Chapter 7

Urbanisation is a critical factor in the economic transformation of any region, and Rajasthan is no exception. As cities grow and attract larger populations, they become centers of commerce, industry, and services, driving both regional and national economies. Chapter 7 delves into the process of urbanisation in Rajasthan, focusing on the state’s demographic changes, infrastructure challenges, and the government’s efforts to manage and sustain urban growth.

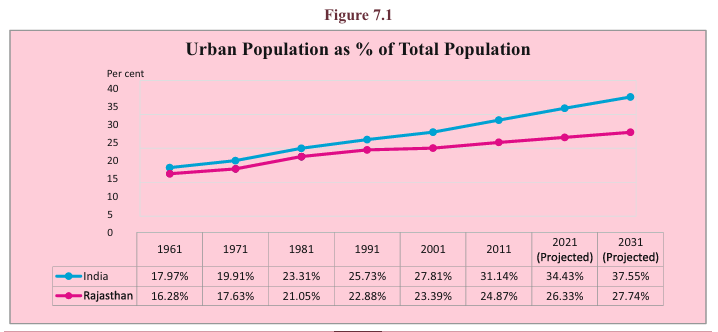

Over the past several decades, Rajasthan has experienced significant migration from rural to urban areas, reflecting broader national and global trends. The state’s urban population has steadily increased from 16.28% in 1961 to 24.87% in 2011, with projections suggesting it will reach 27.74% by 2031. This shift has brought with it both opportunities and challenges, such as the need for improved infrastructure, housing, and public services.

This chapter examines the key drivers of urbanisation in Rajasthan, such as economic opportunities, migration, and natural population growth. It also highlights the state’s efforts to address urban challenges through various initiatives, including the Smart City Mission, AMRUT, and Swachh Bharat Mission. These programs aim to enhance infrastructure, provide sustainable housing solutions, and improve the quality of life in urban areas.

By exploring the demographic trends, infrastructure needs, and policy initiatives tied to urban development, Chapter 7 provides a comprehensive overview of how Rajasthan is navigating the complexities of urban growth and development. The chapter underscores the importance of sustainable planning, inclusive governance, and innovative solutions to create livable, vibrant, and economically dynamic cities in Rajasthan.

- Introduction to Urbanisation

- Global and National Context:

- Urbanisation is a key global trend with over 66.66% of the world’s population expected to live in urban areas by 2050. Urban areas contribute approximately 80% of global GDP.

- In Rajasthan, urbanisation has increased from 16.28% in 1961 to 24.87% in 2011, with a projected rise to 27.74% by 2031.

- Objective Insight: The steady rise in urbanisation in Rajasthan reflects the state’s alignment with national and global trends. This shift has important implications for infrastructure, employment, and the overall economic framework of the state, placing increased demands on city planning, resource management, and service delivery.

- Population Growth and Demographic Changes

- Population Projections (2001-2031):

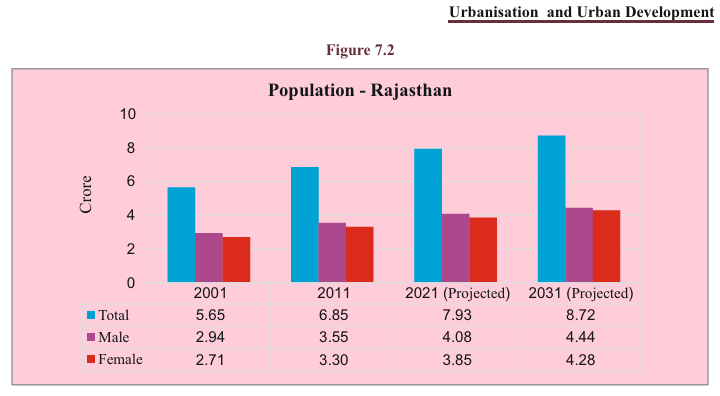

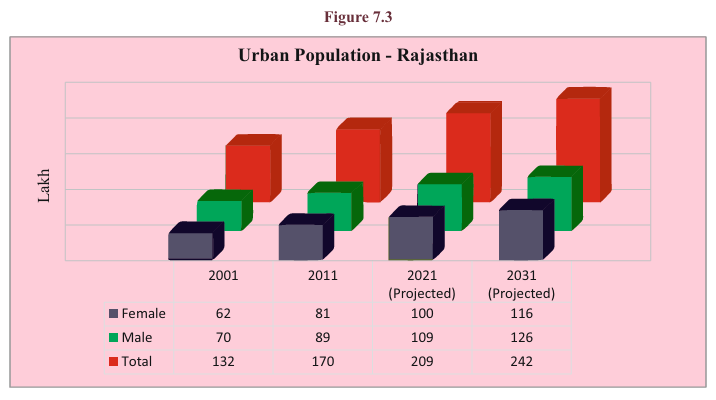

- Rajasthan’s total population is projected to grow from 565 lakh in 2001 to 872 lakh by 2031. The urban population will increase from 132 lakh in 2001 to 242 lakh in 2031, highlighting the accelerating pace of urbanisation.

- The growth of the urban population places significant demands on housing, infrastructure, public services, and employment opportunities.

- Objective Insight: Urbanisation offers opportunities for economic growth, but rapid population growth in cities also presents challenges. The need for urban infrastructure, sustainable housing, and effective public services will become more critical in managing this population influx, necessitating proactive urban planning and investment.

- Urban Sex Ratio and Child Sex Ratio

- Urban Sex Ratio:

- The urban sex ratio in Rajasthan increased from 890 females per 1,000 males in 2001 to 914 females per 1,000 males in 2011. Despite this improvement, rural areas still show higher sex ratios.

- District-wise disparities are prominent, with Jaisalmer (807) having the lowest and Tonk (985) the highest sex ratios in urban areas.

- Child Sex Ratio:

- The urban child sex ratio dropped from 887 girls per 1,000 boys (2001) to 874 girls per 1,000 boys (2011), indicating persistent gender imbalances in urban demographics.

- Objective Insight: The improvement in the overall urban sex ratio suggests progress in gender equality, but the declining child sex ratio signals underlying social and cultural issues. Addressing gender imbalances in urban areas will require focused policy interventions that promote gender equity, especially through education and healthcare access.

- Literacy Rates and Education Trends

- Urban Literacy Rates:

- Rajasthan’s urban literacy rate rose to 79.70% in 2011, compared to 61.40% in rural areas. Educational reforms and state initiatives have contributed to these improvements.

- Despite progress, literacy rates remain uneven across districts, with some urban areas such as Nagaur (70.6%) and Jalore (71.1%) showing lower literacy levels.

- Objective Insight: Higher urban literacy rates indicate improved access to education and government efforts to boost educational outcomes. However, regional disparities suggest that continued investment in education infrastructure and a focus on quality of teaching are necessary to bridge the literacy gap between different urban districts.

- Migration and Urbanisation

- Migration as a Driver of Urbanisation:

- Migration from rural to urban areas plays a key role in Rajasthan’s urbanisation. In 2011, 32 lakh people migrated to urban areas, constituting 4% of India’s total rural-to-urban migration.

- Migration is driven by employment opportunities, better living conditions, and access to services in urban areas.

- Reasons for Migration:

- Male Migration: 49.16% of males moved to urban areas for work.

- Female Migration: 59.11% of female migrants relocated primarily for marriage.

- Objective Insight: Migration to cities is driven by both economic and social factors. While urban areas provide better job opportunities and services, they must also prepare for the influx of migrants by ensuring affordable housing, employment opportunities, and essential urban infrastructure to accommodate the rising population.

- Urban Housing and Slum Development

- Urban Housing Conditions:

- 68.9% of urban homes in Rajasthan are in “Good” condition, while 29% are classified as “Livable” and 2% as “Dilapidated.”

- The rapid pace of urbanisation has increased housing demand, leading to a rise in informal settlements (slums), particularly in cities like Jaipur, where 15.64% of the population resides in slums.

