significant growth in investment, becoming the largest contributor to GFCF in 2022-23, with ₹1,85,069 crore. This reflects major infrastructure projects, including roads, buildings, and urban development.

- Recovery in Manufacturing:

- Manufacturing, which faced a slowdown during the pandemic, saw a strong rebound in 2021-22 and 2022-23. This indicates renewed industrial activity and confidence in the sector, driven by government incentives and economic recovery efforts.

- Public Utilities (Electricity, Gas, Water Supply):

- Investments in utilities grew until 2021-22 but saw a significant decline in 2022-23, potentially due to the completion of major projects or reallocation of resources to other sectors like construction.

- Stable Mining Sector:

- The mining sector’s investment has remained flat over the five-year period. This may reflect regulatory challenges or a lack of expansion in this sector.

- Low Investments in Forestry, Fishing, and Railways:

- These sectors, while showing minor growth, receive minimal investments compared to industries like construction and manufacturing, indicating that these sectors are not major drivers of capital formation in the state.

Key Insights

- Construction and Infrastructure Drive Capital Formation:

- The sharp increase in investments in the construction sector reflects the focus on infrastructure development as a key driver of economic growth. This includes both public and private sector projects.

- Manufacturing Resurgence:

- After a dip during the pandemic, the manufacturing sector is recovering strongly, with investment levels reaching new highs in 2022-23. This indicates increased production capacity and industrial expansion in the state.

- Electricity and Utilities Shift:

- The decline in GFCF in the electricity, gas, and water supply sector in 2022-23 suggests a shift in investment priorities, possibly towards sectors like construction and manufacturing that are witnessing rapid growth.

Key Term

- Gross Fixed Capital Formation (GFCF): A measure of the net increase in fixed assets such as buildings, machinery, and infrastructure, representing long-term investments in the economy that contribute to future production capacity.

Conclusion

The data reveals significant investments in construction and manufacturing, which are key drivers of Rajasthan’s economic growth. The focus on infrastructure and industrial recovery post-pandemic is evident from the strong growth in these sectors, while investments in utilities and railways have seen more fluctuations. This reflects the evolving investment priorities of both public and private sectors.

Table – Gross Capital Formation

Analytical Summary

This table shows the Gross Fixed Capital Formation (GFCF) for key industries from 2018-19 to 2022-23, measured in ₹ crore. The industries covered include communication, trade and services, financial services, residential buildings, and public administration.

Key Data Points (₹ Crore):

- Communication:

- 2018-19: ₹17,308 crore

- 2019-20: ₹15,136 crore

- 2020-21: ₹15,002 crore

- 2021-22: ₹15,815 crore

- 2022-23: ₹15,318 crore

- The communication sector has seen relatively stable investments over the five-year period, with a slight decline in 2022-23 to ₹15,318 crore from a peak of ₹17,308 crore in 2018-19.

- Manufacturing (Unregistered), Trade, Hotels, Restaurant, Transport, and Other Services:

- 2018-19: ₹10,451 crore

- 2019-20: ₹10,902 crore

- 2020-21: ₹10,503 crore

- 2021-22: ₹12,857 crore

- 2022-23: ₹15,045 crore

- Investment in this broad sector has grown steadily, especially after the pandemic. There was a moderate increase in 2021-22 and 2022-23, suggesting recovery and expansion in trade, hotels, and transport services.

- Financial Services:

- 2018-19: ₹1,415 crore

- 2019-20: ₹1,731 crore

- 2020-21: ₹1,322 crore

- 2021-22: ₹1,489 crore

- 2022-23: ₹1,514 crore

- The financial services sector saw a decline during the pandemic year (2020-21), but it has shown a steady recovery since then, with a marginal increase to ₹1,514 crore in 2022-23.

- Residential Building:

- 2018-19: ₹63,322 crore

- 2019-20: ₹66,405 crore

- 2020-21: ₹62,869 crore

- 2021-22: ₹73,474 crore

- 2022-23: ₹79,856 crore

- Residential building investments dipped slightly during the pandemic but rebounded strongly in 2021-22 and 2022-23. The sector saw significant growth in the post-pandemic years, reflecting strong demand for housing.

- Public Administration:

- 2018-19: ₹34,942 crore

- 2019-20: ₹33,518 crore

- 2020-21: ₹33,157 crore

- 2021-22: ₹39,964 crore

- 2022-23: ₹51,114 crore

- Public administration investments have grown substantially, particularly in 2021-22 and 2022-23. The sharp increase to ₹51,114 crore in 2022-23 highlights increased government spending, likely tied to infrastructure development and public services.

