CHAPTER 4

The industrial sector in Rajasthan plays a pivotal role in the state’s economic development, contributing significantly to Gross State Value Added (GSVA) and employment. Chapter 4 delves into the dynamic landscape of industrial development in Rajasthan, a crucial component of the state’s economy. As one of India’s largest states, Rajasthan boasts a diverse industrial base, characterized by a rich endowment of natural resources, a robust MSME sector, and significant contributions from manufacturing, mining, electricity, and construction. The chapter highlights the strategic initiatives undertaken by the Rajasthan government to foster industrial growth, promote entrepreneurship, and enhance competitiveness in both domestic and global markets.

The industrial sector has become a key driver of economic development, contributing significantly to the Gross State Value Added (GSVA) and generating employment opportunities across various segments. The chapter outlines the performance of major industrial sub-sectors, providing insights into growth trends, sectoral contributions, and the overall economic impact of industrial activities. Special emphasis is placed on the role of Micro, Small, and Medium Enterprises (MSMEs), which are essential for promoting entrepreneurship, boosting employment, and enhancing local economies.

Additionally, the chapter explores the impact of government policies and schemes aimed at attracting investment, such as the Rajasthan Investment Promotion Scheme (RIPS), and initiatives that focus on sustainability, export promotion, and the establishment of specialized industrial zones. By examining the current state and future prospects of industrial development in Rajasthan, Chapter 4 provides a comprehensive understanding of how the state is positioning itself as a key player in India’s industrial landscape while addressing challenges and opportunities for growth.

Through this analysis, the chapter aims to illustrate the importance of industrialization in fostering economic resilience, promoting social equity, and ensuring sustainable development in Rajasthan.

- Industrial Growth and Sectoral Performance

- Rajasthan’s industrial sector contributed 28.21% to the GSVA in 2023-24, reflecting 12.43% growth at constant (2011-12) prices.

- Gross State Value Added (GSVA) by major industrial sub-sectors at current prices:

- Manufacturing: ₹1.71 lakh crore (42.27% of the industrial GSVA)

- Construction: ₹1.42 lakh crore (35.26%)

- Electricity, Gas, Water Supply & Other Utility Services: ₹0.42 lakh crore (10.48%)

- Mining & Quarrying: ₹0.48 lakh crore (11.99%)(ES_RJ_Ch4).

- Analysis: The robust growth of the manufacturing and construction sectors is a reflection of the state’s focused policy initiatives, infrastructure investments, and a strong MSME base. The contribution of electricity and utility services shows that energy security and infrastructure have kept pace with industrial demands.

- Key Growth Drivers:

- Infrastructure Development (roads, industrial zones, power availability).

- Industrial Policy Support through investment incentives like RIPS 2022.

- MSME Growth, which provides the backbone for employment and rural industrialization.

- Objective Insight: Rajasthan’s sustained growth in manufacturing and construction showcases the state’s ability to attract investments, particularly in labor-intensive sectors. The high share of the construction sector also reflects increased public spending on urban development and rural infrastructure projects, generating employment and boosting local economies.

- Index of Industrial Production (IIP)

- Rajasthan’s IIP provides a clear picture of industrial growth in three major sub-sectors—manufacturing, mining, and electricity.

- Manufacturing IIP: Grew from 125.93 in 2019-20 to 170.01 in 2023-24.

- Mining IIP: Dropped from 125.60 to 111.38, reflecting volatility in mineral extraction activities.

- Electricity IIP: Increased from 135.15 to 168.64, showing robust power generation(ES_RJ_Ch4).

- Objective Insight: The steady rise in the manufacturing IIP indicates a strong recovery and growth trajectory, underpinned by policy support, export growth, and investments in special economic zones. However, the drop in mining output highlights the challenges faced by the sector, including environmental regulations and resource depletion.

- Micro, Small, and Medium Enterprises (MSMEs)

- Rajasthan’s MSME sector is a significant contributor to the industrial economy, accounting for over 45% of industrial output and employing millions in sectors such as textiles, gems and jewellery, handicrafts, and food processing.

- Performance Highlights (2023-24):

- 4,70,676 MSMEs registered under the Udyam Registration Portal.

- MSMEs attracted total investment proposals worth ₹6,044.93 crore, creating 22,59,227 employment opportunities(ES_RJ_Ch4).

- Mukhyamantri Laghu Udyog Protsahan Yojana (MLUPY) disbursed ₹1,451.70 crore in loans to 7,920 entrepreneurs.

- Objective Insight: MSMEs are the engine of economic growth in Rajasthan, fostering entrepreneurship, generating employment, and promoting inclusive industrialization. The MSME-friendly policies of the state, such as credit access under MLUPY, reflect the government’s focus on self-employment and rural industrialization. Additionally, MSMEs play a crucial role in boosting exports in sectors like textiles and handicrafts, adding significant value to the state’s economy.

- Export Performance

- Rajasthan’s Exports (2023-24):

- Total exports: ₹83,704.24 crore, showing steady growth from ₹77,771.35 crore in 2022-23.

- Major export contributors:

- Engineering Goods: ₹16,592.51 crore (19.82%)

- Gems & Jewellery: ₹11,183.23 crore (13.36%)

- Textiles: ₹8,819.58 crore (10.54%)

- Handicrafts: ₹3,203.56 crore(ES_RJ_Ch4).

- Key Markets: USA, UAE, Germany, and China are the largest markets for Rajasthan’s exports.

- Objective Insight: Rajasthan’s exports are driven by sectors with high value addition, such as gems and jewellery, engineering, and textiles. The state’s focus on export-oriented growth, through the promotion of industrial parks, export councils, and the One District One Product (ODOP) initiative, is critical for positioning Rajasthan as a global player in niche products.

- One District One Product (ODOP)

- ODOP Initiative: Launched to promote district-specific products with high export potential.

- Ajmer: Granite and Marble.

- Alwar: Engineering Products and Indian Sweets.

- Bikaner: Namkeen and Woolen Carpet Yarn(ES_RJ_Ch4).

- Objective Insight: ODOP encourages local specialization, fostering district-level industrial growth and creating market linkages for rural and semi-urban industries. By promoting unique regional products, the scheme helps rural areas integrate into global markets and ensures sustainable development across the state.

- Investment Promotion Schemes

- Rajasthan Investment Promotion Scheme (RIPS) 2022:

- Focuses on attracting domestic and international investments in key sectors like renewable energy, green hydrogen, medical devices, and pharmaceuticals.

- Aims to create 10 lakh employment opportunities by 2027.

- Performance: The Bureau of Investment Promotion (BIP) facilitated investment proposals worth ₹25,351.05 crore, generating 11,186 jobs(ES_RJ_Ch4).

- Objective Insight: The state’s proactive policies for attracting investments are pivotal in diversifying the industrial base and modernizing industries. The focus on green energy and renewables is forward-looking, aligning with India’s push for sustainable industrialization and clean energy transitions.

- RIICO: Expanding Industrial Infrastructure

- Rajasthan State Industrial Development & Investment Corporation (RIICO):

- Land Acquired: 1,266.72 acres.

- Land Developed: 1,068.99 acres.

- Developed key specialized industrial parks:

- Medical Devices Park in Jodhpur.

- Agro Food Parks in Kota, Alwar, and Sriganganagar(ES_RJ_Ch4).

- Objective Insight: RIICO plays a crucial role in developing world-class industrial infrastructure, attracting investments, and supporting sectoral growth through specialized parks. These parks provide focused ecosystems for industries such as agro-processing, medical devices, and renewables, boosting employment and innovation.

- Mining Sector

- Rajasthan’s mining sector is one of the largest contributors to the state’s industrial output, producing a wide range of minerals, including lead, zinc, gypsum, silver, marble, and granite.

- 2023-24 Performance:

- Mining revenue: ₹7,491.20 crore.

- 58 minerals currently being extracted.

- Major outputs: Zinc (50% of India’s production) and Lead (33%)(ES_RJ_Ch4).

- Objective Insight: While mining is a significant revenue generator, the environmental impact of mining and the finite nature of resources highlight the need for sustainable mining practices and long-term planning to prevent resource depletion and ensure continued revenue generation.

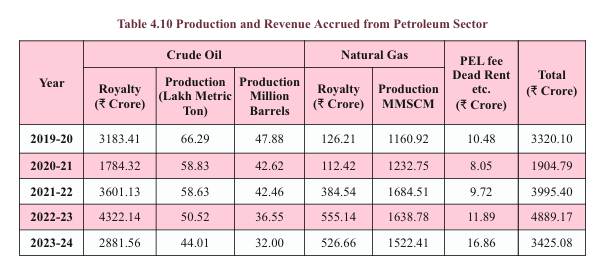

- Oil and Natural Gas Sector

- Rajasthan contributes 14.95% of India’s total crude oil production, primarily from the Barmer-Sanchore Basin.

- 2023-24 Production:

- Crude Oil: 44.01 lakh metric tonnes.

- Natural Gas: 1,522.41 MMSCM(ES_RJ_Ch4).

- The Rajasthan Refinery Project is expected to produce BS-6 standard fuels, adding value to the oil and gas industry.

- Objective Insight: The oil and gas sector is a key contributor to Rajasthan’s industrial economy and India’s energy security. Investments in the Rajasthan Refinery Project will strengthen the state’s energy infrastructure

- Sectoral Diversification

- Importance of Sectoral Balance: The diversification across manufacturing, mining, construction, and electricity is essential for mitigating risks associated with dependency on a single sector. Each sector contributes uniquely to the state’s economic resilience and adaptability.

- Manufacturing has shown strong growth due to investments in technology and skilled labor.

- Construction continues to expand due to public infrastructure projects and urban development.

- Mining faces challenges but remains a significant revenue source, necessitating innovation in extraction and environmental management.