- Slum Population:

- Rajasthan’s total slum population is 20.68 lakh, accounting for 12.13% of the total urban population. Jaipur alone has 3.23 lakh slum dwellers.

- Objective Insight: The rising slum population highlights the disparity between housing demand and supply in Rajasthan’s urban areas. The challenge is to improve affordable housing options, upgrade infrastructure in slum areas, and provide basic amenities such as clean water, sanitation, and electricity to improve the living conditions of slum residents.

- Urban Development Initiatives and Projects

- Urban Planning Authorities:

- Rajasthan has established five development authorities in cities such as Jaipur, Jodhpur, Udaipur, Kota, and Ajmer to manage urban development, implement projects, and improve civic amenities.

- Key projects include the Jaipur Metro, which was launched in 2015 as part of the city’s efforts to address traffic congestion and improve public transportation. Phase-1A was completed at a cost of ₹2,023 crore, while Phase-1B (completed in 2020) was partially funded by the Asian Development Bank (ADB).

- Objective Insight: Urban development projects like the Jaipur Metro demonstrate the state’s commitment to improving public transportation and reducing urban congestion. However, sustained investment in urban planning, public services, and smart infrastructure is necessary to cope with the increasing demands of rapid urban growth.

- Smart City Mission and AMRUT

- Smart City Mission:

- Four cities—Jaipur, Udaipur, Kota, and Ajmer—have been selected for the Smart City Mission to improve infrastructure, enhance public services, and promote sustainable urban growth. As of 2023-24, Rajasthan had incurred a total expenditure of ₹3,617.42 crore for smart city projects.

- Smart initiatives include the development of smart roads, smart water supply systems, and the implementation of public transport enhancements.

- AMRUT Mission:

- Under the Atal Mission for Rejuvenation and Urban Transformation (AMRUT), 29 cities in Rajasthan were selected to receive funding for infrastructure improvements in water supply, sewerage systems, and public spaces. The total project cost is ₹3,223.94 crore.

- Objective Insight: The Smart City Mission and AMRUT programs represent a significant shift towards modernising urban infrastructure and sustainable urban planning. These projects are expected to improve the quality of life, enhance public services, and ensure environmental sustainability in Rajasthan’s urban centers.

- Swachh Bharat Mission and Urban Employment Initiatives

- Swachh Bharat Mission (Urban):

- Rajasthan achieved 100% Open Defecation Free (ODF) certification for 213 Urban Local Bodies (ULBs) under the Swachh Bharat Mission. This milestone indicates improvements in sanitation and hygiene practices.

- Urban Employment Schemes:

- The Indira Gandhi Shahari Rojgar Guarantee Yojana provided employment to 3.19 lakh families in 2023-24, with an expenditure of ₹339 crore and the creation of 202.61 lakh man-days of employment.

- Objective Insight: The success of the Swachh Bharat Mission in Rajasthan highlights the state’s progress in improving sanitation and hygiene in urban areas. Additionally, employment programs like the Indira Gandhi Shahari Rojgar Guarantee Scheme play a vital role in providing jobs and reducing unemployment in urban communities.

Conclusion

Chapter 7 provides a detailed exploration of the urbanisation process in Rajasthan, highlighting its impact on the state’s economy, infrastructure, and population dynamics. Urbanisation in Rajasthan has been driven by several factors, including economic growth, rural-to-urban migration, and natural population increases. While urbanisation offers opportunities for economic development and improved living standards, it also presents significant challenges related to infrastructure, housing, sanitation, and employment. Below are the key takeaways and conclusions from the chapter:

- Increasing Urban Population

- Rajasthan’s urban population is growing rapidly, with projections indicating that it will rise from 132 lakh in 2001 to 242 lakh by 2031.

- The growth in urban population places increased pressure on infrastructure, housing, and essential services, necessitating significant investments in urban planning and development.

- Rapid urbanisation requires a comprehensive approach to managing population growth, focusing on sustainable infrastructure development and adequate housing to meet the needs of expanding urban areas.

- Demographic Changes and Migration

- Rural-to-urban migration has been a key driver of urbanisation in Rajasthan, with 32 lakh people migrating to urban areas by 2011. The majority of male migrants moved for employment, while female migration was largely linked to marriage.

- As the state continues to urbanise, the growing number of migrants will need access to jobs, housing, healthcare, and education, placing further pressure on urban centers.

- Urbanisation in Rajasthan is not only driven by natural population growth but also by migration, which underscores the need for comprehensive urban policies that address employment, housing, and social services for migrants.

- Infrastructure Development and Housing

- Urban infrastructure in Rajasthan faces significant challenges as cities expand. Issues such as inadequate housing, traffic congestion, and insufficient public services remain prevalent.

- 68.9% of urban houses in Rajasthan are classified as being in “Good” condition, while 29% are “Livable” and 2% are “Dilapidated.” Furthermore, the growing slum population, especially in cities like Jaipur, highlights the need for improved housing policies and urban infrastructure.

- Urban development must prioritize the creation of affordable housing, basic amenities, and upgraded infrastructure to meet the needs of a growing urban population. Investments in infrastructure, transportation, and public services are essential for creating livable urban spaces.

- Gender and Educational Disparities

- Despite improvements, gender disparities persist, particularly in the child sex ratio, which has declined from 887 girls per 1,000 boys in 2001 to 874 girls per 1,000 boys in 2011.

- The urban literacy rate in Rajasthan increased to 79.70% by 2011, but there are still regional disparities in educational access and quality across districts.

- Gender and educational disparities must be addressed through targeted interventions, such as gender equality programs and improvements in educational access and quality, particularly in underdeveloped urban districts.

- Role of Government Initiatives

- The government has launched several key initiatives to address urban challenges, including the Smart City Mission, AMRUT, and Swachh Bharat Mission. These programs aim to modernize urban infrastructure, enhance public services, and improve sanitation in urban areas.

- The Smart City Mission has seen significant investment in cities like Jaipur, Udaipur, Kota, and Ajmer, focusing on improving infrastructure, smart roads, and water management systems.

- AMRUT aims to improve infrastructure in 29 cities across Rajasthan, focusing on water supply, sewerage, and green spaces, with a total project cost of ₹3,223.94 crore.

- Under the Swachh Bharat Mission, Rajasthan achieved 100% Open Defecation Free (ODF) certification in its urban areas, reflecting significant improvements in sanitation.

- While government programs such as the Smart City Mission and AMRUT have had a positive impact on urban infrastructure, sustained efforts and increased investment are needed to meet the future demands of Rajasthan’s growing urban population. Focused interventions on sustainable urban development and public service delivery are critical.

- Challenges in Urban Employment and Sanitation

- Employment generation in urban areas is a major challenge, with the Indira Gandhi Shahari Rojgar Guarantee Yojana providing jobs for 3.19 lakh families in 2023-24. The program created 202.61 lakh man-days of employment, but more efforts are required to tackle unemployment in growing urban areas.

- Sanitation challenges, particularly in slums and underserved areas, remain a concern despite progress through the Swachh Bharat Mission.

- The state must continue to focus on urban employment generation and ensure that sanitation improvements are sustainable and equitable, particularly in informal settlements and underserved urban areas.

- Sustainable Urbanisation and the Way Forward

- Rajasthan’s urban growth presents opportunities for economic development, but it must be managed sustainably to ensure that infrastructure keeps pace with population growth.

- Moving forward, the state must invest in sustainable urban planning, focusing on environmentally friendly infrastructure, renewable energy, and green spaces to improve the quality of life for urban residents.

- Sustainable urbanisation will be crucial for Rajasthan’s future. The government must focus on long-term solutions, including smart city innovations, sustainable infrastructure, and inclusive urban policies that address the needs of all segments of the population.

Final Thoughts

- Rising Urban Population: Urbanisation is accelerating, and the state’s population is projected to grow significantly by 2031. This calls for proactive urban planning and infrastructure development.

