Chapter 6

The service sector has emerged as a pivotal component of Rajasthan’s economy, reflecting the broader global shift towards service-oriented economic models. Characterized by its diverse range of activities, the service sector encompasses industries such as hospitality, trade, finance, information technology, and communication, all of which contribute significantly to the state’s overall growth and development. This chapter aims to provide a comprehensive overview of the service sector in Rajasthan, examining its structure, performance, and key subsectors while analyzing the implications for the state’s economic trajectory.

In recent years, the service sector has experienced remarkable growth in Rajasthan, positioning itself as a vital driver of economic expansion. The Gross State Value Added (GSVA) of the service sector illustrates this upward trend, with significant increases reported in both constant and current prices. As of 2023-24, the service sector accounted for approximately 45.07% of Rajasthan’s total GSVA, indicating its dominant role in the state’s economic framework.

This chapter explores the major components of the service sector, starting with a detailed analysis of its contributions to the GSVA. Key subsectors such as trade, hotels, and restaurants, which together form the backbone of the service economy, are examined in terms of their respective shares and growth rates. The analysis further extends to the tourism sector, which has become a significant source of revenue and employment in the state. Rajasthan’s rich cultural heritage and array of historical landmarks have established it as a premier tourist destination, attracting millions of domestic and international visitors annually.

The chapter also delves into the financial services industry, highlighting its critical role in mobilizing savings and providing credit for various economic activities. With the increasing emphasis on digital payments and financial inclusion, Rajasthan has made significant strides in expanding access to banking services for its citizens, thus fostering economic empowerment.

Moreover, the introduction of innovative initiatives aimed at enhancing service delivery and promoting entrepreneurship has been instrumental in driving growth within the sector. Programs that support small businesses, particularly among marginalized communities, underscore the government’s commitment to inclusive economic development.

As the chapter unfolds, it will provide an in-depth examination of the statistical data and analytical insights that underscore the service sector’s importance in Rajasthan. By capturing the dynamic nature of this sector and its contributions to the state’s economy, this chapter aims to illuminate the path forward for sustainable growth and development within the service industry.

- Overview of the Service Sector

- Definition and Scope:

- The service sector is broadly defined as the segment of the economy that provides intangible goods and services. It encompasses a wide array of activities ranging from high-tech industries like software development to essential services like plumbing and hospitality.

- Key categories within the service sector include trade, hotels and restaurants, transportation, storage, communication, financial services, real estate, business services, and community services.

- Gross State Value Added (GSVA):

- The GSVA of the service sector at constant (2011-12) prices increased from ₹2.86 lakh crore in 2019-20 to ₹3.43 lakh crore in 2023-24, indicating a Compound Annual Growth Rate (CAGR) of 4.69%. This growth reflects the sector’s resilience amid economic challenges.

- At current prices, the GSVA surged from ₹4.41 lakh crore in 2019-20 to ₹6.44 lakh crore in 2023-24, showcasing a CAGR of 9.94%. The consistent growth underscores the service sector’s ability to adapt and thrive in a changing economic landscape.

- Share of Service Sector in GSVA

- As of 2023-24, the service sector constituted 45.07% of Rajasthan’s total GSVA at current prices, underscoring its dominance in the state’s economic framework.

- The contributions of various sub-sectors to the GSVA are as follows:

- Trade, Hotels & Restaurants: 28.01%

- Real Estate & Professional Services: 23.59%

- Other Services: 20.66%

- Transport, Storage & Communication: 10.92%

- Financial Services: 9.89%

- Public Administration: 6.93%

- Growth Trends in Sub-sectors

- Projected Growth Rates: The anticipated growth rates for various sub-sectors from 2023-24 onwards are indicative of their potential:

- Trade, Hotels & Restaurants: 6.71%

- Transport, Storage & Communication: 5.10%

- Financial Services: 8.40%

- Real Estate: 5.71%

- Public Administration: 2.29%

- Other Services: 7.89%

- Tourism Sector

- Tourism’s Economic Significance:

- Rajasthan is a premier tourist destination known for its historical forts, palaces, and vibrant culture. The state received 1,807.52 lakh tourists in 2023, with 1,790.52 lakh domestic and 17 lakh foreign tourists visiting. This influx generates substantial revenue and employment opportunities.

- Government Initiatives:

- The tourism sector was granted industry status, enabling benefits such as electricity tariff concessions and U.D. taxes at industrial rates. In 2023-24, eligibility certificates were issued to 342 tourism units, enhancing their operational feasibility.

- Major events like the Great Indian Travel Bazaar and the Rajasthan Domestic Travel Mart were organized to promote inbound and domestic tourism. These initiatives attracted significant participation from foreign tour operators and domestic exhibitors.