- Total GFCF:

- 2018-19: ₹2,65,128 crore

- 2019-20: ₹2,75,755 crore

- 2020-21: ₹2,70,676 crore

- 2021-22: ₹3,54,326 crore

- 2022-23: ₹3,99,594 crore

- Overall, total capital formation has seen strong growth after the pandemic, increasing significantly in 2021-22 and 2022-23, reflecting widespread investments across various sectors.

Key Observations

- Strong Recovery Post-Pandemic:

- Several sectors, including residential building, manufacturing, trade, and public administration, saw a dip during the pandemic year of 2020-21. However, these sectors rebounded strongly in 2021-22 and 2022-23, indicating a recovery in demand and investments.

- Residential Building Growth:

- Investments in residential buildings saw strong growth post-pandemic, reaching ₹79,856 crore in 2022-23. This reflects a housing boom driven by demand for residential properties, government housing schemes, and urban development.

- Public Administration Investments:

- The significant rise in public administration spending from ₹33,157 crore in 2020-21 to ₹51,114 crore in 2022-23 highlights increased government investment in public infrastructure, social services, and administrative services, likely as part of broader recovery programs.

- Stable Financial Services Investment:

- Investments in financial services remain relatively low and stable compared to other sectors. However, the sector has shown signs of recovery since the pandemic and may be an area for future growth.

- Trade, Hospitality, and Transport Recovery:

- The unregistered manufacturing, trade, hotels, restaurants, and transport sector also showed steady growth, with investments increasing from ₹10,503 crore in 2020-21 to ₹15,045 crore in 2022-23. This suggests a revival of consumer demand and business activity in these industries.

Key Insights

- Infrastructure and Public Spending:

- The rise in public administration and residential building investments highlights the government’s role in driving infrastructure projects and housing developments, which are essential for long-term growth and urban development.

- Post-Pandemic Growth:

- The recovery in sectors like trade, hospitality, and manufacturing post-pandemic is crucial for economic stabilization. The continued growth in these sectors reflects renewed business confidence and consumer demand.

- Capital Formation Trends:

- The overall growth in Gross Fixed Capital Formation from ₹2,70,676 crore in 2020-21 to ₹3,99,594 crore in 2022-23 underscores the economy’s resilience and the broad-based nature of investment recovery across different industries.

Key Term:

- Gross Fixed Capital Formation (GFCF): A measure of investment in fixed assets such as infrastructure, buildings, machinery, and equipment. It indicates the economy’s ability to expand productive capacity and support future growth.

Conclusion

The table shows that Rajasthan’s economy is seeing strong post-pandemic recovery, with significant investments in public administration, housing, and key sectors like manufacturing and trade. Government spending, particularly in infrastructure, plays a critical role in driving overall capital formation, while the private sector continues to invest in residential and service industries, fostering economic growth.

Table 1.7

Analytical Summary

This table provides the Wholesale Price Index (WPI) for Rajasthan across various major groups from 2019 to 2023. The WPI reflects the changes in the prices of goods at the wholesale level and is a critical measure of inflation in the economy. The base year for this index is set as 1999-2000 (100).

Key Data Points

- Primary Articles:

- 2019: 317.48

- 2020: 331.49

- 2021: 378.22

- 2022: 416.65

- 2023: 420.67

- Prices of primary articles (including agricultural articles and minerals) have steadily increased, indicating inflationary trends in basic commodities. The index for primary articles has grown by approximately 32.5% over the five-year period.

- Agricultural Articles:

- 2019: 314.89

- 2020: 328.58

- 2021: 377.10

- 2022: 415.64

- 2023: 414.86

- Agricultural article prices have consistently risen, although 2023 shows a slight stabilization compared to 2022.

- Minerals:

- 2019: 337.05

- 2020: 353.47

- 2021: 386.65

- 2022: 424.23

- 2023: 464.56

- The mineral index has seen significant growth, with prices increasing by approximately 37.8% from 2019 to 2023. This could be driven by higher demand for raw materials and global price fluctuations.