- Demographic Shifts: Migration to cities is a major driver of urban growth, with employment and social factors playing significant roles.

- Infrastructure and Housing: As the urban population expands, the demand for adequate housing and infrastructure is increasing, particularly in addressing the needs of slum dwellers and underserved areas.

- Government Initiatives: Programs like the Smart City Mission, AMRUT, and Swachh Bharat Mission are vital in improving urban infrastructure and public services, but sustained efforts are necessary to meet growing demands.

- Education and Gender Equality: Disparities in education and gender ratios remain concerns that need targeted interventions to ensure balanced development.

- Employment and Sanitation: Urban employment generation and improving sanitation remain ongoing challenges that require continuous government attention and investment.

- Sustainable Development: The future of urbanisation in Rajasthan lies in sustainable planning, with a focus on green infrastructure, smart technology, and inclusive growth.

In conclusion, Chapter 7 illustrates the complexities of urbanisation in Rajasthan, outlining both the opportunities and challenges that lie ahead. By focusing on sustainable development, inclusive policies, and infrastructure investment, the state can create vibrant, livable, and economically robust urban centers that support both current and future generations

Chapter 7

Figure 7.1

Analytical Summary

The graph presents the trend of urban population as a percentage of the total population in India and Rajasthan from 1961 to 2031 (projected). It indicates a gradual increase in urbanization for both India and Rajasthan, with India consistently having a higher proportion of its population living in urban areas. The projections for 2021 and 2031 show a continued rise in urbanization for both the country and the state, though Rajasthan lags behind the national average.

Key Data Points

- In 1961, the urban population in India was 17.97%, while in Rajasthan, it was 16.28%.

- By 2011, India’s urban population had risen to 31.14%, while Rajasthan’s urban population reached 24.87%.

- Projections for 2021 show India’s urban population at 34.43% and Rajasthan’s at 26.33%.

- Projections for 2031 estimate 37.55% of India’s population will be urban, compared to 27.74% for Rajasthan.

Key Observations

- India’s urbanization rate has consistently been higher than Rajasthan’s across all decades.

- Both India and Rajasthan are experiencing a steady increase in the proportion of urban residents, though the gap between India and Rajasthan has remained relatively constant.

- The projection shows a sharper increase in urbanization for India between 2021 and 2031 than for Rajasthan.

Key Terms

- Urban Population: Refers to the segment of the population residing in urban areas, typically defined by a higher population density and infrastructure development than rural areas.

- Projection: An estimate of future population trends based on historical data and various assumptions about economic, social, and demographic factors.

- Urbanization: The process by which a growing percentage of a population comes to reside in cities and towns.

Key Insights

- Rajasthan’s slower pace of urbanization compared to India could be influenced by several factors, such as its larger rural base, slower economic diversification, and possibly a lower rate of migration to urban centers.

- The urban population growth in Rajasthan is notable but still lags behind the national average, indicating that the state has a predominantly rural population and will likely continue to have one for the foreseeable future.

- Policy interventions targeting urban infrastructure, migration, and economic development could further accelerate urbanization in Rajasthan.

Conclusion

While both India and Rajasthan are experiencing urban growth, India’s urbanization rate is progressing faster than Rajasthan’s. Rajasthan remains less urbanized, and the projected figures indicate that, while there will be a rise in urbanization, the state will continue to have a predominantly rural population for the next decade. The trends highlight the need for region-specific strategies in handling urban growth and rural development.

Table 7.2

Analytical Summary

This bar graph shows the population growth in Rajasthan across three census years—2001, 2011, and the projected figures for 2021 and 2031. The population data is segmented by gender (male and female), providing a clear picture of total, male, and female population distribution over time. It reflects significant population growth in both genders, with projections indicating further increases by 2031.

Key Data Points

- In 2001, Rajasthan’s total population was 5.65 crore, with 2.94 crore males and 2.71 crore females.

- By 2011, the total population increased to 6.85 crore, with 3.55 crore males and 3.30 crore females.

- The 2021 projections estimate a population of 7.93 crore, with 4.08 crore males and 3.85 crore females.

- By 2031, the projected population reaches 8.72 crore, with 4.44 crore males and 4.28 crore females.

Key Observations

- The population of Rajasthan is consistently increasing across both genders.

- The gap between the male and female population has slightly reduced over time, reflecting gradual gender balancing.

- The projected population figures for 2031 suggest a substantial increase, indicating ongoing population growth, though the growth rate between 2021 and 2031 is slower than between 2001 and 2011.

Key Terms

- Census Year: The official year during which the population data is collected as part of the nationwide census.

- Projection: An estimate of the future population based on historical growth trends and demographic factors.

- Population Growth: The increase in the number of individuals in a population over a specific period.

Key Insights

- Rajasthan’s population is expected to continue growing, with a significant increase between 2011 and 2031.

- The male population remains slightly higher than the female population throughout the years, though the gap appears to be narrowing.

- The state’s population growth aligns with India’s broader demographic trends, but specific factors such as migration, fertility rates, and economic development will influence future growth patterns.

Conclusion

Rajasthan is experiencing continuous population growth, projected to reach 8.72 crore by 2031. While the male population remains larger, the gap between male and female populations is closing. The state needs to prepare for the implications of this growth in terms of urbanization, resource allocation, infrastructure, and public services, as indicated by the increasing population in both rural and urban settings. The gradual increase in population indicates that demographic planning and sustainable development policies will be crucial to meet the future needs of this growing population.

Table 7.3

Analytical Summary

This figure illustrates the growth of Rajasthan’s urban population from 2001 to 2011 and projects population growth for 2021 and 2031. The population is broken down into male and female segments, showcasing the increasing trend of urbanization in the state. The chart provides insight into gender-wise distribution and the overall urban population across these years.

Key Data Points

- In 2001, the total urban population was 132 lakh, with 70 lakh males and 62 lakh females.

- By 2011, the total urban population grew to 170 lakh, with 89 lakh males and 81 lakh females.

- The 2021 projection estimates a population of 209 lakh, with 109 lakh males and 100 lakh females.

- By 2031, the projected urban population reaches 242 lakh, with 126 lakh males and 116 lakh females.

Key Observations

- The urban population has been steadily increasing, with an expected total growth of 110 lakh from 2001 to 2031.

- The gap between the male and female population in urban areas is narrowing, though males still outnumber females slightly in every year considered.

- Significant growth is projected between 2021 and 2031, with both male and female populations experiencing substantial increases in the urban population.

Key Terms

- Urban Population: The number of people living in cities and towns as opposed to rural areas.

- Projection: The estimated population based on growth trends and demographic factors for future years.

- Urbanization: The process of increasing population in urban areas, often linked to economic development and migration from rural regions.

Key Insights

- Rajasthan’s urban population is experiencing rapid growth, aligned with broader trends in India’s urbanization.

- The male population consistently remains higher than the female population, though the gap has reduced significantly by the projected figures for 2031.

- Urbanization is expected to accelerate in the coming years, which will likely place increasing pressure on infrastructure, public services, housing, and transportation systems.

- Gender-based migration patterns or demographic shifts could be driving the narrowing gap between male and female urban populations.

Conclusion

Rajasthan’s urban population growth from 2001 to 2031 reflects the state’s movement towards increased urbanization, driven by economic opportunities, industrialization, and migration trends. The population growth will bring both opportunities and challenges, requiring sustainable urban planning, investment in infrastructure, and policies to manage the growing demand for resources and services in urban areas. The projected growth emphasizes the need for a forward-looking approach to urban development, including gender-equitable planning.