- Key Achievements:

- The Tourism Development Fund was increased from ₹1,000 crore to ₹1,500 crore to support tourism infrastructure and promotional activities.

- A total of 70 fairs and festivals were organized, showcasing Rajasthan’s rich cultural heritage, including well-known events like the Pushkar Fair and the Camel Festival.

- Financial Services

- Banking Overview:

- Financial institutions are pivotal for mobilizing deposits and providing credit, which supports various economic activities. As of March 2024, the total deposits in Rajasthan increased by 12.88% compared to March 2023, indicating a positive trend in savings behavior among residents.

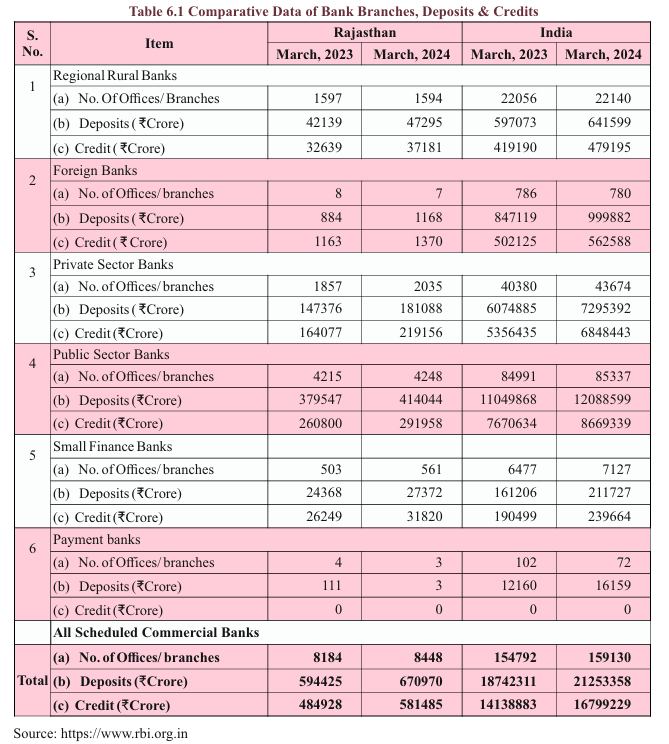

- Table 6.1: Comparative Data of Bank Branches, Deposits & Credits

- This table illustrates the performance of different types of banks in Rajasthan versus national averages.

| Item | Rajasthan (March 2023) | Rajasthan (March 2024) | India (March 2023) | India (March 2024) |

| Total Branches | 8184 | 8448 | 154792 | 159130 |

| Total Deposits (₹ Crore) | 594425 | 670970 | 18742311 | 21253358 |

| Total Credit (₹ Crore) | 484928 | 581485 | 14138883 | 16799229 |

- Credit-Deposit Ratio: The credit-deposit ratio for all scheduled commercial banks in Rajasthan is 86.66%, compared to 79.04% at the national level as of March 2024, indicating efficient utilization of deposits for credit disbursement.

- Digital Payment and Financial Inclusion

- Digital Payment Initiatives:

- The state has embraced various digital payment systems, including UPI, Aadhaar Enabled Payments, and mobile wallets, facilitating financial transactions for citizens. The E-Mitra initiative offers over 600 government services electronically through kiosks and online platforms.

- Financial Inclusion Programs:

- The Stand Up India Scheme promotes entrepreneurship among SC/ST and women by providing bank loans between ₹10 lakh to ₹1 crore. In 2023-24, loans amounting to ₹560.73 crore were sanctioned to 2,407 beneficiaries.

- The Pradhan Mantri Jan-Dhan Yojana has resulted in the opening of 3.54 crore bank accounts in Rajasthan, with a significant percentage linked to Aadhaar, promoting financial inclusion and accountability.

- Key Achievements and Future Prospects

- Increased Funding for Tourism: The Tourism Development Fund expansion is aimed at enhancing infrastructure and marketing strategies to bolster the tourism sector further.

- Recognition of Excellence: Rajasthan received various awards, including the Best Cultural Tourism Destination and the Favorite Indian State for Road Trips, showcasing its appeal as a travel destination.

- Sustainable Tourism Initiatives: The government emphasizes responsible tourism practices, evident from initiatives like the Indian Responsible Tourism State Summit.

Conclusion

This chapter provides a comprehensive analysis of the service sector in Rajasthan, highlighting its critical role in driving economic growth and development in the state. As the largest sector contributing to the Gross State Value Added (GSVA), the service sector encompasses a diverse range of industries, including tourism, financial services, and information technology. The chapter elucidates the sector’s performance, challenges, and opportunities, culminating in several key takeaways that emphasize its significance for Rajasthan’s future economic landscape.