- Takeaway: Continued diversification across these sectors will help Rajasthan withstand economic shocks and adapt to changing market demands. Emphasizing value addition in manufacturing and mining can further enhance sectoral performance.

- Role of Infrastructure in Industrial Growth

- Critical Infrastructure Investments: The role of organizations like RIICO in developing industrial infrastructure—such as specialized industrial parks—is crucial. These parks are designed to cater to specific industries, providing the necessary facilities and support systems for growth.

- Logistical Improvements: Enhancements in transportation (roads and railways) and utilities (electricity and water supply) facilitate smoother operations for industries, ensuring they remain competitive and efficient.

- Takeaway: Continuous investment in infrastructure is vital for sustaining industrial growth. Ensuring that the infrastructure keeps pace with industrial development will bolster productivity and attract further investment.

- Emphasis on Sustainability and Green Industries

- Focus on Sustainable Practices: Rajasthan’s government initiatives encourage environmentally sustainable practices, particularly in mining and manufacturing sectors. The emphasis on renewable energy projects aligns with global trends toward sustainability.

- Green Technologies: Adoption of green technologies in industries can help minimize ecological impact and promote sustainable development.

- Takeaway: The promotion of green industries and sustainable practices is essential not only for compliance with environmental regulations but also for improving the long-term viability of Rajasthan’s industrial sectors.

- Women’s Empowerment through Industrialization

- Role of Women in MSMEs: The MSME sector offers significant opportunities for women, enabling them to become entrepreneurs and participate actively in the economy. Programs targeting women’s participation in industries like handicrafts and textiles can promote gender equity in employment.

- Capacity Building: Initiatives aimed at skill development for women can enhance their contributions to the industrial sector, fostering a more inclusive growth environment.

- Takeaway: Empowering women through industrial opportunities not only improves family income but also enhances community development and social equity in rural and urban settings.

- Strategic Partnerships and Collaborations

- Public-Private Partnerships (PPPs): The state’s focus on PPPs can facilitate the development of infrastructure, innovation, and technology transfer, further boosting industrial capabilities.

- Collaboration with Educational Institutions: Engaging with technical and vocational education institutions can ensure that the workforce is equipped with skills aligned to industry needs.

- Takeaway: Strategic partnerships between the government, private sector, and educational institutions can create a conducive environment for innovation and workforce development, ensuring that industries remain competitive globally.

- Future Challenges and Opportunities

- Market Volatility: Industries must be prepared to navigate market fluctuations, particularly in sectors like mining and manufacturing, which can be influenced by global demand and commodity prices.

- Regulatory Compliance: Adhering to environmental and safety regulations will be crucial for long-term sustainability and social acceptance of industrial activities.

- Technological Advancements: Embracing automation and Industry 4.0 technologies can enhance productivity and efficiency within various industrial sectors.

- Takeaway: Addressing these challenges through proactive planning, continuous innovation, and strategic investment will be vital for ensuring the resilience and growth of Rajasthan’s industrial sector.

Conclusion

Rajasthan’s industrial sector has demonstrated significant growth and resilience, emerging as a crucial driver of the state’s economy. This chapter has explored various dimensions of industrial development, including the contributions of different sectors, policy initiatives, and the performance of Micro, Small, and Medium Enterprises (MSMEs). The following conclusions summarize the key findings, with pointers emphasizing the overall implications for Rajasthan’s industrial landscape.

- Robust Sectoral Growth

- Diverse Industrial Base: The industrial sector’s contribution to the Gross State Value Added (GSVA) was 28.21% in 2023-24, reflecting a 12.43% growth at constant prices. The manufacturing and construction sectors emerged as dominant contributors.

- Sectoral Performance:

- Manufacturing: ₹1.71 lakh crore (42.27% of industrial GSVA).

- Construction: ₹1.42 lakh crore (35.26%).

- Mining: Revenue of ₹7,491.20 crore, highlighting the importance of mineral extraction in the state’s economy.

Takeaway: The sustained growth across various industrial sectors indicates a well-balanced industrial ecosystem that leverages Rajasthan’s natural resources and labor potential.

- Significant Role of MSMEs

- MSME Contribution: With 4,70,676 registered MSMEs, the sector plays a crucial role in driving employment, innovation, and entrepreneurship in Rajasthan.

- Investment and Employment Generation: Investment proposals worth ₹6,044.93 crore were received, generating 22,59,227 employment opportunities. Additionally, the Mukhyamantri Laghu Udyog Protsahan Yojana (MLUPY) has been instrumental in supporting MSMEs through financial assistance.

Takeaway: The MSME sector is a backbone of Rajasthan’s industrial development, fostering local entrepreneurship and economic resilience, especially in rural areas.

- Export Growth and Market Diversification

- Increased Export Performance: Total exports reached ₹83,704.24 crore in 2023-24, indicating a healthy growth trajectory, with key exports including engineering goods, gems & jewellery, and textiles.

- Key Markets: The state has successfully tapped into global markets, establishing a presence in the USA, UAE, and Germany.

Takeaway: The growth in exports not only contributes to foreign exchange earnings but also enhances the state’s industrial profile on international platforms, promoting economic growth through trade.

- Investment Promotion Strategies

- Rajasthan Investment Promotion Scheme (RIPS) 2022: The state’s proactive approach to attracting investments is reflected in proposals worth ₹25,351.05 crore, aimed at creating 10 lakh employment opportunities by 2027.

- Focus on Strategic Sectors: Emphasis on sectors such as renewable energy, green hydrogen, and medical devices aligns with global trends toward sustainability.

Takeaway: Strategic investment promotion and the development of favorable policies are crucial for enhancing Rajasthan’s industrial competitiveness and diversifying its economic base.

- Infrastructure Development and RIICO’s Role

- Critical Infrastructure Investments: RIICO’s efforts in land acquisition and the development of specialized industrial parks have laid the foundation for industrial growth, facilitating smoother operations for businesses.

- Specialized Parks: Parks dedicated to medical devices and agro-processing have boosted sectoral growth and enhanced Rajasthan’s appeal as a destination for specific industries.

Takeaway: Continuous investment in infrastructure is essential for supporting industrial activities and fostering an environment conducive to business growth and innovation.

- Sustainability and Green Initiatives

- Focus on Sustainable Practices: The chapter emphasizes the need for environmentally sustainable practices, particularly in mining and manufacturing, to minimize ecological impact and enhance long-term viability.

- Green Energy: Investments in renewable energy projects will contribute to Rajasthan’s energy security and align with global sustainability goals.

Takeaway: Emphasizing sustainability not only ensures compliance with environmental regulations but also improves the overall health of the ecosystem, contributing to a sustainable industrial future.

- Challenges and Future Prospects

- Market Volatility: Industries must navigate market fluctuations, particularly in mining and manufacturing, which can be influenced by global demand and commodity prices.

- Technological Advancements: Embracing Industry 4.0 technologies and automation will be essential for enhancing productivity and efficiency in various industrial sectors.

Takeaway: Addressing challenges through innovation and strategic planning will be crucial for sustaining growth in Rajasthan’s industrial sector and ensuring its competitiveness in a rapidly changing economic landscape.

Final Thoughts

Rajasthan’s industrial landscape is a testament to the state’s strategic planning, resource potential, and commitment to fostering a diverse and sustainable economic environment. The insights drawn from this chapter highlight several critical aspects that define the current state and future prospects of industrial development in Rajasthan:

- Comprehensive Strategy for Growth: The coordinated efforts across various sectors—manufacturing, mining, MSMEs, and exports—demonstrate a comprehensive strategy aimed at bolstering industrial growth. This approach not only contributes to the state’s GDP but also enhances overall economic resilience.

- Empowerment through MSMEs: The emphasis on Micro, Small, and Medium Enterprises (MSMEs) is vital for creating employment opportunities and promoting local entrepreneurship. Supporting MSMEs through financial assistance and capacity-building initiatives can stimulate innovation and improve livelihoods in both urban and rural settings.

- Global Integration: The increase in exports signifies Rajasthan’s successful integration into the global economy. By focusing on high-value products and diversifying markets, the state can enhance its economic profile and increase foreign exchange earnings.

- Investment in Infrastructure: Continuous investment in industrial infrastructure, spearheaded by RIICO and other agencies, is crucial for facilitating business operations and attracting investment. Infrastructure development, including specialized industrial parks, supports sector-specific growth and boosts the overall industrial ecosystem.

- Sustainability Commitment: Emphasizing environmentally sustainable practices within industries is essential for long-term viability. Addressing the challenges of resource depletion and ecological impact through sustainable practices not only aligns with global standards but also ensures a healthier environment for future generations.

- Adaptability and Innovation: The ability of the industrial sector to adapt to changing market conditions, technological advancements, and consumer preferences will be critical for sustained growth. Embracing new technologies and innovative practices can enhance productivity and efficiency across various sectors.

- Future Challenges: While Rajasthan’s industrial sector is poised for growth, challenges such as market volatility, regulatory compliance, and the need for skilled labor must be addressed. Proactive measures, including workforce development and risk management strategies, will be essential to navigate these challenges.

In conclusion, Rajasthan stands at a pivotal point in its industrial development journey. The state’s unique resources, strategic initiatives, and commitment to sustainability create a promising foundation for future growth. By fostering a collaborative environment among government, industry, and communities, Rajasthan can enhance its position as a key player in India’s industrial landscape, driving economic prosperity and improving the quality of life for its citizens. The path forward will require continuous innovation, investment in human capital, and a focus on sustainable practices to ensure that the benefits of industrial development are felt across all segments of society.