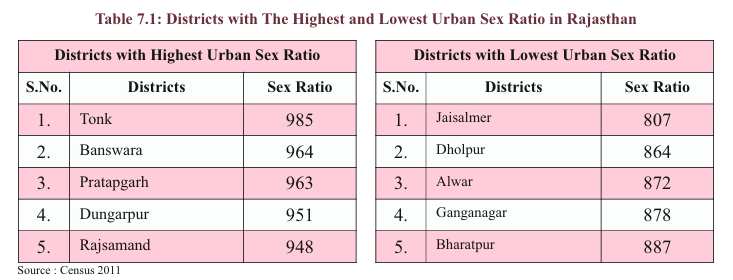

Table 7.1

Analytical Summary

This table presents data on the districts in Rajasthan with the highest and lowest urban sex ratios according to the 2011 Census. The sex ratio is an important demographic indicator, showing the number of females per 1,000 males in a given population. A higher sex ratio implies a better balance between male and female populations, while a lower sex ratio suggests male dominance in the population.

Key Data Points

- Highest Urban Sex Ratio:

- Tonk: 985

- Banswara: 964

- Pratapgarh: 963

- Dungarpur: 951

- Rajsamand: 948

- Lowest Urban Sex Ratio:

- Jaisalmer: 807

- Dholpur: 864

- Alwar: 872

- Ganganagar: 878

- Bharatpur: 887

Key Observations

- Tonk has the highest urban sex ratio in Rajasthan at 985, close to an equal balance between males and females.

- Jaisalmer has the lowest urban sex ratio at 807, reflecting a significant gender disparity with far fewer females compared to males.

- Districts like Banswara, Pratapgarh, and Dungarpur exhibit relatively high urban sex ratios, whereas regions like Dholpur and Alwar show lower sex ratios.

- The variation in sex ratio across districts indicates regional differences in gender balance, which may be influenced by social, cultural, or economic factors.

Key Terms

- Sex Ratio: The number of females per 1,000 males in a population. It is a crucial demographic measure used to assess gender balance within a population.

- Urban Sex Ratio: The sex ratio specific to the urban areas of a region, providing insight into gender demographics in cities and towns.

Key Insights

- The sex ratio in urban areas varies significantly across Rajasthan. While districts like Tonk and Banswara show a high urban sex ratio, others like Jaisalmer and Alwar reflect a concerning imbalance.

- A lower sex ratio, particularly in districts like Jaisalmer, may be indicative of gender disparities in areas such as access to education, healthcare, and employment opportunities for women.

- Higher sex ratios in districts such as Tonk and Banswara suggest better gender balance, potentially indicating more equitable socio-economic conditions in those regions.

Conclusion

The variation in urban sex ratio across Rajasthan’s districts highlights the importance of addressing gender imbalances, particularly in districts with lower ratios such as Jaisalmer and Dholpur. Efforts to improve the status and opportunities for women in urban areas, including better access to education, healthcare, and employment, can help close the gender gap. At the same time, districts with high urban sex ratios provide examples of more balanced gender demographics, which can serve as models for other regions.

Table 7.2

Analytical Summary

The table presents the urban child sex ratio of different districts in Rajasthan based on the 2011 Census data. The child sex ratio refers to the number of girls per 1,000 boys in the age group of 0-6 years. This data is an important indicator of gender equity, particularly in terms of cultural attitudes towards female children, and reflects on future demographic balance.

Key Data Points

- Highest Urban Child Sex Ratio:

- Nagaur: 907

- Bikaner: 906

- Bhilwara: 904

- Baran: 901

- Churu: 899

- Lowest Urban Child Sex Ratio:

- Dholpur: 841

- Ganganagar: 842

- Dausa: 847

- Alwar: 851

- Bharatpur: 852

Key Observations

- Nagaur tops the list with a child sex ratio of 907, closely followed by Bikaner (906) and Bhilwara (904), indicating a better gender balance among children in these regions.

- Dholpur has the lowest child sex ratio (841), signifying a gender imbalance favoring boys. This is a notable gap compared to districts with higher ratios like Nagaur.

- Districts with a higher urban child sex ratio (e.g., Nagaur, Bikaner) show greater parity in gender ratios, which may reflect more progressive social attitudes or greater efforts towards gender equality.

- On the other hand, districts with lower ratios, such as Dholpur and Ganganagar, indicate potential gender bias or cultural preferences favoring male children.

Key Terms

- Child Sex Ratio: The number of female children per 1,000 male children within the 0-6 age group. This is a critical measure for assessing gender bias, especially regarding societal attitudes toward female children.

- Urban Child Sex Ratio: Refers specifically to the child sex ratio in urban regions, providing insights into the gender balance in city and town populations.

Key Insights

- The child sex ratio, particularly in urban areas, is an indicator of the well-being of female children and is influenced by social and cultural norms. A low child sex ratio suggests the possibility of gender-based discrimination, including selective practices that favor male children.

- Districts with high child sex ratios, such as Nagaur and Bikaner, are performing relatively better in terms of gender equity in early childhood. This could reflect improved attitudes towards girls, better healthcare access for female children, and fewer instances of gender-based discrimination.

- Districts like Dholpur and Ganganagar, with lower child sex ratios, may need focused interventions to address potential gender bias and improve the overall gender balance in urban populations.

Conclusion

The urban child sex ratio varies significantly across Rajasthan’s districts, reflecting differences in cultural attitudes toward gender and the status of female children. Districts with low ratios such as Dholpur and Ganganagar may require targeted social programs to address gender disparity and ensure equal treatment of male and female children. Districts with higher ratios, such as Nagaur and Bikaner, can serve as models for fostering gender equity in early childhood. Addressing these disparities will be crucial for improving gender balance and ensuring the long-term socio-economic well-being of women in the state.

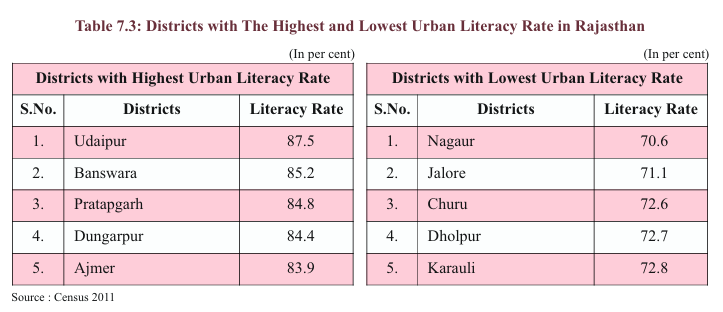

Table 7.3

Analytical Summary

This table highlights the districts in Rajasthan with the highest and lowest urban literacy rates as per the 2011 Census. Literacy rates are a key indicator of education levels and development in a region. This data is crucial for understanding educational disparities across urban areas within Rajasthan, indicating the progress made in some regions and the challenges faced in others.

Key Data Points

- Highest Urban Literacy Rate:

- Udaipur: 87.5%

- Banswara: 85.2%

- Pratapgarh: 84.8%

- Dungarpur: 84.4%

- Ajmer: 83.9%

- Lowest Urban Literacy Rate:

- Nagaur: 70.6%

- Jalore: 71.1%

- Churu: 72.6%

- Dholpur: 72.7%

- Karauli: 72.8%

Key Observations

- Udaipur has the highest urban literacy rate at 87.5%, making it the most educated urban district among the regions listed. This may reflect better access to education infrastructure and a focus on educational development.

- Nagaur, at 70.6%, has the lowest urban literacy rate, indicating significant educational challenges in its urban population.

- There is a clear gap between the highest literacy district (Udaipur) and the lowest (Nagaur), with a difference of nearly 17%. This disparity highlights the uneven distribution of educational resources and development across urban regions of Rajasthan.

- Districts like Banswara and Pratapgarh are also performing well, showing literacy rates above 84%, whereas districts such as Jalore and Churu lag behind, with rates slightly above 70%.

Key Terms

- Urban Literacy Rate: The percentage of people in urban areas who are able to read and write. This is calculated as the proportion of literate individuals (aged seven years and above) in the total urban population.

- Literacy: A basic human right, literacy is the ability to read and write and is essential for communication, personal empowerment, and socio-economic development.

Key Insights

- The variation in literacy rates among Rajasthan’s urban districts suggests that while some regions have made significant strides in education, others are still facing substantial hurdles. Factors such as economic development, the presence of educational institutions, and government initiatives could play a role in the differences observed.