- Fuel, Power, Light, and Lubricants:

- 2019: 461.22

- 2020: 509.26

- 2021: 569.93

- 2022: 578.86

- 2023: 579.11

- The index for fuel, power, light, and lubricants has been highly volatile, reflecting global energy price shifts. After peaking in 2021, prices stabilized somewhat in 2022 and 2023, but they remain significantly higher than in previous years.

- Manufactured Products:

- 2019: 256.74

- 2020: 272.27

- 2021: 285.65

- 2022: 302.60

- 2023: 303.29

- Prices for manufactured products have shown a steady increase over the five years, reflecting cost-push inflation due to rising input costs like fuel and raw materials.

- All Commodities:

- 2019: 310.56

- 2020: 330.86

- 2021: 363.23

- 2022: 385.83

- 2023: 387.90

- The overall WPI for all commodities shows steady inflationary pressure, with the index increasing from 310.56 in 2019 to 387.90 in 2023, marking a 24.9% rise over the period.

Key Observations

- Inflationary Pressures in Primary Articles:

- The increase in the WPI for primary articles, particularly minerals and agricultural products, indicates that the cost of essential goods has risen steadily over time. The price of minerals, in particular, has grown faster than agricultural products, suggesting higher demand for raw materials.

- Fuel Price Volatility:

- The fuel, power, light, and lubricants index has been highly volatile, reflecting global energy price fluctuations. Fuel prices spiked in 2021 and have remained high through 2023, impacting transportation, manufacturing, and other sectors reliant on energy inputs.

- Stable Growth in Manufactured Products:

- The index for manufactured products shows a more moderate and consistent increase, reflecting incremental price hikes in goods. This is likely due to the rise in input costs, including raw materials and fuel, passed on to consumers at the wholesale level.

- Overall Inflation:

- The All Commodities WPI shows a steady rise, highlighting general inflation across all sectors. From 2019 to 2023, the index increased by nearly 24.9%, indicating broad-based inflationary pressures across the economy.

Key Insights

- Agriculture and Mineral Price Increases:

- The significant rise in prices of primary articles, particularly in minerals and agricultural products, could have implications for both consumers and producers. Higher input costs could affect profitability for businesses, while increased consumer prices may reduce purchasing power.

- Energy Costs Drive Inflation:

- The volatility in the fuel, power, light, and lubricants sector suggests that energy costs are a major driver of inflation. High energy prices can cascade through the economy, affecting transportation, manufacturing, and service sectors, thereby contributing to overall inflation.

- Inflationary Pressures Persist:

- The rise in the WPI across all categories suggests that Rajasthan is experiencing persistent inflationary pressures, likely driven by supply chain disruptions, rising global commodity prices, and increased demand for raw materials post-pandemic.

Key Term

- Wholesale Price Index (WPI): A measure of the average change in the prices of goods at the wholesale level, reflecting the cost of raw materials and intermediate goods. It serves as a leading indicator of inflation in the economy.

Conclusion:

The data highlights increasing inflationary pressures across various sectors in Rajasthan, particularly in primary articles and energy-related products. The steady rise in the WPI for all commodities indicates that inflation remains a concern, driven by global price trends and rising input costs. The higher cost of energy and raw materials may continue to influence the prices of manufactured goods, affecting overall economic stability.

Table 1.8

Analytical Summary

This table outlines the Annual Average Percent Variations in the Wholesale Price Index (WPI) for various major commodity groups from 2019 to 2023. The table provides year-on-year percentage changes in wholesale prices, reflecting inflationary trends across different sectors.

Key Data Points (% Year-on-Year Change)

- Primary Articles:

- 2019: 6.15%

- 2020: 4.41%

- 2021: 14.10%

- 2022: 10.16%

- 2023: 0.96%

- The primary articles category, which includes agricultural articles and minerals, saw significant price increases in 2021 and 2022, driven by supply chain disruptions and rising global commodity prices. However, the growth rate slowed dramatically in 2023 to just 0.96%, indicating some stabilization.

- Agricultural Articles:

- 2019: 6.43%

- 2020: 4.35%

- 2021: 14.77%

- 2022: 10.22%

- 2023: -0.19%

- Agricultural article prices saw sharp increases in 2021 and 2022, likely due to post-pandemic supply shortages and rising input costs. However, in 2023, prices slightly contracted by -0.19%, signaling that the inflationary pressure in this category has eased.

- Minerals:

- 2019: 4.26%

- 2020: 4.87%

- 2021: 9.39%

- 2022: 9.72%

- 2023: 9.51%