CHAPTER 4

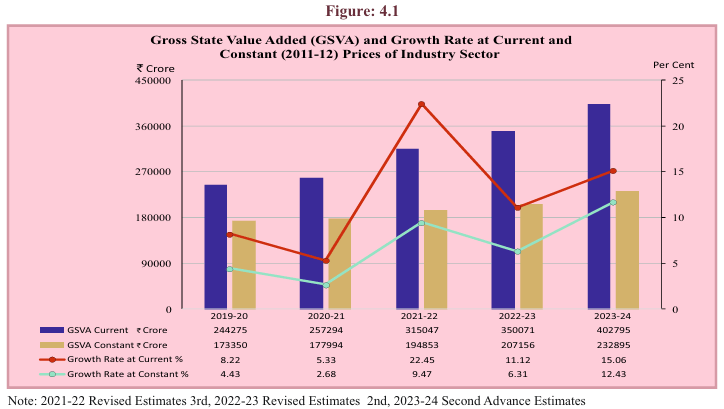

Figure 4.1

Analytical Summary

This chart provides a detailed view of the Gross State Value Added (GSVA) and growth rates for the Industry Sector in Rajasthan for the years 2019-20 to 2023-24, both at current prices and constant (2011-12) prices.

Key Data Points

- GSVA at Current Prices (₹ Crore):

- 2019-20: ₹2,44,275 crore

- 2023-24: ₹4,02,795 crore

- Insight: The GSVA at current prices has nearly doubled over the period, indicating strong growth in the industrial sector. The sharp rise in 2021-22 can be attributed to recovery from the pandemic, with growth stabilizing in the subsequent years.

- GSVA at Constant (2011-12) Prices (₹ Crore):

- 2019-20: ₹1,73,350 crore

- 2023-24: ₹2,32,895 crore

- Insight: The GSVA at constant prices, adjusted for inflation, shows steady growth, reflecting real economic growth in the industrial sector. The sector has grown by approximately 34% in real terms over the five-year period.

- Growth Rate at Current Prices (% Per Year):

- 2019-20: 8.22%

- 2023-24: 15.06%

- Insight: The growth rate at current prices shows fluctuations, with a significant peak in 2021-22 at 22.45%. This surge likely reflects a post-pandemic recovery, after which the growth stabilized in the range of 11-15%.

- Growth Rate at Constant Prices (% Per Year):

- 2019-20: 4.43%

- 2023-24: 12.43%

- Insight: The growth rate at constant prices follows a similar trend, peaking at 9.47% in 2021-22. The steady rise in growth over the years reflects increasing industrial activity and economic recovery.

Key Observations

- Sharp Growth Post-Pandemic (2021-22):

- The 2021-22 period shows an extraordinary jump in the GSVA and growth rates, suggesting a robust recovery from the economic slowdown caused by the pandemic. The industrial sector saw a surge in output during this period, driven by a combination of government stimulus, increased industrial production, and normalization of supply chains.

- Steady Growth in the Industrial Sector:

- Both the GSVA at constant and current prices show consistent growth over the years, with current prices reflecting the effects of inflation and constant prices providing a real view of the industrial sector’s expansion. This suggests a healthy trajectory for the sector.

- Moderate Growth in Earlier Years:

- Growth rates in 2019-20 and 2020-21 were relatively moderate, particularly at constant prices, likely due to a combination of global economic factors and the impact of the COVID-19 pandemic. The sector managed to maintain positive growth, but at a slower pace during these years.

- Stabilization in Growth from 2022-23:

- Following the peak in 2021-22, growth rates began to stabilize in 2022-23 and 2023-24, suggesting that the sector is moving towards a more sustainable growth pattern post-recovery.

Key Insights

- Industrial Recovery Post-Pandemic:

- The significant growth rates in 2021-22 highlight the resilience of the industrial sector, bouncing back strongly from the pandemic-induced slowdown. This recovery was driven by factors such as increased production, higher demand, and supportive government policies.

- Sustained Growth Opportunities:

- The 15% growth rate at current prices in 2023-24 suggests that the industrial sector continues to expand at a healthy pace. Continued investment in infrastructure, manufacturing, and technological innovation will be key to maintaining this upward trajectory.

- Focus on Inflation-Adjusted Growth:

- The constant price growth rate of 12.43% in 2023-24 indicates that the industrial sector’s real growth is strong, with inflation-adjusted gains reflecting increased productivity and output. This is crucial for long-term economic sustainability.

Conclusion

The industrial sector in Rajasthan has shown robust growth, particularly during the post-pandemic recovery in 2021-22, with GSVA and growth rates peaking during this period. The sector has since stabilized and continues to show strong potential for sustained growth. The steady rise in both current and constant prices suggests that industrial output, infrastructure, and productivity are all contributing to the state’s economic growth.

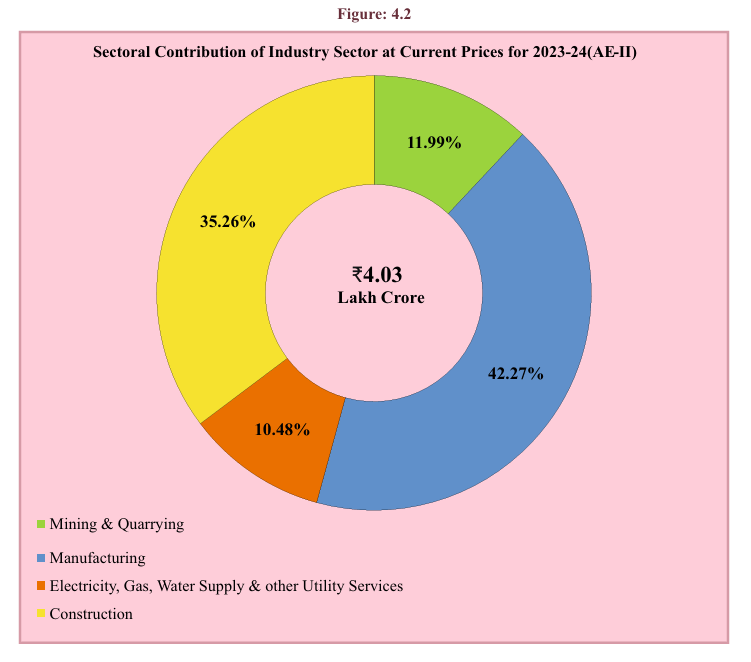

Figure 4.2

Analytical Summary

This chart presents the sectoral contribution of the Industry Sector in Rajasthan at current prices for the year 2023-24 (AE-II). The total contribution of the Industry Sector amounts to ₹4.03 lakh crore.

Key Data Points

- Manufacturing:

- Contribution: 42.27%

- Insight: Manufacturing forms the largest component of the industrial sector, contributing over 42% to the total GSVA of ₹4.03 lakh crore. This indicates that the manufacturing sector remains the backbone of Rajasthan’s industrial output, likely driven by both large-scale industries and small and medium enterprises (SMEs).

- Construction:

- Contribution: 35.26%

- Insight: Construction is the second-largest contributor, accounting for 35.26% of the total sectoral contribution. This reflects significant ongoing investments in infrastructure, urban development, housing, and other construction activities, making it a key driver of industrial growth.

- Electricity, Gas, Water Supply & Other Utility Services:

- Contribution: 10.48%

- Insight: Utility services contribute 10.48%, highlighting the essential role of electricity, gas, water supply, and other services in supporting industrial activities and the broader economy. This share reflects the infrastructure needs to support Rajasthan’s growing industries.

- Mining & Quarrying:

- Contribution: 11.99%

- Insight: Mining and quarrying contribute around 12% to the industrial sector. Given Rajasthan’s rich mineral resources, this contribution underscores the importance of mining activities in the state’s economy, including the extraction of minerals such as limestone, marble, and gypsum.

Key Observations

- Manufacturing as the Primary Driver:

- The manufacturing sector dominates the industrial landscape, contributing nearly half of the sector’s GSVA. This indicates that Rajasthan’s industrial policies are likely focused on strengthening and expanding manufacturing capabilities, especially in key sectors such as textiles, cement, and auto components.

- Significant Role of Construction:

- The high contribution of the construction sector (35.26%) reflects ongoing infrastructure development projects. This includes housing, commercial real estate, roads, and public works, which are critical for both urban and rural development.

- Mining & Quarrying’s Strategic Role:

- The mining & quarrying sector plays a vital role in Rajasthan’s economy, especially as the state is known for its vast mineral wealth. Despite being the smallest contributor in this chart, its contribution of nearly 12% is significant, indicating the strategic importance of Rajasthan’s mining activities.

- Utility Services Supporting Industrial Growth:

- The utility services sector, contributing 10.48%, shows that electricity, gas, and water supply infrastructure is a key enabler of industrial activities. Investments in these utilities are crucial to sustaining and expanding industrial operations in Rajasthan.

Key Insights

- Diversified Industrial Sector:

- The contributions from manufacturing, construction, mining, and utilities indicate that Rajasthan has a diversified industrial base. While manufacturing is dominant, other sectors such as construction and mining also play critical roles in the state’s overall industrial output.

- Potential for Growth in Mining:

- Although mining contributes 11.99%, there is potential for further growth in this sector, especially with the rising global demand for minerals. Enhancing mining efficiency and ensuring sustainable practices could increase its contribution to the state’s economy.

- Infrastructure Development:

- The large share of construction activities suggests that infrastructure development is a priority. Continued investment in infrastructure will not only boost the construction sector but also enhance industrial productivity by improving transportation and logistical networks.

Conclusion

The Industry Sector in Rajasthan for 2023-24 is largely driven by manufacturing and construction, accounting for the bulk of the sectoral contribution. Mining & quarrying and utility services also play significant roles, supporting the broader industrial ecosystem. To sustain growth, Rajasthan will need to continue focusing on improving infrastructure, supporting manufacturing, and maximizing the potential of its mining sector.