- Dominance of the Service Sector

- The service sector accounted for 45.07% of Rajasthan’s GSVA in 2023-24, reflecting its position as the leading contributor to the state’s economy.

- The growth in the service sector at a CAGR of 9.94% at current prices demonstrates its resilience and adaptability in the face of economic fluctuations.

- Contribution of Sub-sectors

- Trade, Hotels & Restaurants remain the most significant contributors, making up 28.01% of the GSVA in the service sector. This underscores the importance of tourism and hospitality as major economic drivers.

- Other critical sub-sectors, such as Real Estate and Financial Services, also exhibit strong growth potential, indicating diversified economic contributions within the service industry.

- Tourism as an Economic Catalyst

- Rajasthan’s rich cultural heritage and array of historical landmarks have established it as a premier tourist destination, with over 1,807.52 lakh tourists visiting in 2023, generating substantial revenue and employment opportunities.

- The government’s initiatives, such as granting industry status to tourism, have facilitated enhanced infrastructure development and promotional activities.

- Financial Services and Digital Innovation

- The financial services sector plays a vital role in mobilizing savings and facilitating credit access, crucial for supporting economic activities across various sectors.

- Significant advancements in digital payment systems and financial inclusion programs, such as the Pradhan Mantri Jan-Dhan Yojana, have improved access to banking services for marginalized communities, promoting economic empowerment.

- Government Initiatives and Policy Support

- The Rajasthan government has implemented various programs to bolster the service sector, including the Stand Up India Scheme, which promotes entrepreneurship among SC/ST and women.

- The introduction of digital platforms like E-Mitra and initiatives aimed at enhancing service delivery have contributed to increased efficiency and transparency in government services.

- Challenges and Areas for Improvement

- Despite the overall growth of the service sector, challenges remain, including the need for improved infrastructure, particularly in rural areas, to support service delivery and accessibility.

- The growing demand for skilled labor in service-oriented industries necessitates investment in education and training programs to prepare the workforce for future opportunities.

- Future Prospects and Strategic Directions

- The service sector’s future in Rajasthan appears promising, with ongoing government support, increasing investments, and a focus on sustainable practices.

- Emphasizing innovation and technology adoption will be critical for enhancing competitiveness in sectors such as tourism, IT, and finance.

Final Thoughts

- Economic Significance: The service sector is a cornerstone of Rajasthan’s economy, accounting for a substantial portion of the GSVA.

- Growth Opportunities: Strong performance in tourism and financial services highlights the potential for further growth and diversification within the sector.

- Government Support: Policy initiatives and digital innovations are driving advancements in service delivery and financial inclusion.

- Challenges Ahead: Addressing infrastructure gaps and enhancing workforce skills will be crucial for sustaining growth.

- Strategic Focus: Future development should prioritize innovation, sustainable practices, and skill development to maximize the service sector’s contribution to the economy.

In conclusion, the chapter illustrates the vital role of the service sector in shaping Rajasthan’s economic landscape. By leveraging its strengths and addressing existing challenges, the state can continue to foster a vibrant service economy that benefits all segments of society, ultimately contributing to sustainable growth and prosperity.

Chapter 6

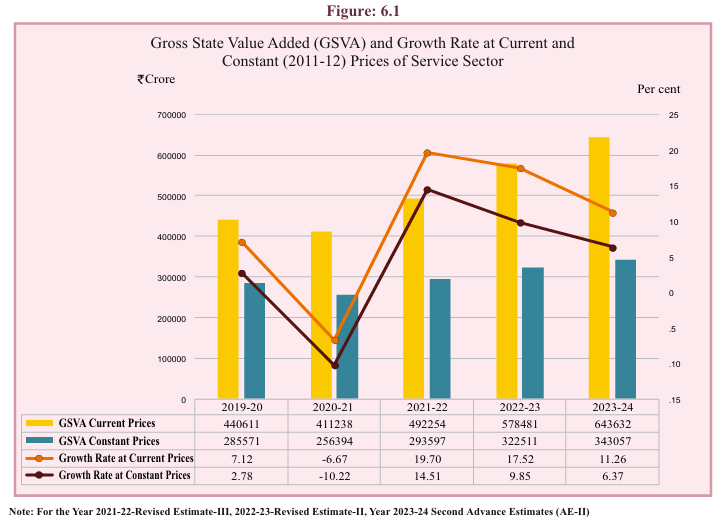

Figure 6.1

Analytical Summary

This graph (Figure 6.1) illustrates the Gross State Value Added (GSVA) and growth rates at both current and constant prices (base year 2011-12) for the service sector in Rajasthan from 2019-20 to 2023-24.