- The relatively high literacy rates in districts like Udaipur, Banswara, and Ajmer indicate the effectiveness of educational policies and possibly greater availability of schools, colleges, and other educational resources in these urban centers.

- The lower literacy rates in districts like Nagaur and Jalore point to potential gaps in educational outreach or quality, which may need targeted interventions such as building more schools, improving teacher training, or providing incentives for school attendance.

Conclusion

The disparities in urban literacy rates across districts in Rajasthan reflect the state’s uneven educational development. While districts such as Udaipur lead in literacy, others like Nagaur lag significantly. The focus going forward should be on addressing these educational inequalities by enhancing access to education, particularly in the districts with lower literacy rates. By prioritizing educational development in these areas, Rajasthan can improve overall literacy and socio-economic outcomes for its urban population.

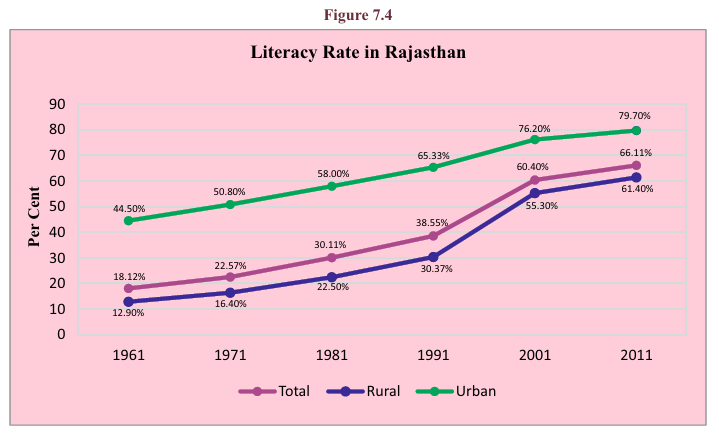

Figure 7.4

Analytical Summary

This figure tracks the literacy rate in Rajasthan from 1961 to 2011, divided into three categories: Total, Rural, and Urban populations. The data illustrates significant growth in literacy rates across all segments, with the most rapid increases occurring between 1991 and 2011. The chart highlights a steady urban-rural literacy gap, with urban areas consistently outperforming rural regions.

Key Data Points

- Urban Literacy Rate:

- 1961: 44.50%

- 1981: 58.00%

- 2001: 76.20%

- 2011: 79.70%

- Rural Literacy Rate:

- 1961: 12.90%

- 1981: 22.50%

- 2001: 55.30%

- 2011: 61.40%

- Total Literacy Rate (including both rural and urban):

- 1961: 18.12%

- 1981: 30.11%

- 2001: 60.40%

- 2011: 66.11%

Key Observations

- Significant improvement: Rajasthan’s overall literacy rate has shown a remarkable increase from 18.12% in 1961 to 66.11% in 2011. This growth underscores progress in education access and policy.

- Urban vs Rural Divide: The gap between urban and rural literacy rates remains wide. In 2011, the urban literacy rate stood at 79.70%, while rural literacy lagged behind at 61.40%, showing a difference of more than 18 percentage points. This reflects disparities in education infrastructure and access between rural and urban areas.

- Rapid improvement in rural literacy: While the gap persists, rural literacy has seen the sharpest growth, especially between 1991 and 2011, increasing from 30.37% to 61.40%. This shows significant efforts in extending education to rural regions.

- Slower growth in urban literacy: Urban areas have had high literacy rates since 1961, with more gradual increases, indicating the early availability of educational opportunities in urban regions.

Key Terms

- Literacy Rate: The percentage of people aged seven and above who can read and write with understanding. It is a key indicator of educational development in a region.

- Urban-Rural Literacy Gap: The difference in literacy rates between urban and rural areas, often reflecting inequalities in access to education and infrastructure.

Key Insights

- Rajasthan has made considerable progress in improving its overall literacy rate, with a marked rise in both rural and urban areas over the decades. However, the persistent gap between urban and rural literacy rates suggests that more efforts are required to ensure equal access to education across all regions.

- The rapid improvement in rural literacy from 1991 to 2011 suggests the success of initiatives aimed at promoting education in rural areas. The consistent upward trajectory indicates continued improvements in educational access, likely influenced by policies promoting school enrollment, adult literacy programs, and infrastructure development in underserved areas.

- The slower increase in urban literacy, compared to rural areas, reflects the saturation effect—urban areas already had relatively high literacy rates in earlier decades, making further large increases less dramatic.

Conclusion

The literacy rate in Rajasthan has seen sustained improvements from 1961 to 2011, with significant growth in both rural and urban areas. While the urban areas continue to lead in literacy, the substantial progress made in rural literacy highlights the effectiveness of state interventions aimed at reducing educational disparities. Moving forward, targeted efforts are needed to bridge the rural-urban gap and further boost literacy across all sectors of society.

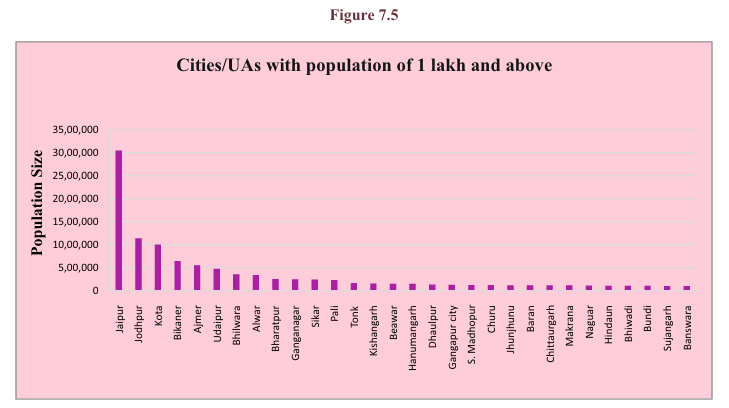

Figure 7.5

Analytical Summary

This graph visualizes the population sizes of cities and urban agglomerations (UAs) in Rajasthan that have populations of over 1 lakh. Jaipur is by far the most populous city in the state, followed by Jodhpur and Kota. The graph highlights the significant disparity in population sizes among the top cities in Rajasthan, showing Jaipur’s dominance in terms of urban population.

Key Data Points

- Top three cities by population:

- Jaipur: Over 30 lakh (3 million) inhabitants, making it the largest city by a wide margin.

- Jodhpur: Approximately 15 lakh (1.5 million) inhabitants, making it the second largest city.

- Kota: Close to 10 lakh (1 million) inhabitants.

- Smaller urban areas: Cities like Alwar, Bharatpur, and Gangapur have populations in the range of 1 to 2 lakh, reflecting the smaller scale of urbanization in these regions.

Key Observations

- Disparity in urban population: The population distribution among cities is highly unequal. Jaipur’s population is more than double that of Jodhpur, and nearly three times that of Kota, which are the next two largest cities. This demonstrates a concentration of urban population in Jaipur.

- Medium-sized cities: Cities like Bikaner, Ajmer, Udaipur, and Bhilwara have relatively balanced populations, with sizes ranging between 3 to 5 lakh. This middle tier of cities plays an important role in regional development.

- Many smaller urban centers: A significant number of cities and urban agglomerations fall within the 1-2 lakh population range. These include cities like Tonk, Pali, and Churu, which suggests urban growth is relatively distributed in smaller urban centers, despite the dominance of larger cities.

Key Terms

- Urban Agglomeration (UA): A continuous urban spread constituting a town and its adjoining outgrowths, or two or more physically contiguous towns together with or without outgrowths.

- Population Size: Refers to the total number of people residing in a city or urban agglomeration.

Key Insights

- Jaipur’s dominance: Jaipur’s overwhelming lead as the largest urban center reflects its importance as the political, economic, and cultural hub of Rajasthan. Its size makes it a central focus for urban planning, infrastructure development, and service provision.