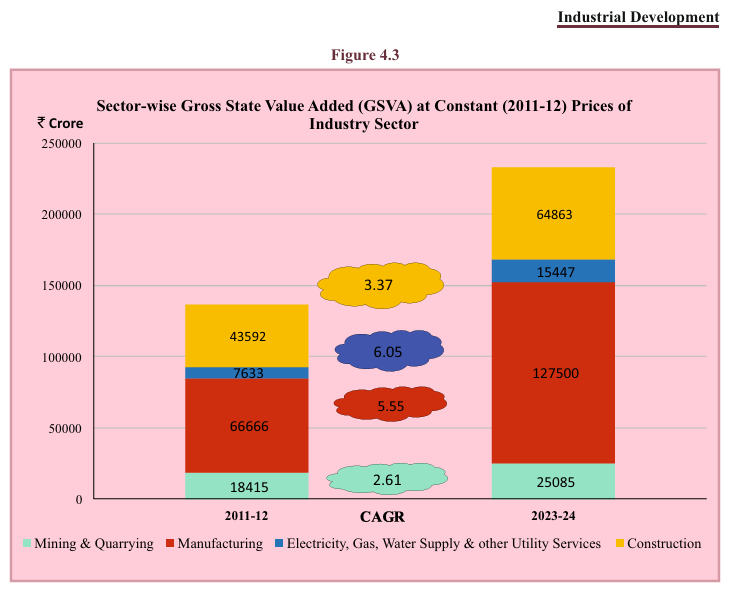

Figure 4.3

Analytical Summary

This chart depicts the sector-wise Gross State Value Added (GSVA) at constant (2011-12) prices for the Industry Sector in Rajasthan, comparing 2011-12 with 2023-24 and displaying the Compound Annual Growth Rate (CAGR) for each sector within the industry.

Key Data Points

- Mining & Quarrying:

- 2011-12 GSVA: ₹18,415 crore

- 2023-24 GSVA: ₹25,085 crore

- CAGR: 2.61%

- Insight: The mining and quarrying sector has experienced slow but steady growth over the years, with a CAGR of 2.61%. This reflects stable, incremental development in this sector, which is important given Rajasthan’s rich mineral resources.

- Manufacturing:

- 2011-12 GSVA: ₹66,666 crore

- 2023-24 GSVA: ₹1,27,500 crore

- CAGR: 5.55%

- Insight: Manufacturing is the largest contributor to the industry sector, showing significant growth from ₹66,666 crore to ₹1,27,500 crore, with a CAGR of 5.55%. This reflects the increasing importance of manufacturing activities, which have more than doubled in this period, likely driven by the expansion of industries such as textiles, automobiles, and cement.

- Electricity, Gas, Water Supply & Other Utility Services:

- 2011-12 GSVA: ₹7,633 crore

- 2023-24 GSVA: ₹15,447 crore

- CAGR: 6.05%

- Insight: Utility services have grown at the highest rate among the sectors with a CAGR of 6.05%. This is a reflection of increasing demand for infrastructure, energy, and water supply to support both residential and industrial expansion.

- Construction:

- 2011-12 GSVA: ₹43,592 crore

- 2023-24 GSVA: ₹64,863 crore

- CAGR: 3.37%

- Insight: The construction sector has grown at a moderate rate, with a CAGR of 3.37%. This indicates ongoing infrastructure and real estate development, but at a slower pace compared to manufacturing and utilities.

Key Observations

- Manufacturing as the Growth Engine:

- The manufacturing sector remains the dominant contributor to the overall GSVA of the industry sector, with substantial growth over the 12-year period. It continues to be the key driver of industrial expansion, likely supported by state and central government initiatives to boost industrialization and exports.

- Steady Growth in Utilities:

- Utility services have grown at the fastest rate, highlighting the increasing need for energy, water, and other essential infrastructure to sustain both urbanization and industrial activities. The high CAGR of 6.05% reflects the sector’s critical role in supporting Rajasthan’s industrial ecosystem.

- Slower Growth in Mining & Construction:

- The mining and construction sectors, while essential, have grown at slower rates compared to manufacturing and utilities. Mining’s CAGR of 2.61% indicates that while it remains an important sector, there is room for further expansion, especially as the demand for minerals increases globally. Construction’s CAGR of 3.37% also suggests the need for more investment in infrastructure projects.

Key Insights

- Potential for Expansion in Mining:

- The slow growth in the mining and quarrying sector presents an opportunity for increased investment and innovation. Enhancing mining technologies and promoting sustainable practices could accelerate growth and improve the sector’s contribution to the state’s industrial output.

- Critical Role of Utilities in Industrial Expansion:

- The rapid growth in the utilities sector reflects the state’s push to improve infrastructure, especially in energy and water supply, which are crucial for supporting industrial and urban growth. Continuing to invest in these services will be vital for sustaining future industrial expansion.

- Focus on Strengthening Manufacturing:

- With a CAGR of 5.55%, manufacturing has demonstrated consistent and substantial growth, highlighting the sector’s ability to drive overall industrial development in Rajasthan. Further support in the form of policies, incentives, and infrastructure development can enhance its role as the key driver of economic growth.

Conclusion

The industry sector in Rajasthan has experienced solid growth, particularly in the manufacturing and utility services sectors. While mining and construction have grown at slower rates, they remain essential contributors to the overall industrial landscape. Continued investments in manufacturing, infrastructure, and sustainable practices in mining will be crucial to maintaining Rajasthan’s economic momentum in the coming years.

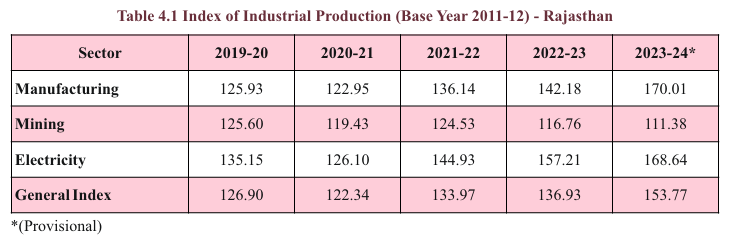

Table 4.1

Analytical Summary

This table provides the Index of Industrial Production (IIP) for Rajasthan across different industrial sectors—Manufacturing, Mining, and Electricity—from 2019-20 to the provisional estimate for 2023-24. The General Index represents the combined performance of these sectors.

Key Data Points:

- Manufacturing:

- 2019-20: 125.93

- 2023-24 (Provisional): 170.01

- Insight: The manufacturing sector has shown consistent growth over the years, with a significant jump from 142.18 in 2022-23 to 170.01 in 2023-24. This reflects a strong post-pandemic recovery and increasing industrial activity, indicating that manufacturing is a key driver of Rajasthan’s industrial production.

- Mining:

- 2019-20: 125.60

- 2023-24 (Provisional): 111.38

- Insight: In contrast to manufacturing, the mining sector has seen a decline, with the index falling from 125.60 in 2019-20 to 111.38 in 2023-24. This suggests challenges in the mining sector, potentially related to regulatory, environmental, or resource-related issues, which may have impacted production levels.

- Electricity:

- 2019-20: 135.15

- 2023-24 (Provisional): 168.64

- Insight: The electricity sector has grown steadily, reaching 168.64 in 2023-24, up from 157.21 in 2022-23. This growth highlights increasing energy production to meet the growing industrial and domestic demand, reflecting improvements in power infrastructure and supply reliability.

- General Index:

- 2019-20: 126.90

- 2023-24 (Provisional): 153.77

- Insight: The General Index, which reflects the overall industrial production across sectors, has steadily increased from 126.90 in 2019-20 to 153.77 in 2023-24. This overall growth reflects the combined improvements in manufacturing and electricity, offsetting the decline in mining.

Key Observations

- Manufacturing Driving Growth:

- The manufacturing sector has seen the most robust growth over the period, with its index rising from 125.93 in 2019-20 to a provisional 170.01 in 2023-24. This highlights the sector’s increasing contribution to industrial production, likely driven by diversification and modernization in industries such as textiles, cement, and automotive components.

- Decline in Mining:

- The mining sector has experienced a steady decline, with the index falling from 125.60 in 2019-20 to 111.38 in 2023-24. This suggests that mining activities are facing challenges, possibly related to resource depletion, stricter environmental regulations, or lower global demand for certain minerals. Addressing these issues will be critical to revitalizing this sector.

- Steady Rise in Electricity Production:

- The electricity sector has shown consistent growth, with the index increasing from 135.15 in 2019-20 to 168.64 in 2023-24. This reflects improvements in energy production capacity, likely driven by investments in renewable energy, coal, and other sources to meet the growing energy demand in both industrial and residential areas.

- Post-Pandemic Industrial Recovery:

- The growth in the General Index from 122.34 in 2020-21 to 153.77 in 2023-24 signals a strong post-pandemic recovery. The surge in manufacturing and electricity production has driven this recovery, while the decline in mining highlights the need for diversification and sector-specific policies.

Key Insights

- Manufacturing as the Growth Engine:

- The robust growth in manufacturing underscores the importance of this sector in driving Rajasthan’s industrial production. Continued support in terms of infrastructure development, skilled labor, and technological innovation will be critical for sustaining this momentum.

- Addressing Challenges in the Mining Sector:

- The declining mining index points to underlying issues that need to be addressed. Enhancing mining efficiency, adopting sustainable practices, and possibly expanding exploration activities could help reverse this trend and boost production.

- Increased Energy Production:

- The rise in the electricity index reflects the state’s efforts to improve energy infrastructure, likely involving renewable energy projects such as solar and wind. Further expansion in energy capacity will be necessary to support continued industrial growth.

- Balanced Industrial Growth:

- The steady increase in the General Index signals that Rajasthan’s industrial sector is growing at a healthy rate, driven largely by manufacturing and electricity. Ensuring that mining contributes positively to this index in the future will help maintain balanced industrial growth.