- GSVA at Current Prices:

- The GSVA at current prices has shown a steady increase over the years. In 2019-20, it stood at ₹440,611 crore, which grew to ₹643,632 crore by 2023-24. This indicates a continuous expansion in the value added by the service sector.

- GSVA at Constant Prices:

- At constant prices, the GSVA also increased from ₹285,571 crore in 2019-20 to ₹343,057 crore in 2023-24. The growth here reflects the real expansion in the sector after accounting for inflation.

- Growth Rate at Current Prices:

- The growth rate at current prices dropped sharply in 2020-21 to -6.67%, likely due to the economic impact of the COVID-19 pandemic. However, the growth rebounded in 2021-22 to 19.70% and remained relatively strong at 17.52% in 2022-23 before settling at 11.26% in 2023-24.

- Growth Rate at Constant Prices:

- The growth rate at constant prices shows a similar trend, falling to -10.22% in 2020-21 but rebounding to 14.51% in 2021-22. The growth slowed to 9.85% in 2022-23 and further to 6.37% in 2023-24, indicating a stabilization of the growth momentum.

Key Data Points

- GSVA at Current Prices (2023-24): ₹643,632 crore

- GSVA at Constant Prices (2023-24): ₹343,057 crore

- Growth Rate at Current Prices (2023-24): 11.26%

- Growth Rate at Constant Prices (2023-24): 6.37%

Key Observations

- The GSVA of the service sector has shown consistent growth at both current and constant prices, with a notable rebound in 2021-22 after the pandemic-induced dip in 2020-21.

- The growth rate at current prices is higher than the growth rate at constant prices, suggesting that inflation has played a role in boosting nominal growth.

- Despite the overall growth, the service sector’s growth rate has decelerated in 2023-24 compared to previous years.

Key Terms

- Gross State Value Added (GSVA): A measure of the value of goods and services produced in the state, specifically focusing on the contribution of the service sector in this case.

- Current Prices: Prices that are not adjusted for inflation and reflect the actual market prices during the respective years.

- Constant Prices: Prices that are adjusted for inflation, using a base year (in this case, 2011-12), to reflect real growth.

- Growth Rate: The percentage change in the GSVA, which indicates the expansion or contraction of the service sector.

Key Insights

- The service sector, a critical component of the state’s economy, has recovered well from the COVID-19-induced slump, showing resilience with robust growth rates, especially at current prices.

- The deceleration in growth in 2023-24 suggests that while the sector is expanding, the pace is moderating, likely due to post-pandemic adjustments and external economic factors such as inflation and global market conditions.

Conclusion

The service sector in Rajasthan is showing positive trends in both GSVA and growth rates. Despite challenges like the pandemic, the sector’s strong recovery highlights its importance to the state’s economy. However, the declining growth rates at constant prices in the last couple of years suggest that the state may need to focus on sustaining real growth by boosting productivity and addressing inflationary pressures.

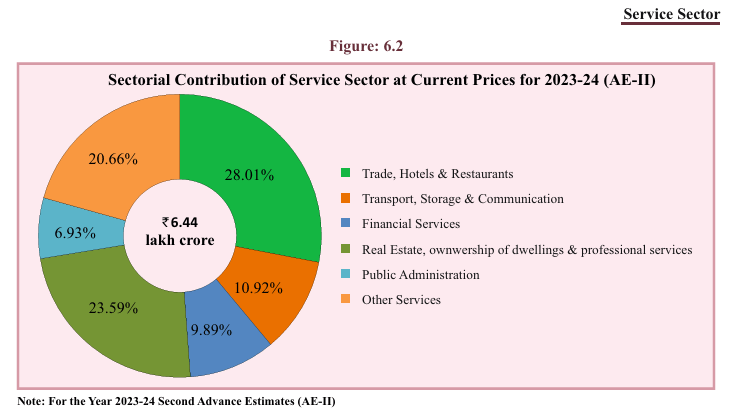

Figure 6.2

Analytical Summary

The chart (Figure 6.2) represents the sectoral contribution of the service sector to the Gross State Value Added (GSVA) at current prices for 2023-24 (Second Advance Estimates). The total contribution of the service sector stands at ₹6.44 lakh crore, with each sub-sector’s contribution outlined below.

- Trade, Hotels & Restaurants:

- This sector is the largest contributor, accounting for 28.01% of the total service sector’s GSVA. It highlights the significance of consumer services, tourism, and trade activities in the state’s economy.

- Real Estate, Ownership of Dwellings & Professional Services:

- Contributing 23.59%, this sector forms the second-largest segment of the service sector. It indicates the importance of real estate transactions, housing, and professional services such as legal and consulting in the state’s economic landscape.