- Urban growth in smaller cities: While Jaipur, Jodhpur, and Kota are leading in population, smaller urban areas like Bhilwara, Alwar, and Sikar are also expanding. This may reflect migration patterns or regional industrial growth fostering urbanization in these cities.

- Urban planning challenges: The population concentration in a few key cities suggests that these areas may face greater challenges in terms of infrastructure, housing, transportation, and public services. Conversely, smaller cities might require focused attention to prevent underdevelopment and to balance urban growth across the state.

Conclusion

The graph showcases significant urban concentration in Rajasthan’s largest cities, particularly Jaipur, which is a key urban hub. This points to potential challenges in managing urban sprawl, infrastructure, and services in Jaipur and other growing cities like Jodhpur and Kota. Smaller cities also play a vital role in the state’s urban landscape, indicating a need for balanced development strategies across all urban centers to ensure sustainable growth throughout Rajasthan.

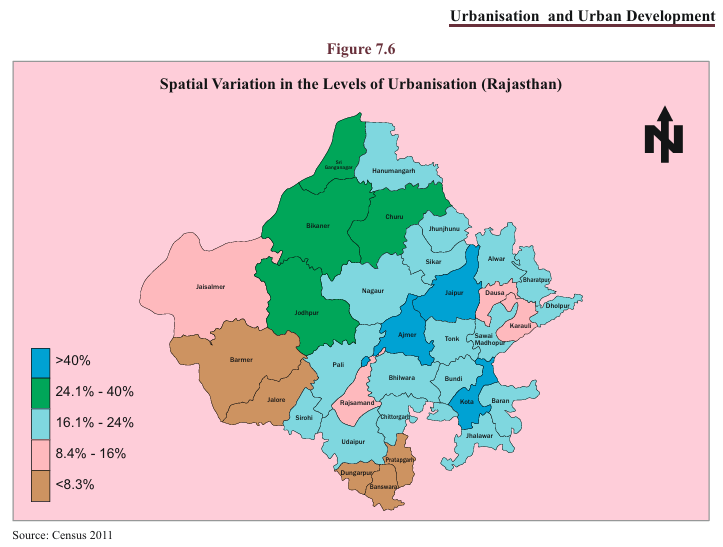

Figure 7.6

Analytical Summary

This map shows the spatial distribution of urbanization across Rajasthan, highlighting the different levels of urbanization in various districts. The districts are categorized by the percentage of the population that lives in urban areas, with a clear division between highly urbanized regions and more rural areas. The color-coded map divides the districts into five distinct urbanization brackets: greater than 40%, 24.1% to 40%, 16.1% to 24%, 8.4% to 16%, and less than 8.3%.

Key Data Points

- Highly urbanized regions (>40% urban population): Jaipur, Kota, and Ajmer fall into the highest category of urbanization, showcasing significant levels of urban development and concentration.

- Moderately urbanized regions (24.1% – 40%): Districts like Jodhpur, Udaipur, and Alwar have moderately high urban populations, indicating developing urban centers in these regions.

- Medium urbanization (16.1% – 24%): Districts such as Bhilwara, Sikar, and Nagaur fall into this category, showing balanced development with some urbanization.

- Low urbanization (8.4% – 16%): Regions like Chittorgarh, Jalore, and Sirohi have relatively low urbanization levels, indicating a predominantly rural population.

- Very low urbanization (<8.3%): Districts like Barmer, Banswara, and Jaisalmer are the least urbanized areas, highlighting their rural nature and lack of urban infrastructure.

Key Observations

- Urban concentration in central and eastern Rajasthan: The most urbanized districts are concentrated around the central and eastern parts of the state, where the state capital Jaipur and other large urban centers like Ajmer and Kota are located.

- Western districts remain largely rural: Districts like Barmer, Jaisalmer, and Banswara in the western and southern parts of the state have very low urbanization, reflecting their rural economies and the challenges of urban development in these areas.

- Jaipur as an urban hub: Jaipur stands out as the most urbanized region, with more than 40% of its population living in urban areas, reinforcing its status as the state’s political, economic, and administrative center.

Key Terms

- Urbanization: The process by which more of a population comes to live in urban areas, often associated with the growth of cities and towns.

- Spatial Variation: The differences in urbanization levels across different geographical areas within the state.

- Urban Population: The portion of the total population living in cities or towns as opposed to rural areas.

Key Insights

- Regional disparities: Rajasthan shows clear regional disparities in urbanization, with some districts highly urbanized while others remain predominantly rural. This may reflect economic, geographic, and infrastructural differences across the state.

- Growth potential in moderately urbanized regions: Districts such as Jodhpur, Udaipur, and Alwar, which are moderately urbanized, have potential for further urban growth and development. These areas could become secondary hubs in the state, alleviating pressure on highly urbanized areas like Jaipur.

- Challenges in rural areas: Districts with very low levels of urbanization, such as Barmer and Banswara, may face developmental challenges, particularly in terms of infrastructure, healthcare, and education. These areas may require targeted government intervention to promote balanced development.

Conclusion

The spatial variation in urbanization across Rajasthan shows a clear divide between urbanized and rural regions. While districts like Jaipur and Kota are urbanized and rapidly growing, many rural districts remain underdeveloped in terms of urban infrastructure. This map underscores the need for balanced urban development policies that address the growing pressures on urban centers while promoting sustainable development in rural areas. The map also highlights areas of potential urban growth, particularly in regions that are moderately urbanized, such as Jodhpur and Udaipur.

Table 7.7

Analytical Summary

The chart provides a breakdown of the reasons for rural-to-urban migration in both Rajasthan and India, differentiated by gender (male and female). The reasons include employment (work), marriage, education, business, movement after birth, moving with the household, and other unspecified reasons. It highlights the stark differences in migration patterns between men and women and between the state of Rajasthan and India as a whole.

Key Data Points

- Rajasthan (Male): The primary reason for migration among males is work/employment, which makes up a substantial portion of the total, far surpassing other reasons.

- Rajasthan (Female): Marriage is the dominant reason for female migration, followed by movement with the household and work.

- India (Male): Similar to Rajasthan, employment is the primary driver of male migration at the national level, with a relatively smaller share for education and other reasons.

- India (Female): The largest reason for migration among females nationwide is also marriage, with migration for household movement being a secondary factor.

Key Observations

- Gender Differences in Migration: A stark gender-based difference exists where the majority of males migrate for employment, while for females, marriage is the overwhelming reason for migration, particularly in Rajasthan.

- Employment as a Major Factor for Men: Employment consistently remains the primary reason for migration among men both in Rajasthan and across India, suggesting that job opportunities are a major pull factor for males relocating to urban areas.

- Marriage as a Key Factor for Women: For women, especially in Rajasthan, marriage accounts for the bulk of migration, indicating that traditional familial and social structures significantly influence female mobility.

- Relatively Low Educational Migration: Migration for education remains a small fraction for both men and women, indicating limited educational migration from rural to urban areas compared to other factors.

Key Terms

- Work/Employment Migration: Movement of individuals from rural areas to urban areas in search of better employment opportunities or work prospects.

- Marriage Migration: Movement of women, typically after marriage, as part of traditional societal norms where brides relocate to the residence of their spouse.

- Household Movement: Migration where individuals move along with their families, often for reasons related to relocation of the household due to work, property, or other familial needs.

- Census Data: The data is drawn from the Census of India 2011, which records the reasons for migration based on population surveys.

Key Insights

- Socio-cultural Factors in Female Migration: In Rajasthan and across India, the migration of women is overwhelmingly influenced by marriage, reflecting the socio-cultural norms of the country. This indicates that, while men move for economic reasons, women’s migration is more often tied to social structures like marriage and family.

- Economic Drivers for Male Migration: The primary driver for male migration in both Rajasthan and India is work-related, showing that economic opportunities in urban centers act as significant attractors for men from rural regions.

- Urbanization Impacts: The reasons for migration have profound implications for urbanization. Employment-driven migration boosts urban workforce numbers, while marriage-driven migration contributes to family-based urban population growth.