Conclusion

Rajasthan’s industrial production has seen consistent growth over the past five years, particularly driven by the manufacturing and electricity sectors. The decline in mining is a cause for concern, but with strategic interventions, this sector can regain its footing. Overall, the industrial sector’s growth trajectory is positive, and continued investments in infrastructure, energy, and manufacturing will be key to sustaining this progress.

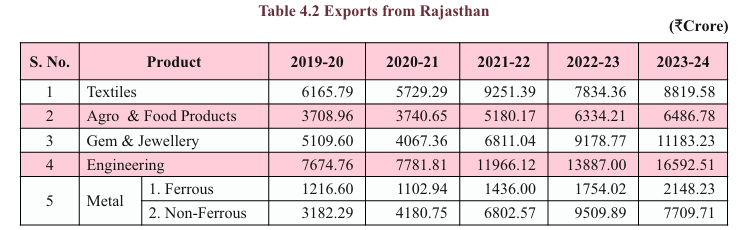

Table 4.2

Analytical Summary

This table provides a detailed breakdown of Rajasthan’s exports across key product categories for the years 2019-20 to 2023-24. The values are provided in ₹ crore.

Key Data Points

- Textiles:

- 2019-20: ₹6,165.79 crore

- 2023-24: ₹8,819.58 crore

- Insight: The textile sector has seen steady growth in exports, increasing from ₹6,165.79 crore in 2019-20 to ₹8,819.58 crore in 2023-24. The sharp rise in 2021-22 (₹9,251.39 crore) reflects a post-pandemic recovery, supported by demand for garments and textiles globally.

- Agro & Food Products:

- 2019-20: ₹3,708.96 crore

- 2023-24: ₹6,486.78 crore

- Insight: The export of agro and food products has shown consistent growth, particularly rising significantly from 2021-22 onwards. This highlights Rajasthan’s agricultural export strength, which includes grains, spices, and processed food products.

- Gems & Jewellery:

- 2019-20: ₹5,109.60 crore

- 2023-24: ₹11,183.23 crore

- Insight: Gems and jewellery exports have more than doubled over this period, reflecting Rajasthan’s prominence in the gemstone and jewellery sector. The surge from ₹6,811.04 crore in 2021-22 to ₹11,183.23 crore in 2023-24 points to increased global demand and recovery in luxury markets.

- Engineering:

- 2019-20: ₹7,674.76 crore

- 2023-24: ₹16,592.51 crore

- Insight: Engineering exports have seen a robust increase, more than doubling in five years. This sector includes machinery, equipment, and other engineering goods, reflecting Rajasthan’s growing capabilities in manufacturing and exporting high-value-added products.

- Metal:

- Ferrous Metals:

- 2019-20: ₹1,216.60 crore

- 2023-24: ₹2,148.23 crore

- Insight: The export of ferrous metals has shown a moderate increase, indicating steady demand for steel and iron products globally.

- Non-Ferrous Metals:

- 2019-20: ₹3,182.29 crore

- 2023-24: ₹7,709.71 crore

- Insight: The export of non-ferrous metals (such as copper, zinc, aluminum) has seen significant growth, highlighting Rajasthan’s mineral wealth and its export potential in non-ferrous metal industries.

- Ferrous Metals:

Key Observations

- Gems & Jewellery Exports Lead Growth:

- The gems and jewellery sector has seen the highest growth among the sectors, more than doubling from ₹5,109.60 crore in 2019-20 to ₹11,183.23 crore in 2023-24. This reflects Rajasthan’s position as a major hub for gemstone cutting, polishing, and jewellery manufacturing, driven by both domestic expertise and international demand.

- Engineering and Manufacturing Export Expansion:

- The significant rise in engineering exports from ₹7,674.76 crore to ₹16,592.51 crore shows Rajasthan’s growing capabilities in this sector. This growth could be driven by government initiatives and increased investments in engineering goods manufacturing for global markets.

- Consistent Growth in Agro & Food Products:

- The steady growth in the export of agro and food products reflects Rajasthan’s strong agricultural base, with increasing global demand for products such as grains, spices, and processed foods. This sector continues to be an important contributor to Rajasthan’s exports.

- Growth in Non-Ferrous Metals Exports:

- The sharp increase in non-ferrous metals exports, from ₹3,182.29 crore in 2019-20 to ₹7,709.71 crore in 2023-24, highlights the growing importance of this sector in Rajasthan’s export portfolio. Rajasthan’s mineral wealth is being leveraged to meet global demand for these metals, which are critical for industries such as automotive, construction, and electronics.

Key Insights

- Diversification in Export Portfolio:

- Rajasthan’s export portfolio is well-diversified, spanning textiles, agro products, gems and jewellery, engineering goods, and metals. This diversification helps reduce dependency on any single sector and spreads risk across multiple industries.

- Strong Manufacturing Base:

- The growth in engineering and textiles exports indicates a strong and expanding manufacturing base in Rajasthan. Investments in manufacturing infrastructure, innovation, and global market access are likely driving this growth.

- Global Demand for Luxury and Specialty Products:

- The remarkable growth in gems and jewellery exports reflects strong international demand for Rajasthan’s high-quality gemstones and jewellery. Continued focus on branding, quality assurance, and meeting international standards will help sustain this growth trajectory.

- Mineral Wealth and Industrial Potential:

- The increase in non-ferrous metals exports highlights the potential of Rajasthan’s mineral wealth, which includes zinc, lead, and other valuable metals. Expanding mining and refining capabilities could further boost this sector.

Conclusion

Rajasthan’s exports have grown steadily across a diverse range of sectors, with significant gains in gems and jewellery, engineering, and non-ferrous metals. The state’s manufacturing base is expanding, supported by strong exports in textiles and engineering goods. Meanwhile, the continued growth in agro and food products reflects Rajasthan’s strength as an agricultural exporter. Going forward, sustaining this growth will require continued investments in infrastructure, skill development, and global market access.

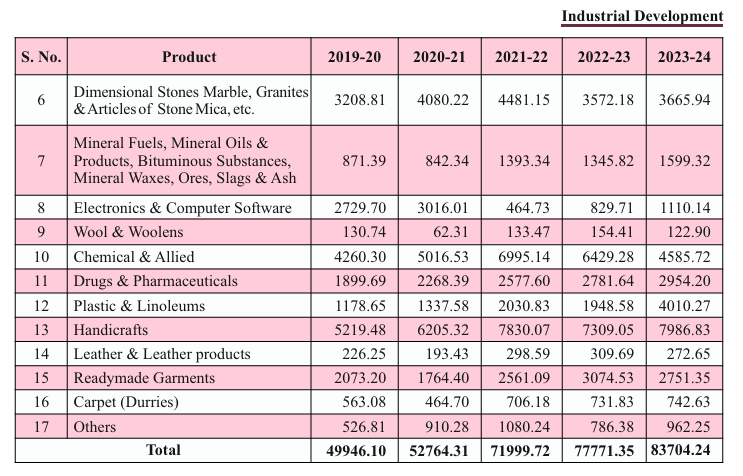

Table – Exports from Rajasthan: Industrial Products

Analytical Summary

This table provides a detailed breakdown of Rajasthan’s exports across various industrial products for the years 2019-20 to 2023-24. The values are provided in ₹ crore.

Key Data Points:

- Dimensional Stones (Marble, Granites, Articles of Stone Mica, etc.):

- 2019-20: ₹3,208.81 crore

- 2023-24: ₹3,665.94 crore

- Insight: The exports of dimensional stones have grown steadily, reflecting the demand for high-quality stone products from Rajasthan, known globally for its marble and granite. However, the growth between 2022-23 and 2023-24 shows a modest increase, indicating possible market saturation or competition from other regions.

- Mineral Fuels, Mineral Oils & Products, Bituminous Substances, Mineral Waxes, Ores, Slags & Ash:

- 2019-20: ₹871.39 crore

- 2023-24: ₹1,599.32 crore

- Insight: This category has experienced significant growth, nearly doubling its exports. This highlights the increasing global demand for mineral fuels and oils, as well as Rajasthan’s ability to cater to the energy and mineral markets.

- Electronics & Computer Software:

- 2019-20: ₹2,729.70 crore

- 2023-24: ₹1,110.14 crore

- Insight: The exports in electronics and computer software peaked in 2021-22 but dropped significantly in subsequent years. This could indicate increased competition, shifting market demand, or a focus on other product categories by exporters.

- Wool & Woolens:

- 2019-20: ₹130.74 crore

- 2023-24: ₹122.90 crore

- Insight: The export of wool and woolen products has remained relatively stagnant, with minor fluctuations. This indicates a stable but limited global demand for these products.

- Chemical & Allied Products:

- 2019-20: ₹4,260.30 crore

- 2023-24: ₹4,558.72 crore

- Insight: The exports in chemical and allied products have seen gradual growth, indicating sustained demand in this sector. Rajasthan likely supplies important chemical products used in industrial manufacturing globally.

- Drugs & Pharmaceuticals:

- 2019-20: ₹1,899.69 crore

- 2023-24: ₹2,954.20 crore

- Insight: The pharmaceutical sector has shown significant growth, driven by global demand for medicines and healthcare products, particularly after the COVID-19 pandemic.

- Plastic & Linoleums:

- 2019-20: ₹1,178.65 crore

- 2023-24: ₹4,010.27 crore

- Insight: This sector has experienced one of the largest jumps, more than tripling in export value. This could reflect rising demand for plastic and related products, as well as Rajasthan’s growing manufacturing capacity in this segment.

- Handicrafts:

- 2019-20: ₹5,219.48 crore

- 2023-24: ₹7,986.83 crore

- Insight: Handicrafts have shown robust growth, reflecting Rajasthan’s rich tradition in artisanal products and strong global demand for culturally unique, handcrafted items.

- Readymade Garments:

- 2019-20: ₹2,073.20 crore

- 2023-24: ₹2,751.35 crore

- Insight: Readymade garments have shown steady growth in exports, driven by Rajasthan’s strong textile manufacturing base, especially in apparel and garments.