- Other Services:

- Other services contribute 20.66%, showing that miscellaneous services, including personal, educational, and health services, play a crucial role in the state’s economy.

- Transport, Storage & Communication:

- The transport and communication sector adds 10.92% to the GSVA, reflecting the state’s infrastructure and logistics role in economic activities.

- Public Administration:

- Public administration’s share is 9.89%, indicating the government’s substantial role in driving service sector growth through administrative functions, public welfare, and policy implementation.

- Financial Services:

- Financial services contribute 6.93% to the GSVA, encompassing banking, insurance, and other financial intermediation services, which are critical for economic transactions and investments.

Key Data Points

- Total GSVA (Service Sector): ₹6.44 lakh crore

- Trade, Hotels & Restaurants Contribution: 28.01%

- Real Estate & Professional Services Contribution: 23.59%

- Other Services Contribution: 20.66%

- Transport, Storage & Communication Contribution: 10.92%

- Public Administration Contribution: 9.89%

- Financial Services Contribution: 6.93%

Key Observations

- The Trade, Hotels & Restaurants sector, the largest contributor, suggests a vibrant market economy driven by commerce and tourism.

- The Real Estate and Professional Services sector’s large share reflects a dynamic housing market and demand for professional expertise.

- The notable Public Administration contribution emphasizes the government’s extensive involvement in the service sector.

Key Terms

- Gross State Value Added (GSVA): It is the measure of the economic value generated by all sectors within a state, contributing to the overall GDP.

- Current Prices: Reflects the nominal value without adjusting for inflation, showing the actual market value in monetary terms.

Key Insights

- The service sector’s reliance on trade, real estate, and public administration points to the state’s focus on commerce, infrastructure, and governance.

- The growth in Other Services reflects an expanding demand for personal and community-based services like healthcare, education, and tourism.

- Financial services contribute a relatively smaller share, indicating a potential growth opportunity for banking, insurance, and investment activities.

Conclusion

Rajasthan’s service sector shows a diverse contribution across various sub-sectors, with Trade, Hotels & Restaurants and Real Estate leading the growth. The sector plays a significant role in the state’s economy, driven by both consumer and government-oriented services. Future growth potential exists in areas like Financial Services and Transport & Communication, which could help further diversify the state’s economic base.

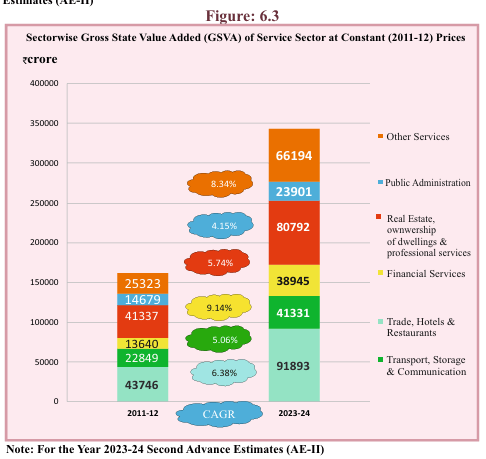

Figure 6.3

Analytical Summary

The bar chart in Figure 6.3 depicts the sector-wise Gross State Value Added (GSVA) of the service sector at constant (2011-12) prices for the year 2023-24 based on the second advance estimates. It highlights the contributions of different service sectors and the compounded annual growth rate (CAGR) from 2011-12 to 2023-24.

- Transport, Storage & Communication:

- The largest contributor at ₹91,893 crore, representing 6.38% CAGR. This reflects robust infrastructure and communication developments in Rajasthan, likely driven by improvements in logistics, telecommunications, and transportation networks.

- Trade, Hotels & Restaurants:

- This sector contributes ₹41,331 crore with a 5.06% CAGR, indicating steady growth in consumer-driven services such as trade, tourism, and hospitality, important for Rajasthan’s tourism and retail sectors.

- Financial Services:

- At ₹38,945 crore and growing at 5.74% CAGR, the financial services sector shows consistent growth, supported by the expansion of banking, insurance, and other financial activities within the state.

- Real Estate, Ownership of Dwellings & Professional Services:

- Contributing ₹80,792 crore, with a relatively modest 4.15% CAGR, this sector reflects Rajasthan’s steady growth in real estate transactions and professional services like consulting, IT, and legal services.

- Public Administration:

- Public administration contributes ₹23,901 crore with a 4.15% CAGR. It highlights the growing governmental spending in welfare schemes, policy implementation, and public service improvements.