Conclusion

The patterns of rural-to-urban migration in Rajasthan and India display significant gender-specific trends. While men predominantly migrate for work opportunities, women’s migration is largely driven by social reasons such as marriage. This reflects the economic pressures on males to find better job opportunities and the traditional role of women in household and marital structures. These trends have important implications for urban development policies, particularly in addressing the differing needs of male and female migrants and the supporting infrastructure in urban centers to accommodate this growth.

Figure 7.8

Analytical Summary

This chart compares the condition of urban households in Rajasthan with those in India as per the Census of India 2011. The urban households are categorized into three conditions: Good, Livable, and Dilapidated. The data shows that the majority of households in both Rajasthan and India fall under the “Good” category, with a smaller percentage classified as “Livable” and an even smaller fraction as “Dilapidated.”

Key Data Points

- India:

- Good: 68%

- Livable: 29%

- Dilapidated: 3%

- Rajasthan:

- Good: 69%

- Livable: 29%

- Dilapidated: 2%

Key Observations

- High Percentage of Good Condition Households: In both India and Rajasthan, a substantial majority of urban households are categorized as being in good condition. Rajasthan slightly surpasses the national average, with 69% of its urban households rated as good, compared to 68% for India.

- Minimal Dilapidated Households: Only a small fraction of households in both India and Rajasthan are considered dilapidated (3% in India and 2% in Rajasthan), which reflects an overall good standard of urban housing infrastructure.

- Consistency in Livable Conditions: The proportion of “Livable” households is identical in both India and Rajasthan, with 29% of the urban households falling into this category, indicating similar housing standards across the country and the state.

Key Terms

- Good Condition: Refers to houses that are structurally sound, well-maintained, and suitable for long-term living.

- Livable Condition: Refers to houses that may have some structural or maintenance issues but are still habitable.

- Dilapidated Condition: Refers to houses that are in a state of serious disrepair and may not be safe or suitable for living.

Key Insights

- High Quality of Urban Housing: The data reflects a generally good quality of urban housing both in Rajasthan and at the national level, with nearly 70% of households in good condition.

- Slightly Better Urban Infrastructure in Rajasthan: Rajasthan slightly outperforms the national average in terms of the proportion of households in good condition and has a marginally lower percentage of dilapidated housing.

- Livable Housing Challenges: Nearly 30% of urban households in both India and Rajasthan fall into the “Livable” category, which may signal the need for targeted interventions to improve the housing conditions of these households.

Conclusion

The condition of urban households in Rajasthan is comparable to the national standard, with the majority of homes rated as being in good condition and a very small percentage in a dilapidated state. However, a significant proportion of urban households are still classified as “Livable,” which suggests that while the housing infrastructure is relatively strong, there is room for improvement in addressing the structural and maintenance issues affecting these homes. The overall findings indicate a robust urban housing system but with areas that require continued attention for improvement.

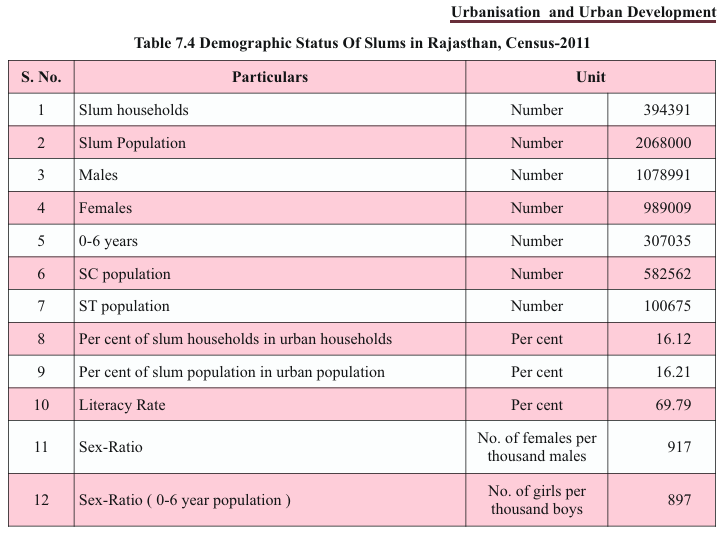

Table 7.4

Analytical Summary

This table provides key demographic data about slum households in Rajasthan, based on the Census of India 2011. The data includes the total number of slum households, population, sex ratio, literacy rate, and specific population groups like SC (Scheduled Castes) and ST (Scheduled Tribes). It also outlines the percentage of slum households and population relative to the total urban population, offering insights into the living conditions in urban slums.

Key Data Points

- Slum Households: 394,391 households

- Slum Population: 2,068,000 people

- Males in Slums: 1,078,991

- Females in Slums: 989,009

- Children (0-6 years): 307,035

- SC Population in Slums: 582,562

- ST Population in Slums: 100,675

- Percentage of Slum Households in Total Urban Households: 16.12%

- Percentage of Slum Population in Total Urban Population: 16.21%

- Literacy Rate in Slums: 69.79%

- Sex Ratio in Slums: 917 females per 1,000 males

- Sex Ratio for 0-6 Year Population in Slums: 897 girls per 1,000 boys

Key Observations

- Large Slum Population: Slums make up over 16% of the total urban population and households, indicating a significant portion of the urban populace lives in slums.

- Lower Sex Ratio: The overall sex ratio in slums (917) is below the state average, reflecting gender disparity in slum areas. The child sex ratio (0-6 years) is even lower at 897, indicating a potential demographic concern for young girls.

- Notable SC and ST Presence: The Scheduled Caste (SC) population makes up a substantial proportion of the slum population (582,562), while the Scheduled Tribe (ST) population in slums is comparatively smaller (100,675).

- Relatively Low Literacy Rate: The literacy rate in slums is 69.79%, which is lower than the overall urban literacy rate in Rajasthan, suggesting educational challenges among slum residents.

Key Terms

- Slum Household: A group of individuals living in a single residence, typically in an area with inadequate housing and infrastructure.

- SC Population: Scheduled Castes, groups that are historically disadvantaged and are eligible for affirmative action.

- ST Population: Scheduled Tribes, indigenous groups that are recognized by the government for affirmative action.

- Sex Ratio: The number of females per 1,000 males in a population.

- Literacy Rate: The percentage of people aged 7 and above who can read and write in any language.

Key Insights

- High Concentration of Vulnerable Populations: Slums house a considerable percentage of SC and ST populations, indicating that these groups are disproportionately affected by urban poverty.

- Educational Disparity: With a literacy rate below 70%, slum populations face significant educational barriers, which likely affects their socio-economic mobility.

- Gender Imbalance: The low sex ratio, particularly among children, may suggest gender-based disparities in survival and access to resources in slum areas.

Conclusion

Slums in Rajasthan represent a significant portion of the urban demographic, particularly among disadvantaged groups like SCs and STs. The lower literacy rates and skewed sex ratios reflect broader socio-economic challenges in these areas. Addressing these issues will require targeted interventions in education, gender equality, and infrastructure development to improve the living standards and future prospects of slum dwellers.

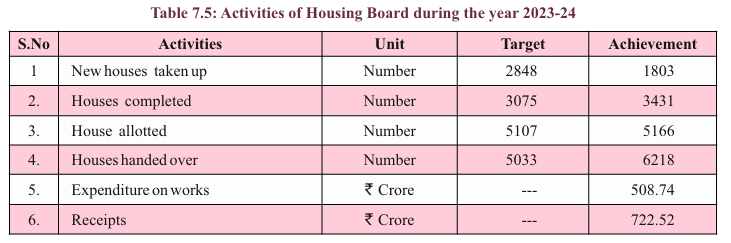

Table 7.5

Analytical Summary

This table outlines the key activities undertaken by the Housing Board in Rajasthan for the year 2023-24, focusing on new houses taken up, completed, allotted, and handed over. It also provides data on financial aspects such as expenditure on works and receipts generated during the year.