- Carpets (Durries):

- 2019-20: ₹563.08 crore

- 2023-24: ₹742.63 crore

- Insight: The carpets and durries segment has grown gradually, reflecting consistent global demand for traditional Indian handwoven carpets.

Key Observations

- Rise in Plastic and Linoleum Exports:

- The most notable increase has been in the plastic and linoleum sector, with exports growing from ₹1,178.65 crore to ₹4,010.27 crore. This indicates that Rajasthan has seen considerable growth in manufacturing plastic products, likely benefiting from global supply chain demands.

- Steady Growth in Handicrafts:

- Handicraft exports have shown consistent growth, reflecting the state’s strong tradition in handmade items and increasing demand from international markets for unique, artisan goods. Rajasthan remains a key player in global handicrafts, which is an essential part of its cultural and economic identity.

- Pharmaceutical Growth Post-Pandemic:

- The rise in drugs and pharmaceuticals exports reflects increased global demand for Indian pharmaceuticals, especially after the COVID-19 pandemic. This trend is likely to continue as Rajasthan strengthens its pharmaceutical production capacity.

- Stable Growth in Marble and Dimensional Stones:

- Exports of dimensional stones such as marble and granite have shown steady growth, highlighting the state’s importance in the global stone industry. Despite fluctuations in other sectors, stone exports remain a reliable revenue stream for the state.

- Decline in Electronics & Computer Software Exports:

- A sharp decline in the electronics and computer software sector after 2021-22 suggests changes in global demand or competitive pressures in this segment. This could signal a need for Rajasthan to diversify further or invest in upgrading technology capabilities to compete better.

Key Insights

- Industrial Diversification:

- Rajasthan’s export profile shows significant diversification, from traditional sectors like handicrafts and marble to modern industries such as pharmaceuticals and plastics. This diversification will help stabilize the state’s economy by reducing reliance on any single sector.

- Opportunities for Expanding High-Value Sectors:

- The growth in drugs and pharmaceuticals, plastics, and chemicals points to opportunities for Rajasthan to further invest in these high-value sectors. Expanding these industries will boost exports and increase their contribution to the state’s economy.

- Sustaining Handicraft and Textile Dominance:

- Rajasthan remains a leader in handicrafts and textile exports, and maintaining this dominance will require continuing support for artisans, skills development, and improved access to global markets.

Conclusion

Rajasthan’s export portfolio reflects a balance between traditional and modern industries, with growth driven by sectors like handicrafts, pharmaceuticals, and plastics. This diversified export base positions the state well for continued growth, though sectors such as electronics may need additional focus to regain competitiveness. The overall rise in exports from ₹49,946.10 crore in 2019-20 to ₹83,704.24 crore in 2023-24 demonstrates the state’s strong performance in the global market.

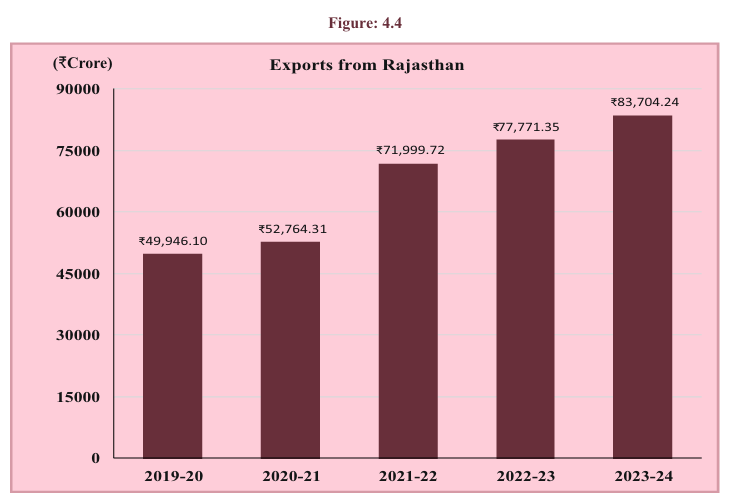

Figure 4.4

Analytical Summary

This bar graph depicts the steady rise in exports from Rajasthan over the fiscal years from 2019-20 to 2023-24, with values in ₹ crore.

Key Data Points

- 2019-20: ₹49,946.10 crore

- 2020-21: ₹52,764.31 crore

- 2021-22: ₹71,999.72 crore

- 2022-23: ₹77,771.35 crore

- 2023-24: ₹83,704.24 crore

Key Insights:

- Steady Export Growth:

- Rajasthan’s exports have shown a significant upward trend over the five-year period, increasing from ₹49,946.10 crore in 2019-20 to ₹83,704.24 crore in 2023-24. This represents a growth of more than 67.5% over this period.

- Post-Pandemic Recovery:

- The jump from ₹52,764.31 crore in 2020-21 to ₹71,999.72 crore in 2021-22 highlights a strong recovery in export activities following the global COVID-19 pandemic. This period saw the reopening of global markets and increased demand for Rajasthan’s diverse export products.

- Sustained Growth:

- The steady growth between 2021-22 and 2023-24, with exports rising from ₹71,999.72 crore to ₹83,704.24 crore, shows sustained performance in international markets. This likely reflects the robust performance of key export sectors such as textiles, engineering goods, gems and jewellery, plastics, and handicrafts.

- Diversified Export Base:

- The consistent rise in export values indicates that Rajasthan has a well-diversified export base, contributing to its resilience against global economic fluctuations. Sectors like manufacturing, pharmaceuticals, and chemicals have likely played a role in maintaining this growth.

Conclusion

Rajasthan’s export growth over the last five years showcases the state’s ability to adapt and expand its presence in global markets. The sharp recovery following the pandemic and the sustained export performance in recent years underline the success of its economic and industrial policies. Going forward, continued investment in key export sectors and improving infrastructure for trade will be crucial to maintaining this positive trajectory.

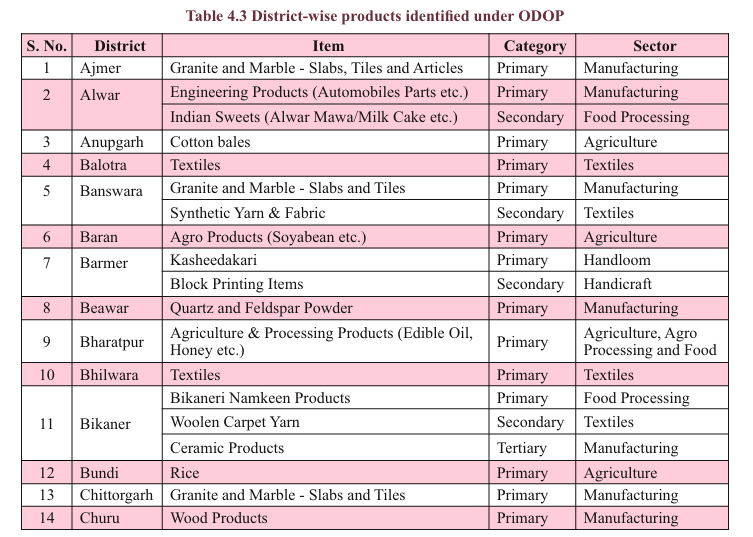

Table 4.3

Analytical Summary

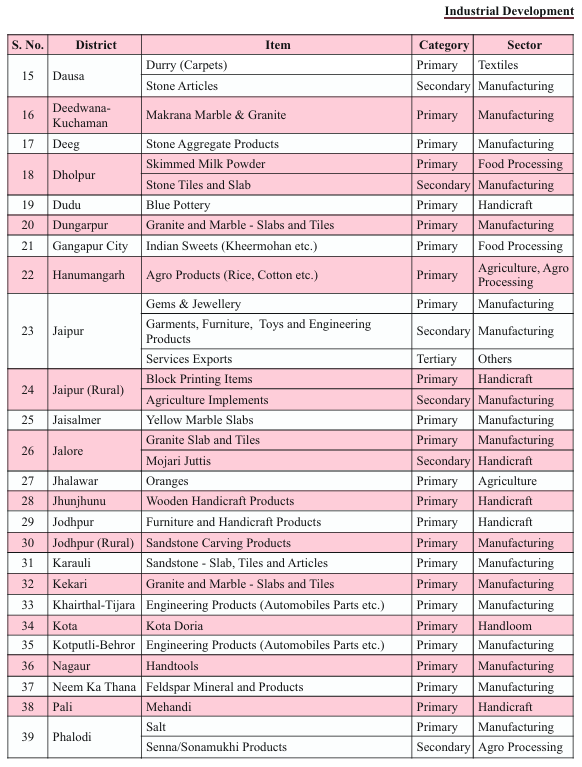

This table highlights the district-wise products identified under the One District One Product (ODOP) initiative in Rajasthan, categorizing the items by sector and industry type (primary, secondary, or tertiary).

Key Insights

- Manufacturing Sector Dominance:

- Many districts, such as Ajmer, Banswara, and Beawar, are focused on manufacturing products like granite, marble, and tiles, as well as quartz and feldspar powder. This emphasizes Rajasthan’s strong foothold in the stone and mineral industries, contributing significantly to both domestic and export markets.

- Textiles:

- Districts like Balotra, Bhilwara, and Bikaner are known for their focus on textiles. Bhilwara, in particular, has a large share in textile production, while Balotra and Bikaner also contribute to Rajasthan’s growing textile industry.

- Agriculture & Food Processing:

- Several districts, such as Anupgarh, Bharatpur, and Bundi, focus on agricultural products and food processing, including cotton bales, edible oil, and rice. This highlights the agricultural strength of these regions and their value-added production capacity.

- Handicrafts & Traditional Products:

- Barmer stands out with its focus on Kasheedakari (a form of handloom embroidery) and block printing items, showcasing Rajasthan’s rich tradition in handicrafts and textiles. Handloom production, such as this, is an essential cultural and economic activity for rural areas.