- Other Services:

- The Other Services category, contributing ₹66,194 crore, demonstrates an 8.34% CAGR, showing the highest growth. This includes education, health, and miscellaneous services, underscoring the importance of social services and allied sectors in the economy.

Key Data Points

- Transport, Storage & Communication Contribution: ₹91,893 crore (6.38% CAGR)

- Trade, Hotels & Restaurants Contribution: ₹41,331 crore (5.06% CAGR)

- Financial Services Contribution: ₹38,945 crore (5.74% CAGR)

- Real Estate & Professional Services Contribution: ₹80,792 crore (4.15% CAGR)

- Public Administration Contribution: ₹23,901 crore (4.15% CAGR)

- Other Services Contribution: ₹66,194 crore (8.34% CAGR)

Key Observations

- Transport, Storage & Communication is the largest contributor, reflecting Rajasthan’s focus on improving its logistics and communication networks.

- The Other Services category has the highest CAGR, driven by growing demand in education, health, and other personal services.

- Financial Services and Trade, Hotels & Restaurants have shown steady, moderate growth, underscoring their importance in the state’s service economy.

Key Terms

- GSVA (Gross State Value Added): It represents the value of goods and services produced within the state economy, contributing to the overall GDP.

- CAGR (Compounded Annual Growth Rate): A measure of the mean annual growth rate of an investment over a specified period of time longer than one year.

Key Insights

- The high growth rate in Other Services and Transport sectors indicates significant structural changes in Rajasthan’s service economy. Social services and infrastructure are increasingly important drivers of economic growth.

- The steady growth in Trade, Hotels & Restaurants reaffirms Rajasthan’s role as a tourism and retail hub.

- Financial Services have room for expansion, given their moderate share compared to other sectors, despite a healthy growth rate.

Conclusion

Rajasthan’s service sector is showing balanced growth across various subsectors, with Transport, Storage & Communication and Other Services leading in terms of both absolute contributions and growth rates. The state’s infrastructure and social services are expected to drive future growth, alongside steady contributions from tourism, trade, and real estate.

Table 6.1

Analytical Summary

Table 6.1 presents a comparative analysis of bank branches, deposits, and credits in Rajasthan versus India as of March 2023 and projected data for March 2024. The table offers a breakdown by various types of banks including Regional Rural Banks (RRBs), Foreign Banks, Private Sector Banks, Public Sector Banks, Small Finance Banks, and Payment Banks.

Key Data Points

- Total Number of Branches (All Scheduled Commercial Banks) in Rajasthan:

- March 2023: 8,184

- March 2024: 8,448

- Nationally (India): March 2024: 159,130

- Deposits in Rajasthan (₹ Crore):

- March 2023: ₹5,94,425 crore

- March 2024: ₹6,70,970 crore (expected)

- Nationally: March 2024: ₹21,25,335 crore

- Credits in Rajasthan (₹ Crore):

- March 2023: ₹4,84,928 crore

- March 2024: ₹5,81,485 crore (expected)

- Nationally: March 2024: ₹16,79,229 crore

Key Observations

- Rural Banking Expansion:

- Regional Rural Banks (RRBs) are playing a significant role in Rajasthan, with 1,594 branches as of March 2024. However, growth is modest, with a small increase in deposits and credit, indicative of stable but slow expansion in rural areas.

- Growth in Private Sector Banks:

- Private sector banks are showing robust growth in Rajasthan. The number of branches is expected to grow from 1,857 in March 2023 to 2,035 in March 2024, with a significant increase in deposits from ₹1,47,376 crore to ₹1,81,088 crore and credits from ₹1,64,077 crore to ₹2,19,156 crore. This indicates a strong inclination toward private banking for both deposits and lending.

- Public Sector Banks Dominance:

- Public Sector Banks still hold the largest market share in Rajasthan, with 4,248 branches and a massive deposit base of ₹4,14,044 crore as expected by March 2024. However, the growth rate for deposits and credit is more moderate compared to private sector banks.

- Small Finance Banks are gradually expanding, reflecting inclusivity in banking with more branches and increasing deposits and credits aimed at underserved sectors.

- Minimal Role of Foreign and Payment Banks: Foreign banks and payment banks have a limited presence in Rajasthan, with minor growth in deposits and credits, indicating their niche operational focus.

Key Terms

- Deposits: The total amount of money held in bank accounts, representing savings and other forms of deposits by individuals, businesses, and institutions.

- Credit: Loans or advances given by banks to customers, including personal loans, business loans, and credit to different sectors of the economy.

- Regional Rural Banks (RRBs): Banks established to serve rural areas with the aim to provide financial and banking services to farmers, small businesses, and rural entrepreneurs.

- Small Finance Banks: A type of niche bank in India with the objective of expanding access to financial services in underserved areas by providing credit to small businesses, agriculture, and individuals.