Key Data Points

- New Houses Taken Up:

- Target: 2,848

- Achievement: 1,803

- Achievement Rate: ~63% of the target achieved.

- Houses Completed:

- Target: 3,075

- Achievement: 3,431

- Achievement Rate: Exceeded target by 11.6%.

- Houses Allotted:

- Target: 5,107

- Achievement: 5,166

- Achievement Rate: Slightly exceeded the target, achieving 101.2%.

- Houses Handed Over:

- Target: 5,033

- Achievement: 6,218

- Achievement Rate: Exceeded target by 23.6%.

- Expenditure on Works: ₹ 508.74 crore (no target provided).

- Receipts: ₹ 722.52 crore (no target provided).

Key Observations

- Underachievement in New Houses: Only 63% of the target for new houses taken up was achieved, indicating a potential delay in the start or planning stages of new housing projects.

- Overachievement in Houses Completed and Handed Over: The Housing Board exceeded its targets for house completions (11.6% higher) and handovers (23.6% higher), reflecting efficient execution and timely completion of projects.

- Financial Performance: The board generated receipts worth ₹722.52 crore, while spending ₹508.74 crore on works. This indicates a favorable financial position, with receipts surpassing expenditure, though no specific targets for these were listed.

Key Terms

- Houses Taken Up: Refers to new housing projects initiated during the year.

- Houses Completed: Houses that have been fully constructed and are ready for occupancy.

- Houses Allotted: Refers to houses that have been assigned to beneficiaries or buyers.

- Houses Handed Over: Refers to houses that have been physically transferred to the occupants.

- Expenditure on Works: The total money spent on construction and other related activities by the Housing Board.

- Receipts: The income generated by the Housing Board, likely from house sales, leases, or other financial operations.

Key Insights

- Efficiency in Project Completion: The Housing Board has demonstrated efficiency in completing and handing over houses, exceeding its targets in both categories.

- Challenges in New Projects: The underachievement in the target for new houses indicates challenges in initiating new projects, possibly due to administrative delays or funding issues.

- Positive Financial Position: The Housing Board’s receipts outstripping expenditure suggests a healthy financial standing, which could be reinvested into future housing projects or infrastructural improvements.

Conclusion

The Housing Board’s performance for 2023-24 shows effective execution in completing and allotting houses, exceeding set targets. However, the shortfall in new housing projects suggests that efforts need to be concentrated on better planning and faster initiation of new projects. The financial data reflects sound management, positioning the Board well for future endeavors in urban housing development.

Table 7.6

Analytical Summary

This table presents the progress under the Deendayal Antyodaya Yojana – National Urban Livelihoods Mission (DAY-NULM) for the year 2023-24. It highlights the number of Self Help Groups (SHGs) formed, revolving funds distributed, self-employment loans provided, and SHG credit linkages established.

Key Data Points

- Self Help Groups (SHGs) formed:

- Achievement: 3,261 SHGs were formed in the year.

- Revolving fund given to SHGs:

- Achievement: 2,433 SHGs received revolving funds.

- Self-employment loans (individual and group):

- Achievement: 3,217 self-employment loans were sanctioned.

- SHG Credit Linkage:

- Achievement: 837 SHGs established credit linkages.

Key Observations

- Formation of SHGs: A significant number of SHGs (3,261) were formed, indicating active grassroots-level mobilization for livelihood enhancement.

- Revolving Fund Distribution: The revolving fund support was provided to 2,433 SHGs, enabling them to sustain or expand their activities.

- Self-employment Loan Achievement: Both individual and group loans were sanctioned, totaling 3,217, indicating an emphasis on creating employment opportunities through self-initiated business ventures.

- Credit Linkages: 837 SHGs were linked with formal financial institutions, improving their access to credit, which is vital for scaling operations or stabilizing income generation.

Key Terms

- Self Help Groups (SHGs): Community-based groups formed to provide mutual support, usually consisting of 10-20 members, who come together to engage in collective savings and credit activities.

- Revolving Fund: A fund given to SHGs that acts as seed capital for further credit cycles, supporting small enterprises and local activities.

- Self-employment Loans: Loans provided to individuals or groups to initiate or scale small businesses, which are part of livelihood promotion schemes.

- Credit Linkage: The process of connecting SHGs to formal financial institutions to access credit facilities.

Key Insights

- Strong Focus on SHGs: The formation of 3,261 SHGs and the distribution of revolving funds demonstrate the mission’s strong focus on empowering community-level entrepreneurship.

- Credit Linkages Lagging: While a significant number of SHGs were formed, only 837 managed to establish credit linkages. This highlights a potential gap in financial integration, which might need attention in future planning.

- Employment Generation through Loans: The provision of 3,217 self-employment loans suggests that DAY-NULM is actively fostering entrepreneurship and livelihood creation, but further data on business success rates would provide deeper insights.

Conclusion

The progress under DAY-NULM for 2023-24 reflects a robust focus on creating Self Help Groups and extending financial support through revolving funds and self-employment loans. However, there is a noticeable gap between SHGs formed and those that have achieved formal credit linkage, signaling the need for enhanced financial connectivity efforts. Nonetheless, the mission is fostering self-employment, which is critical for poverty alleviation and livelihood promotion in urban areas.

Table 7.7

Analytical Summary

The table presents data on the fund allocation and expenditure for four key cities in Rajasthan (Jaipur, Udaipur, Ajmer, and Kota) under various funding schemes up to 2023-24. The funds are divided into contributions from the Government of India (GoI), Government of Rajasthan (GoR), Urban Local Bodies (ULB), and development authorities. Each city has a fixed total share of ₹1000 crore, divided into different funding sources.

The total available funds and actual expenditure for each city are also listed, showing how efficiently the funds have been utilized up to the current period.

Key Data Points

- Total Share (₹ Crore): Each city has been allocated ₹1000 crore in total funds, divided as 50% from the GoI, 30% from GoR, 10% from ULB, and 10% from Development Authority/UIT.

- Available Fund: This reflects the actual amount of money available from the combined contributions. Jaipur and Kota each have ₹940 crore available, while Udaipur has ₹990 crore, and Ajmer has ₹942 crore.

- Expenditure Incurred: The actual expenditure up to 2023-24 is reported. Udaipur has the highest expenditure of ₹955.61 crore, followed by Ajmer with ₹888.99 crore. Jaipur incurred ₹878.15 crore, and Kota spent ₹894.67 crore.

Key Observations

- Uniform Total Allocation: Each city received ₹1000 crore as part of its funding package, with consistent contribution proportions across the cities.

- Expenditure Efficiency: All four cities have utilized nearly 90% of their available funds, with Udaipur showing the most efficient fund usage.

- Disparity in Available Funds: Udaipur has slightly more available funds compared to other cities, likely due to additional contributions from local authorities.

- Development Authority Share: Each city has received the same contribution from their development authorities, indicating a standardized approach to urban funding allocation.

Key Terms

- GoI Share: The portion of funds contributed by the central government, amounting to 50% of the total share.

- GoR Share: The portion of funds contributed by the Rajasthan state government, amounting to 30%.

- ULB Share: The 10% share provided by Urban Local Bodies, responsible for local governance and administration.

- Development Authority/UIT Share: The remaining 10% is funded by parastatal agencies such as Urban Improvement Trusts (UITs) or other development bodies.

Key Insights

- The high expenditure rate across all cities indicates strong implementation capacity and prioritization of urban development projects.

- Udaipur has marginally higher expenditure, reflecting possibly more aggressive or efficient development programs compared to the other cities.

- The consistent share distribution ensures equitable development opportunities for each city but leaves room for analyzing how these funds are specifically used within individual cities.

Conclusion

The fund allocation and expenditure data suggest that urban development programs in Rajasthan’s major cities are progressing efficiently, with high fund utilization rates across the board. This reflects a well-coordinated approach to managing urban projects, though future studies could look into the specific impacts of these expenditures on city infrastructure and quality of life.