- Bikaneri Namkeen and Sweets:

- Bikaner and Alwar are known for their food processing products, including Bikaneri Namkeen (a popular savory snack) and Alwar Mawa/Milk Cake, showing Rajasthan’s prominence in traditional food products that have demand beyond the state.

Notable Products

- Granite and Marble:

- Prominent in Ajmer, Banswara, and Chittorgarh, this product is essential to Rajasthan’s identity as a significant player in the global stone industry.

- Engineering and Automotive Parts:

- Alwar is known for engineering products such as automobile parts, reflecting its industrial manufacturing capacity.

- Agro Products:

- Districts like Baran and Bharatpur contribute significantly to agriculture with products like soybean and edible oil, indicating their agricultural prominence.

Key Insights

- Strategic Resource Utilization:

- Districts are leveraging their natural resources and traditional skills to produce high-demand products. For example, Ajmer and Banswara are maximizing their granite and marble resources, while Barmer is capitalizing on its handloom and handicraft traditions with products like Kasheedakari and block printing items.

- Agriculture as a Strong Pillar:

- Several districts like Anupgarh, Baran, Bharatpur, and Bundi are using their agricultural strength to focus on products like cotton bales, soybeans, edible oil, and rice. This indicates the importance of agriculture and agro-processing industries in sustaining Rajasthan’s economy.

- Textile Sector Growth:

- The prominence of textiles in districts like Balotra, Bhilwara, and Bikaner showcases Rajasthan’s strong position in the textile industry, known for both domestic and international exports. Bhilwara, in particular, continues to be a textile hub within the state.

- Emphasis on Food Processing:

- Bikaner and Alwar are well-known for their food processing industries, producing items like Bikaneri Namkeen and Indian sweets. These regions are optimizing their culinary heritage for wider market reach, highlighting the role of traditional foods in the state’s economic profile.

- Diverse Economic Sectors:

- The table demonstrates a balance between primary, secondary, and tertiary sectors. While districts like Baran and Bharatpur focus on primary agricultural products, Alwar and Beawar are engaged in secondary manufacturing activities like automobile parts and feldspar powder. Meanwhile, Bikaner exhibits strength in tertiary sector activities with its food processing and textile industries.

- Handicrafts as an Economic Driver:

- Districts such as Barmer and Banswara maintain a strong focus on handicrafts, reinforcing Rajasthan’s global reputation for high-quality artisan goods. This focus also plays an essential role in preserving the cultural heritage of the state while providing employment in rural areas.

- Promotion of Niche Products:

- The table reveals the promotion of niche products like Bikaneri Namkeen and Alwar Mawa, which have geographical importance and cultural significance. These products not only cater to domestic markets but also have export potential, particularly in countries with large Indian diaspora populations.

- Manufacturing Leading Export Potential:

- Districts like Ajmer, Banswara, and Beawar focus on manufacturing products, particularly stone and minerals. The emphasis on quartz, granite, and marble supports Rajasthan’s role as a leader in the natural stone industry, catering to both national and international construction markets.

- Sectoral Diversification:

- The wide range of sectors, including food processing, textiles, manufacturing, handicrafts, and agriculture, indicates that Rajasthan is diversifying its economic activities at the district level. This diversification helps mitigate risks associated with economic downturns in any single sector and promotes sustainable economic growth.

Conclusion

The district-wise identification of products under ODOP reflects Rajasthan’s regional specialization and resource optimization. The state’s economy is well-diversified, ranging from textiles and manufacturing to agriculture and handicrafts, ensuring economic resilience and market competitiveness. These identified products and sectors not only support local economic growth but also offer export potential that enhances Rajasthan’s economic footprint on a global scale.

This strategic focus on district-level specialization will further drive economic development, providing employment opportunities and boosting both domestic and international trade.

Table – District-Wise Classification of Products

Analytical Summary

The table presents a district-wise classification of products identified under the “One District One Product” (ODOP) scheme in Rajasthan, focusing on key items produced in each district, categorized by the sector and the nature of production (Primary, Secondary, or Tertiary).

- Industrial Focus:

- The products listed cover various sectors such as textiles, manufacturing, food processing, handicrafts, and agriculture, indicating a diversified industrial landscape in Rajasthan.

- Manufacturing dominates in many districts, especially in products like stone, marble, and granite, reflecting the state’s rich natural resources and expertise in stone-related industries.

- Handicrafts:

- Districts such as Jalore (Mojari Juttis), Jodhpur (Furniture and Handicraft Products), and Dudu (Blue Pottery) emphasize the importance of handicrafts. This reinforces Rajasthan’s global reputation for unique handcrafted goods.

- Agriculture and Food Processing:

- Several districts are focused on agro-based industries and food processing, such as Hanumangarh (Rice and Cotton) and Dholpur (Skimmed Milk Powder), reflecting the importance of agriculture in the state’s economy.

- Engineering and High-Value Manufacturing:

- Some districts have a focus on engineering products, such as Kotputli-Behror and Khairthal-Tijara, emphasizing the state’s capabilities in high-value manufacturing, particularly in the automobile sector.

Key Insights

- Sectoral Diversification:

- Rajasthan’s economic landscape is diversified, with districts focusing on various sectors such as manufacturing, handicrafts, agriculture, and food processing. This diversification helps in risk mitigation and economic stability.

- Importance of Natural Resources:

- The significant focus on stone, marble, and granite products highlights the state’s rich geological resources and expertise in processing these materials for domestic and export markets.

- Handicraft Heritage:

- The inclusion of handicrafts such as Mojari Juttis, wooden handicrafts, and block printing highlights the cultural richness of Rajasthan, which not only preserves traditional crafts but also provides employment and export potential.

- Manufacturing Hub:

- Many districts, particularly those like Jodhpur (rural), Dungarpur, and Jaipur, are focusing on manufacturing activities, particularly engineering and automotive products, indicating that Rajasthan is positioning itself as a key player in the manufacturing sector.

- Agro-Processing Potential:

- The table also highlights the growing importance of agro-processing industries, with districts like Hanumangarh and Gangapur City focusing on rice, cotton, and sweets. This suggests that the state’s agricultural output is being increasingly processed locally for added value.

Definitions of Key Terms

- Primary Sector: The primary sector includes industries that extract or harvest products directly from natural resources such as agriculture, mining, and forestry.

- Secondary Sector: The secondary sector refers to industries involved in the manufacturing and processing of raw materials into finished goods, such as textile production, stone manufacturing, and engineering products.

- Tertiary Sector: This sector includes services such as export of services, tourism, banking, and information technology. In this table, it primarily refers to services exports.

- Agro Processing: Agro-processing refers to the value addition to agricultural products through processing and packaging, such as turning raw milk into skimmed milk powder or rice into ready-to-sell products.

- Handicrafts: These are artisanal products made largely by hand, often representing cultural heritage. Examples include block printing, blue pottery, and wooden handicrafts.

Conclusion

The table provides a comprehensive overview of the district-wise product specialization in Rajasthan under the ODOP initiative. The state’s reliance on a diverse mix of manufacturing, handicrafts, and agro-processing sectors demonstrates its potential for sustainable economic growth and export expansion. The ODOP scheme capitalizes on each district’s unique resources and skills, promoting local employment and economic development while preserving Rajasthan’s rich cultural heritage.

Table District-Wise Classification of Products for 2023-24

Analytical Summary

This table presents the district-wise products under Rajasthan’s ODOP (One District One Product) scheme for 2023-24, focusing on specific items, their categories, and the sectors they belong to. The products are categorized as Primary, Secondary, and Tertiary activities, with sectors including manufacturing, handicrafts, food processing, and others.

Key Observations

- Handicrafts:

- Several districts, such as Pratapgarh (Thewa Art), Shahpura (Phad Paintings), and Sikar (Antique Furniture), focus on preserving and promoting handicrafts. These traditional crafts are vital for preserving Rajasthan’s cultural heritage and contributing to employment in the cottage industries.

- Terracotta from Rajsamand and Marble Articles from Sirohi further emphasize the importance of craftsmanship in the state.

- Stone and Marble Industry:

- Granite and Marble dominate in districts such as Rajsamand, Salumber, and Udaipur, emphasizing the state’s natural stone resources. The stone industry is a significant economic contributor, with Rajasthan being a leading producer of marble and granite products for domestic and export markets.

- Food Processing:

- Sri Ganganagar’s Kinnow and Sanchore’s Spices reflect the importance of agriculture and agro-processing. Rajasthan’s climate and agricultural practices support the growth of high-value crops, which are processed locally to add value and increase export potential.

- Tourism:

- Sawai Madhopur, known for its tourism, is listed under the tertiary sector. Tourism plays a major role in Rajasthan’s economy, particularly in areas known for their cultural and natural attractions like Ranthambore National Park.

- Miscellaneous:

- Unique products such as Slate Stone Tiles in Tonk and Onyx Marble from Salumber highlight the district-specific specialization that the ODOP scheme encourages. This ensures that each district leverages its natural or cultural assets for economic development.

Key Insights

- Preservation of Cultural Heritage:

- The focus on handicrafts, such as Thewa Art and Phad Paintings, shows a concerted effort to preserve and promote traditional crafts that are unique to Rajasthan. This not only helps sustain artisan livelihoods but also enhances the tourism industry by attracting visitors interested in local culture and art forms.

- Natural Resources as Economic Drivers:

- The significant presence of granite and marble products highlights the importance of natural stone resources in the state’s economy. Districts like Rajsamand, Salumber, and Udaipur have established themselves as key players in the stone industry, providing raw materials and processed stone for both domestic use and export markets.