- Public and Private Sector Banks: Public sector banks are government-owned, whereas private sector banks are owned by private individuals or corporations.

Key Insights

- Private Sector Banks are growing rapidly in Rajasthan, capturing more market share in both deposits and credits, showing that customers may prefer private banking services for faster and more efficient service.

- Public Sector Banks remain dominant but show slower growth, particularly in rural and semi-urban areas where they have a stronghold through branches and outreach programs.

- Regional Rural Banks (RRBs) continue to play an essential role in rural development, particularly in areas where access to formal banking services is limited.

- The overall credit-deposit ratio in Rajasthan is improving, signaling increased lending activity in the economy, which can drive growth in both urban and rural areas.

Conclusion

The banking sector in Rajasthan is expanding steadily, driven by the growth of private sector banks and RRBs. The focus on increasing both deposits and credit reflects the expanding financial inclusion and economic activity in the state. While public sector banks continue to lead, private banks are capturing significant market share, indicating a shift in consumer preferences. The role of small finance banks and payment banks will be crucial in future expansions to cater to the unbanked population, particularly in rural areas.

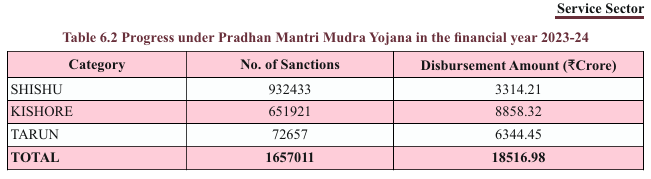

Table 6.2

Analytical Summary

Table 6.2 provides a breakdown of the Progress under Pradhan Mantri Mudra Yojana (PMMY) for the financial year 2023-24. The table classifies the data into three categories: Shishu, Kishore, and Tarun, representing different stages of business growth and corresponding loan amounts. It showcases the number of loan sanctions and the total amount disbursed under each category.

Key Data Points

- Total Loan Sanctions:

- Shishu: 9,32,433

- Kishore: 6,51,921

- Tarun: 72,657

- Total: 16,57,011

- Total Disbursement Amount (₹ Crore):

- Shishu: ₹3,314.21 crore

- Kishore: ₹8,858.32 crore

- Tarun: ₹6,344.45 crore

- Total: ₹18,516.98 crore

Key Observations

- Highest Number of Sanctions in Shishu Category:

- The Shishu category, which caters to the smallest loans (up to ₹50,000), has the largest number of sanctions with 9,32,433 loans, but the lowest disbursement amount (₹3,314.21 crore). This reflects the emphasis on micro-enterprises and small ventures needing minimal financial assistance.

- Kishore Category Leads in Disbursement:

- The Kishore category (loans between ₹50,001 and ₹5 lakh) has the second-highest number of sanctions, 6,51,921, but accounts for the largest disbursement of funds at ₹8,858.32 crore. This highlights the growing demand for medium-sized loans for businesses at the intermediate growth stage.

- Tarun Category Has the Largest Average Loan Size:

- The Tarun category, targeting enterprises with higher loan needs (₹5 lakh to ₹10 lakh), has the fewest sanctions (72,657) but a substantial disbursement total of ₹6,344.45 crore, indicating a larger average loan size for businesses with greater financial needs.

Key Terms

- Shishu (Infant): Loans up to ₹50,000, aimed at micro-enterprises or startups in their nascent stage.

- Kishore (Adolescent): Loans ranging from ₹50,001 to ₹5 lakh, meant for businesses in their growth phase, requiring additional capital to expand.

- Tarun (Adult): Loans between ₹5 lakh and ₹10 lakh, intended for well-established enterprises looking for larger funding.

- Pradhan Mantri Mudra Yojana (PMMY): A government initiative launched to provide loans to micro, small, and medium enterprises (MSMEs) in three categories—Shishu, Kishore, and Tarun—based on the stage of business growth and the financial requirement.

Key Insights

- Focus on Micro-Enterprises: The large number of loan sanctions in the Shishu category suggests that a significant portion of the population is engaged in small-scale or micro-entrepreneurial ventures, where lower capital requirements are common.

- Growing Demand in Kishore: The Kishore category’s leading disbursement figures indicate a rising demand for loans among growing businesses. It shows that businesses in the intermediate stage are looking for more capital to sustain and expand their operations.

- Lower Loan Sanctions but Higher Funding in Tarun: Though the Tarun category has fewer loan sanctions, the large amount of funds disbursed points to an increasing demand for larger-scale business financing, particularly for well-established enterprises looking to make major investments.

Conclusion

The data from the Pradhan Mantri Mudra Yojana (PMMY) indicates the scheme’s success in supporting various stages of business growth, with a particular emphasis on micro and small enterprises (Shishu and Kishore). While the Shishu category drives the highest number of loan sanctions, the Kishore category dominates the disbursement figures, reflecting the growing financial needs of expanding businesses. The Tarun category signifies the importance of larger loans for businesses looking to make significant investments, though the number of enterprises seeking these loans is lower. The scheme plays a critical role in fostering entrepreneurship and supporting MSMEs across India.

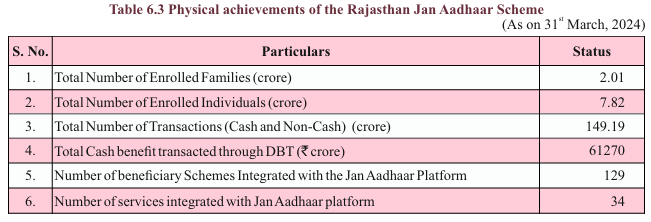

Table 6.3

Analytical Summary

Table 6.3 presents the Physical Achievements of the Rajasthan Jan Aadhaar Scheme as of 31st March, 2024. The table highlights the number of families and individuals enrolled, the total number of transactions (both cash and non-cash), the cash benefits disbursed via Direct Benefit Transfer (DBT), and the number of schemes and services integrated into the Jan Aadhaar platform.

Key Data Points

- Total Number of Enrolled Families (crore): 2.01 crore

- Total Number of Enrolled Individuals (crore): 7.82 crore

- Total Number of Transactions (Cash and Non-Cash) (crore): 149.19 crore

- Total Cash Benefit Transacted through DBT (₹ crore): ₹61,270 crore

- Number of Beneficiary Schemes Integrated with Jan Aadhaar Platform: 129 schemes

- Number of Services Integrated with Jan Aadhaar Platform: 34 services

Key Observations

- Widespread Enrollment: With 2.01 crore families and 7.82 crore individuals enrolled, the Jan Aadhaar scheme covers a significant portion of the population in Rajasthan, indicating high adoption and reach of the program.

- High Transaction Volume: The platform has facilitated 149.19 crore transactions across both cash and non-cash services, demonstrating the active usage of the Jan Aadhaar system for a wide range of transactions.

- Massive Cash Benefits via DBT: The scheme has distributed a substantial ₹61,270 crore through the Direct Benefit Transfer (DBT) system, ensuring direct delivery of benefits to citizens, which is an essential mechanism to reduce leakage and inefficiency in welfare schemes.

- Integration with Multiple Schemes and Services: The Jan Aadhaar platform is integrated with 129 beneficiary schemes and 34 services, highlighting its utility as a centralized platform for the distribution of benefits across various social welfare programs and services.

Key Terms

- Direct Benefit Transfer (DBT): A government initiative in India to transfer subsidies and benefits directly into the bank accounts of beneficiaries, reducing delays and ensuring transparency.

- Jan Aadhaar Scheme: A state-specific identification and benefit transfer system in Rajasthan that simplifies and centralizes access to various welfare schemes for citizens, aiming to replace the earlier Bhamashah Yojana.

- Beneficiary Schemes: Social welfare programs aimed at providing direct or indirect benefits to the eligible population, including health, education, food security, and financial aid programs.

- Integrated Services: Government or other public services that have been connected to the Jan Aadhaar platform, allowing users to access these services through a single unified system.

Key Insights

- Effective Coverage: The data indicates that the Rajasthan Jan Aadhaar Scheme has effectively penetrated the population, with a significant number of families and individuals enrolled. This coverage ensures that most citizens benefit from the integrated welfare schemes and services.

- High Trust in DBT Mechanism: The large cash transfers through DBT, amounting to ₹61,270 crore, reflect trust in the system’s efficiency, as it ensures direct cash benefits to the targeted beneficiaries, minimizing the scope for fraud or delay.

- Comprehensive Welfare Delivery: With 129 schemes and 34 services integrated into the platform, the Jan Aadhaar system offers a robust framework for administering various government services. This centralization of schemes under a single umbrella increases accessibility for citizens and streamlines administrative processes.

Conclusion

The Rajasthan Jan Aadhaar Scheme plays a crucial role in delivering welfare benefits to a large portion of the state’s population. Its high enrollment rates, the volume of transactions processed, and the substantial cash benefits transferred through the DBT mechanism demonstrate its success in ensuring efficient and transparent delivery of services. The wide integration of schemes and services further strengthens its position as a vital tool for social welfare management in the state. Moving forward, this system is likely to continue as a cornerstone for inclusive governance and public welfare in Rajasthan.