- Agriculture and Agro-Processing:

- Products like Kinnow and Spices show the state’s potential in agriculture and food processing. Rajasthan’s dry climate and specialized agricultural practices allow for the production of high-demand crops, which are then processed locally to add value, improving the state’s economic resilience.

- Tourism’s Economic Role:

- Sawai Madhopur’s listing as a tourism destination under the ODOP highlights the economic importance of Rajasthan’s heritage and wildlife tourism. The tourism sector provides employment and generates revenue for local economies, with potential for further expansion.

Definitions of Key Terms

- Primary Sector: This sector involves the extraction of natural resources or products. In this table, it refers to industries such as agriculture, handicrafts, and mining.

- Secondary Sector: The secondary sector involves processing or manufacturing raw materials into finished goods. For example, marble slabs or tiles are processed from raw stone.

- Tertiary Sector: This sector includes services like tourism, which is essential for Rajasthan, known for its historical monuments and wildlife tourism destinations.

- ODOP (One District One Product): A government initiative aiming to promote specialization and self-reliance in each district by identifying and focusing on a specific product for economic growth, job creation, and export potential.

- Handicrafts: Products made largely by hand, often using traditional techniques. These items often carry cultural significance and are important for promoting the local arts and crafts industry.

Conclusion

The table provides a detailed overview of the diversity within Rajasthan’s economy, showcasing the state’s potential in sectors like manufacturing, handicrafts, agro-processing, and tourism. The ODOP scheme is a strategic effort to capitalize on local resources and skills for economic growth, job creation, and the promotion of cultural heritage. This approach not only supports the rural economy but also enhances the export potential of the state through value-added processing.

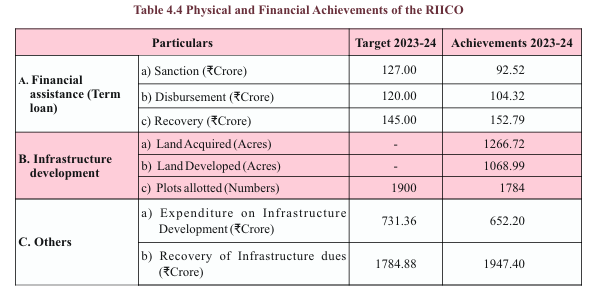

Table 4.4

Analytical Summary

This table presents the physical and financial achievements of the Rajasthan State Industrial Development and Investment Corporation (RIICO) for the financial year 2023-24. The table is divided into three main sections: Financial Assistance, Infrastructure Development, and Other Activities.

Key Observations

- Financial Assistance (Term Loans):

- Sanction: RIICO had a target of sanctioning ₹127.00 crore in term loans but achieved ₹92.52 crore, indicating a shortfall of approximately 27%.

- Disbursement: A target of ₹120.00 crore was set for disbursements, and ₹104.32 crore was disbursed, reflecting a 13% deviation from the target.

- Recovery: The recovery of loans exceeded the target, with ₹152.79 crore recovered against the target of ₹145.00 crore, indicating a positive financial management outcome.

- Infrastructure Development:

- Land Acquired: RIICO acquired 1266.72 acres of land for industrial and infrastructure development, though no specific target was set.

- Land Developed: A total of 1068.99 acres was developed, contributing to the industrial expansion and enhancement of infrastructure capabilities.

- Plots Allotted: RIICO aimed to allot 1900 plots but fell short, achieving 1784 allotments, which represents a 6% underperformance in this area.

- Expenditure on Infrastructure Development:

- RIICO targeted an expenditure of ₹731.36 crore for infrastructure development but spent ₹652.20 crore, indicating prudent spending at around 89% of the target.

- Recovery of Infrastructure Dues:

- RIICO exceeded its target for the recovery of infrastructure dues, collecting ₹1947.40 crore against the target of ₹1784.88 crore, reflecting effective financial performance.

Key Insights

- Prudent Financial Management:

- The recovery of term loans and infrastructure dues both exceeded their respective targets, showing strong financial health and effective recovery strategies implemented by RIICO.

- Land Acquisition and Development:

- Despite the absence of explicit land acquisition and development targets, the acquisition of 1266.72 acres and the development of over 1000 acres are significant achievements, indicating continued industrial growth and expansion in Rajasthan.

- Challenges in Loan Disbursement:

- Although disbursements were close to the target, the shortfall in the sanctioning of term loans suggests that there may have been constraints in approving new loans, possibly due to economic conditions or tighter risk management.

- Plot Allotment:

- While RIICO aimed to allot 1900 plots, the actual achievement of 1784 allotments indicates strong demand for industrial plots but also points to potential constraints or delays in the allotment process.

Definitions of Key Terms

- Sanction: The approval of a term loan amount by RIICO. This is the initial step before disbursement.

- Disbursement: The actual release of loan funds to the recipient after approval (sanction).

- Recovery: The collection of repayments on loans or infrastructure dues from borrowers or industrial plot allottees.

- Infrastructure Development: This refers to the construction and development of physical facilities such as roads, power, and water supply systems to support industrial operations in designated industrial zones.

- Plots Allotted: The number of industrial plots allocated or sold by RIICO for industrial or commercial purposes.

Conclusion

RIICO’s performance for 2023-24 shows a strong focus on infrastructure development and financial recovery, despite some shortfalls in term loan sanctions and plot allotments. The organization’s ability to recover more than the targeted dues and maintain a high rate of land development highlights its importance in supporting Rajasthan’s industrial sector. While there is room for improvement in meeting financial targets for loan sanctions and disbursements, the overall achievements underscore RIICO’s ongoing efforts to drive industrial growth in the state.

Table 4.5

Analytical Summary

This table provides a comparison of financial targets and achievements of the Rajasthan Financial Corporation (RFC) over five years, specifically focusing on loan sanctions, loan disbursements, and loan recovery. The data highlights trends in RFC’s performance in meeting its financial goals from 2019-20 to 2023-24.

Key Observations

- Loan Sanctions:

- The target for loan sanctions was reduced each year, starting from ₹250 crore in 2019-20 and reducing to ₹125 crore by 2023-24.

- The achievements in loan sanctions followed the same decreasing trend, reaching ₹104.51 crore in 2023-24 from a high of ₹228.60 crore in 2019-20.

- RFC met and exceeded its loan sanction targets in 2019-20 and closely aligned its performance to targets in subsequent years.

- Loan Disbursements:

- Loan disbursement targets also decreased annually, from ₹200 crore in 2019-20 to ₹110 crore in 2023-24.

- The disbursement achievements were consistently lower than the set targets. For example, in 2023-24, only ₹83.65 crore was disbursed against a target of ₹110 crore.

- Loan Recovery:

- The loan recovery targets remained relatively stable, ranging between ₹200 crore and ₹300 crore.

- RFC consistently exceeded its recovery targets, reaching its peak recovery in 2019-20 at ₹311.53 crore, while in 2023-24 it achieved ₹214.75 crore against a target of ₹210 crore.

Key Insights

- Decreasing Loan Sanctions and Disbursements:

- Both the targets and achievements for loan sanctions and disbursements have decreased consistently over the years, indicating either a conservative approach by RFC in issuing new loans or possibly a reflection of lower demand for financing.

- Consistent Loan Recovery Performance:

- RFC has demonstrated strong performance in loan recovery, consistently surpassing its targets each year. This indicates the corporation’s robust mechanisms for collecting dues and managing defaults.

- Performance Dip in 2023-24:

- The 2023-24 figures, though tentative, indicate a potential performance dip, especially in loan disbursements, where the achievement is significantly lower than the target. This could be due to economic factors, risk management policies, or other operational constraints.

Definitions of Key Terms

- Loan Sanction: The approval of a loan amount by RFC, typically indicating a commitment to lend to the borrower.

- Loan Disbursement: The actual release of loan funds to the borrower after the approval (sanction) stage.

- Loan Recovery: The collection of repayments (principal and interest) on loans issued by RFC.

Conclusion

The performance of RFC in terms of loan recovery remains strong, reflecting effective financial management and a well-implemented recovery process. However, the decreasing trend in both loan sanctions and disbursements over the years raises concerns about potential challenges in lending operations or demand for financial services. The upcoming years may require RFC to reassess its lending strategies or explore new avenues for financial growth.

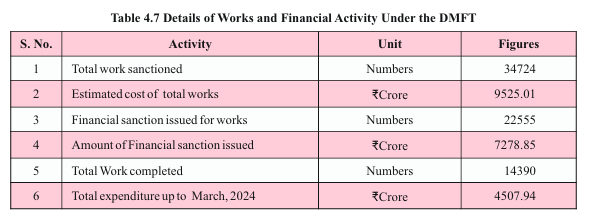

Table 4.6

Analytical Summary

The table presents the target-wise physical achievements of the prospecting work carried out over the year. It highlights the annual targets and corresponding achievements for four categories of geological and mineral-related activities: Regional Mineral Survey, Regional Geological Mapping, Detail Geological Mapping, and Drilling.

Key Observations

- Regional Mineral Survey (Sq. Km.):

- The annual target for regional mineral surveys was set at 750.00 sq. km., and this target was fully met, with 750.00 sq. km. achieved.

- This suggests a well-managed and efficient execution of survey activities across the allocated regions.

- Regional Geological Mapping (Sq. Km.):

- The annual target for regional geological mapping was 345.00 sq. km., which was also fully met, with an achievement of 345.00 sq. km..

- Full achievement reflects a focus on geological mapping accuracy and regional coverage as planned.

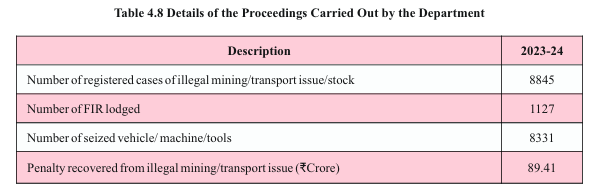

- Detail Geological Mapping (Sq. Km.):